As I’ve been monitoring HBAR, the price is currently attempting to hold steady around $0.100. However, a deeper look at the derivatives market tells a different story. Funding rates and futures positioning indicate that traders remain generally bearish on HBAR, even after the positive news we saw last week. It seems the surface optimism isn’t fully reflected in how traders are actually positioning themselves.

Funding Flips, Bears Take Control

As part of my research, I’ve been monitoring market sentiment using Coinglass OI-weighted funding rates. Currently, the rate is at -0.0048% as of Tuesday, and it actually turned negative on Monday. While it might seem like a small number, this indicates that short sellers are currently dominating – meaning more traders are positioned to profit from a price decrease than from an increase.

This change is significant. When funding rates are negative, it usually means many traders are betting against the price, and currently, it indicates little belief that the price will recover soon. The overall price chart for HBAR shows similar uncertainty, as any attempts to increase the price have only resulted in temporary gains.

Open interest in futures has dropped to $108.82 million, continuing a recent downward trend. This usually means fewer traders are participating, and activity is slowing down. This isn’t typically what happens when investors are actively buying.

FedEx Boost, Short-Term Spark

Things became more interesting when FedEx announced it would join the Hedera Council. This news briefly boosted the price of HBAR, pushing it back towards $0.10. Partnerships with well-known companies often attract attention and temporarily increase demand.

But let’s be real: price reaction alone doesn’t erase broader sentiment.

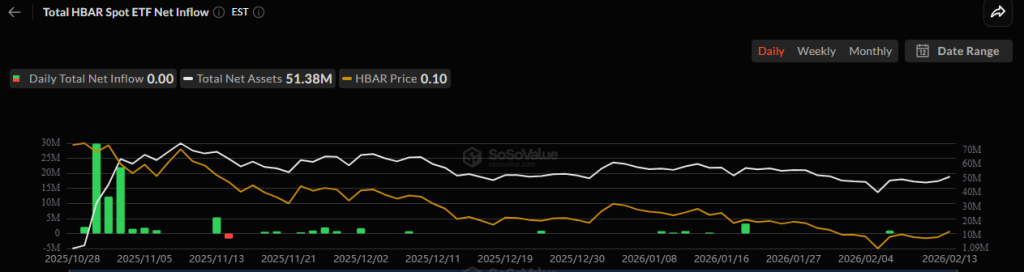

Investment into the ETF hasn’t been strong either. The last significant increase in funds was around $1 million on February 6th, and there’s been no notable investment since then. Most days since the ETF launched have seen no new money coming in, with only a few days showing even a small increase. This lack of consistent interest from larger investors isn’t enough to create a lasting change in the market.

Although the recent news about FedEx gave HBAR/USD markets a temporary boost, it hasn’t led to a lasting increase in investment.

The $0.150 Survival Zone

Currently, the $0.150 price level appears to be a key point for HBAR. If the price rises from its current level of $0.100 and reaches $0.150, it could attract more buyers in the short term. However, technical indicators suggest the price might struggle to go much higher. The Relative Strength Index (RSI) is currently at a neutral 52.07, meaning there’s potential for further upward movement, but reaching $0.150 could cause the RSI to indicate the price is overbought.

While CMF is showing a slight sign of improvement at -0.02, similar patterns in the past – specifically in July and October – led to price increases that ultimately failed when they reached between $0.14 and $0.18. This history makes it difficult to confidently predict a significant price increase for HBAR.

Both the AO and MACD indicators are starting to show increasing positive momentum, although they are still negative overall. This indicates the price could continue to rise until it encounters strong resistance.

What happens next depends on the price of HBAR. If it rises above $0.150 and stays there in the first three months of 2026, things could change. However, if it stays below that level, the price is likely to continue falling.

Read More

- Mewgenics Tink Guide (All Upgrades and Rewards)

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- How to Unlock the Mines in Cookie Run: Kingdom

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Starsand Island: Treasure Chest Map

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2026-02-17 19:23