In the grand theater of economy, Bitcoin, that elusive specter of wealth, seems to be drawing back from the precipice of despair. The recent sell-off, much like a melodramatic plot twist, appears to be losing its fervor, as whispers of institutional investors-those titans of finance-begin to weave through the marketplace. After a prolonged period during which panic reigned supreme and selling pressure relentlessly bore down upon the digital currency, we now observe a gentle easing, akin to a weary traveler finding solace at a rest stop.

Yet, dear reader, let us not hastily declare victory. Although the winds have shifted slightly, the cautious sentiment still lingers in the air, much like the smell of stale bread in a poorly ventilated kitchen. Large investors, it seems, are discreetly amassing their fortunes at these bargain prices, even as the overall mood resembles that of a somber family reunion where no one quite knows what to say. Is this a sign of impending glory for Bitcoin (BTC), or merely a momentary pause before the next dramatic plunge?

The Rise of Wise Accumulators

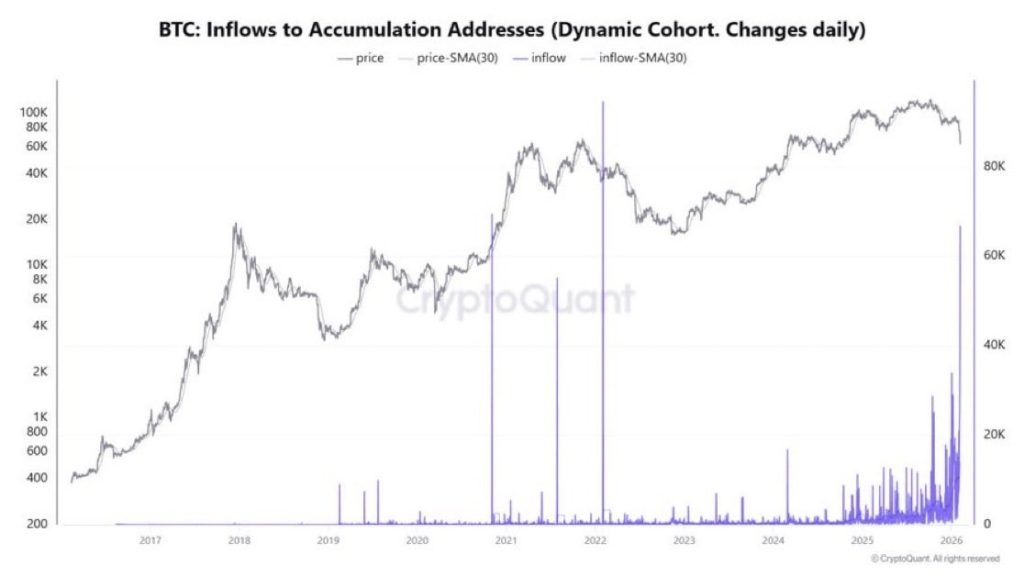

Behold the charts-the sacred scrolls of market prophets! They reveal an uptick in Bitcoin being funneled into accumulation addresses, much like a squirrel gathering nuts for the winter. For weeks, our dear BTC languished in obscurity, but lo and behold! Daily inflows have surged forth with vigor, surpassing 15,000 BTC in several instances, nearly touching the mythical heights of 20,000 BTC. Such enthusiasm is commendable, yet it raises eyebrows when one notes that this surge occurs while Bitcoin’s price remains far below its recent peaks. It’s as if the crowd has gathered at the foot of a mountain only to find that the summit has vanished into the clouds.

This accumulation, while intriguing, is not a clarion call for celebration. For Bitcoin to ascend to a state of sustained recovery, these inflows must persist, accompanied by a favorable price structure-akin to a well-rehearsed symphony rather than a cacophony of discordant notes.

Do Whales Hold the Key?

Despite the burgeoning appetite of whales and long-term holders, Bitcoin’s price action remains as muted as a monk’s chant. Currently, BTC meanders around $69,300, precariously perched above the 0.236 Fibonacci retracement level at $69,014, a line of defense that has been tested more than a contestant on a reality show. The bounce from the recent low near $60,074-like a cat falling from a great height-indicates that buyers have indeed shown their faces, though their resolve seems as flimsy as a paper umbrella in a monsoon.

The RSI, that oft-quoted arbiter of market health, hovers between 32 and 34, still firmly in the realm of bearishness, only beginning to lift its weary head from the depths of despair. Meanwhile, the MACD remains stubbornly negative, with the histogram expanding downward as if it were a balloon losing air. This suggests that while whale accumulation may have created a temporary safety net near $60K, it has yet to morph into a robust upward trajectory.

Levels Worth Watching

For accumulation to wield any meaningful influence over Bitcoin’s price, it must reclaim higher technical thresholds:

- Immediate resistance: $74,500-$75,000 – A close above this range would signal that the buyers are finally taking the driver’s seat, and perhaps even remembering to signal when they turn.

- Bullish confirmation zone: $79,000-$80,000 – A move into this territory would suggest that the recent sell-off was merely a corrective hiccup, not the onset of a protracted decline.

- Downside risk: Should $69,000 falter, we might witness a retreat to the $60,000-$62,000 demand zone, a place where the strongest buying response was last observed, akin to a beloved restaurant gone out of business.

Conclusion: Traders, Take Heed!

Whale accumulation seems to be absorbing some of the downward pressure, yet Bitcoin’s price behavior continues to resemble a tortoise in a race against a hare-slow and steady, but not necessarily victorious. After the rebound from the $60,000-$62,000 zone, BTC clings to $69,000, indicating that while sellers have paused, buyers are still hesitating at the door, unsure whether to knock or simply walk away.

As long as Bitcoin (BTC) remains below the pivotal $74,500 mark, any upward movements are likely to be mere flirtations rather than genuine commitments. A break above this threshold could paint a brighter picture and open the path towards $79,000-$80,000, while a slip below $69,000 would bring the $60,000-$62,000 support area back into sharp focus, much like a recurring character in a soap opera.

Read More

- Solo Leveling: Ranking the 6 Most Powerful Characters in the Jeju Island Arc

- How to Unlock the Mines in Cookie Run: Kingdom

- YAPYAP Spell List

- Top 8 UFC 5 Perks Every Fighter Should Use

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How to Build Muscle in Half Sword

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- The Saddest Deaths In Demon Slayer

2026-02-10 09:47