As a seasoned researcher with years of experience observing the cryptocurrency market, I find it fascinating to see XRP regaining momentum. The recent influx of investor funds into XRP ETPs is noteworthy, especially considering the 366% increase in just seven days. This surge underscores the resilience and potential of this digital asset.

In recent headlines, XRP has been featured prominently following the publication of CoinShares’ latest weekly review focusing on investment trends in digital asset-centric Exchange Traded Products (ETPs). This weekly analysis continues to highlight XRP as a significant player within the crypto market.

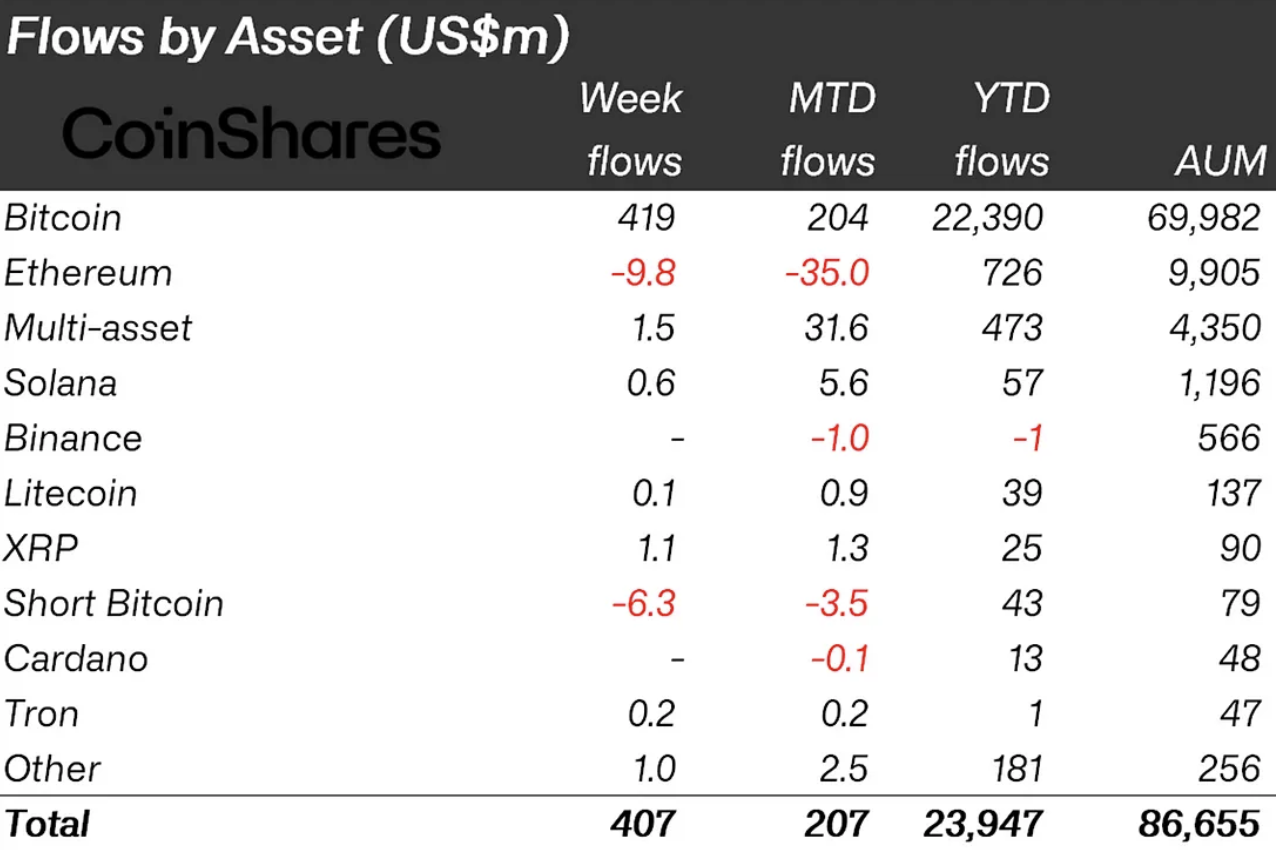

Indeed, it’s worth noting that last week, approximately $1.1 million was invested into XRP Exchange-Traded Products (ETPs). To put this into perspective, investment in products centered around the seventh largest cryptocurrency only amounted to $300,000 during the same period. Interestingly, over the past seven days, investments in XRP ETPs have surged by a substantial 366%.

To date this year, there has been approximately $25 million flowing into these investment tools, making XRP one of the leading contenders in this particular market.

Bigger picture

A notable point in the latest report is the significant reversal from a $147 million outflow to an inflow of $407 million. This shift could be largely due to investors’ heightened interest in the upcoming U.S. elections, as suggested by James Butterfill, an analyst at CoinShares, rather than their focus on monetary policy outlooks.

Instead of this strong economic data causing people to hold onto their positions, they instead chose to sell them. On the other hand, the recent political changes triggered an immediate increase in inflows and prices for cryptocurrencies.

Most inflows are primarily attributed to Bitcoin ETF investments, totaling approximately $419 million. Conversely, investments that employ a short strategy towards the primary cryptocurrency have experienced outflows amounting to about $6.3 million, moving funds in the opposite direction.

Conversely, Ethereum ETFs experienced a withdrawal of approximately $9.8 million last week, pushing their net monthly flow into the red zone at $35 million since early October.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD CLP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD COP PREDICTION

- GFT PREDICTION. GFT cryptocurrency

2024-10-14 16:04