As a seasoned crypto investor with a keen eye for political trends and their impact on the digital asset market, I find myself intrigued by the analysis presented by Alex Thorn and other industry experts regarding the potential crypto policies of different administrations.

Under Kamala Harris’ leadership, the U.S. cryptocurrency sector could potentially receive greater backing than it does under President Joe Biden’s current administration.

Harris More Supportive Than Biden, Trump ‘Undoubtedly’ More Favorable

Alex Thorn, who leads research at Galaxy Research, has recently published an in-depth comparison of cryptocurrency and blockchain policies under various administrations: the Biden administration, a hypothetical Harris-Walz administration, and the Trump-Vance administration.

Thorn pointed out that a Trump triumph might bring greater advantages to the expansive crypto sector, but a Harris presidency could potentially provide even stronger backing than the existing Biden administration. He characterized the potential drawbacks of a Harris presidency as ‘minimal.’

As for the classification of digital assets as securities, the Biden administration has taken a somewhat unclear position on regulations, thereby allowing the Securities and Exchange Commission (SEC) to deal with each situation independently.

Instead of saying “In contrast,” let’s rephrase it as “On one side, we have…

Another parameter is the difference in stance toward Bitcoin (BTC) mining. While the Biden administration has proposed a 30% tax on mining, Harris is expected to be ‘slightly better’ than Biden due to her connections in Silicon Valley.

Significantly, Trump strongly advocates for Bitcoin mining, considering it a form of domestic production, and has promised that the process of creating Bitcoin will primarily occur within American borders.

Although both the Biden and Harris administrations don’t seem to be secretly opposing crypto self-custody, the U.S. Treasury under Biden has tried to classify providers of non-custodial wallets as money transmitters. Contrastingly, Trump has openly pledged to safeguard self-custody rights, as emphasized in a speech in Nashville in July 2024.

The Biden government is considering setting clear guidelines for the regulation of stablecoins, with a suggestion that only banks should have the power to create these digital assets.

It’s likely that Harris supports Maxine Waters’ strategy, which emphasizes that stablecoins should be backed by secure assets such as short-term Treasury bills. In this scenario, the Federal Reserve and major banks could be involved in their issuance. Conversely, Trump is in favor of enabling non-bank institutions to issue stablecoins.

Harris Leaving No Stones Unturned To Woo Crypto Voters

Despite widespread belief that a Trump win could significantly boost digital asset prices and the overall industry, Harris has made efforts to appeal to voters interested in cryptocurrency.

More recently, she disclosed her economic plan, assuring the public about her intentions for crypto regulation and digital currency. Furthermore, it’s been noted that Harris has obtained a million dollars’ worth of XRP as political contributions from Ripple‘s co-creator, Chris Larsen.

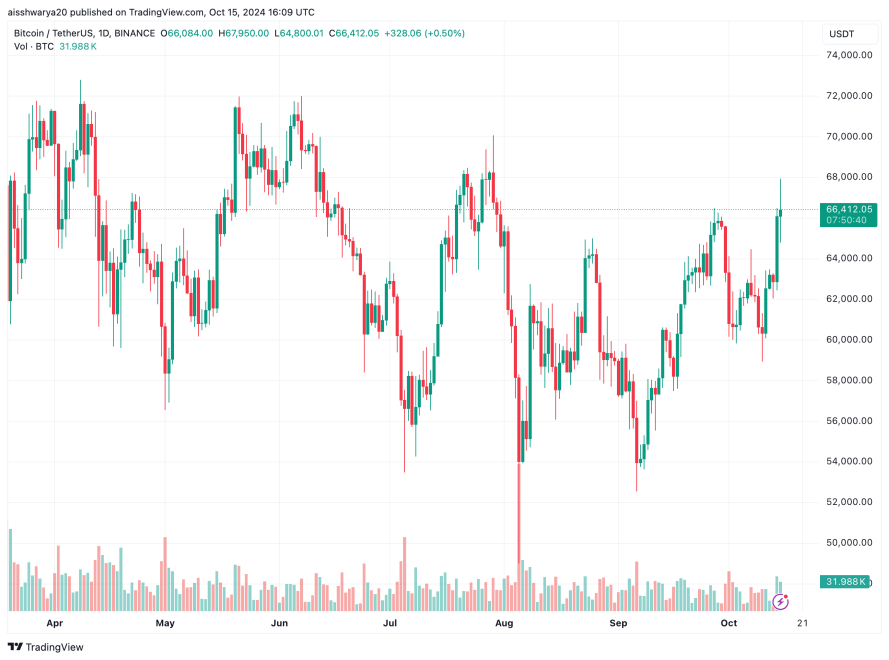

In line with Thorn’s perspective, QCP Capital suggests that a win by Harris might not necessarily be detrimental for crypto investors as some assume. At this moment, Bitcoin is trading at $66,412, marking a 0.8% increase over the last 24 hours.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD CLP PREDICTION

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- CHOW PREDICTION. CHOW cryptocurrency

- USD COP PREDICTION

- LAZIO PREDICTION. LAZIO cryptocurrency

2024-10-16 15:41