Bitcoin trades under $76K cost basis, but on-chain data shows no major selling pressure.

Behold! The mighty Bitcoin, once a golden goose, now plummets below the average price of a certain Mr. Saylor, whose five-year accumulation has turned into a most unfortunate quagmire. Alas, the market gossips of his $6.7 billion paper loss, yet the data whispers that this is but a minor tempest in a teacup.

Saylor’s Bitcoin Position Underwater as Derivatives Risk Builds

According to the sage Arkham, our nobleman has poured $54.52 billion into Bitcoin since 2020, averaging a price of $76,027. Now, the price dangles 12.4% lower-a mere trifle, one might say, compared to Bitcoin’s storied volatility.

BITCOIN IS MORE THAN 10% BELOW SAYLOR’S AVERAGE PRICE

After 5 and a half years of buying Bitcoin – Saylor has purchased a total of $54.52B BTC at an average price of $76,027.

The price is currently 12.4% lower than his average – meaning that Saylor is currently sitting on an…

– Arkham (@arkham)

What a plight! A $6.7 billion loss, yet the market remains calm. How peculiar! One might imagine the derivatives as a troupe of overwrought actors, still bickering even as the curtain falls.

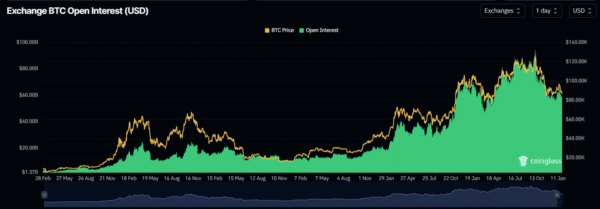

Image Source: CoinGlass

Thus, the stage is set for a dramatic showdown: if Bitcoin rebounds, short sellers may flee like frightened sparrows. But if it plummets further, the chaos shall be epic.

On the other hand, if key support levels break, long positions could be liquidated. In this case, selling pressure could increase.

The current market structure shows that deleveraging is not yet complete. In past mid-cycle pullbacks, open interest usually dropped more sharply. However, that kind of reset remains absent. As a result, many leveraged positions are still active, which means price swings could remain strong in the short term.

On-Chain Data Shows No Forced Selling as BTC Pullback Stays Within Cycle Norms

Wallet clusters linked to Saylor’s treasury show strong internal connections. Large connected addresses suggest centralized control and cold storage separation.

In addition, outbound transfers appear to be internal movements or security adjustments. So far, there are no clear signs of funds moving to exchange wallets. And as such, the risk of forced selling remains low.

Bitcoin has often experienced 20%-40% declines during broader bull markets. In full bear markets, prices have fallen by 70% or more. Compared with those moves, a 12.4% drop below a five-year average looks relatively small. A mere flicker in the grand tapestry of crypto’s antics.

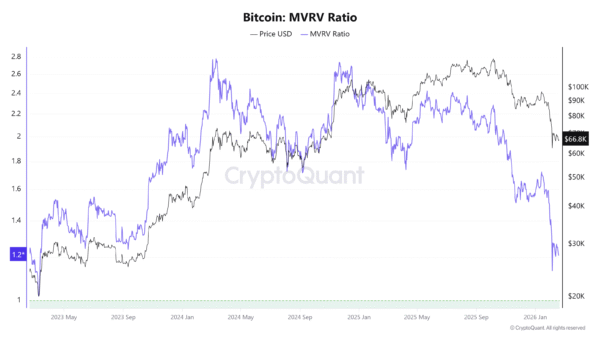

Image Source: CryptoQuant

Meanwhile, data from Coinglass shows that long-term holder supply is still close to cycle highs. When experienced holders increase their supply, it usually shows confidence. In past cycles, sharp drops in this metric came before major tops.

However, current data does not show wide selling from long-term holders. A large unwind like previous peaks has not appeared. With this in mind, current behavior looks more like a slowing of demand than a full exit from the market.

Saylor’s Bitcoin Position Faces Paper Loss as Market Tests Key Levels

Retail investors often focus mainly on the size of the dollar loss, while institutional investors place more weight on long-term time horizon and normal market volatility. From that perspective, five and a half years of steady buying spans multiple bull and bear cycles, which changes how short-term losses are viewed.

Bitcoin often moves 20% to 30% during broader uptrends. For that reason, a 12% gap below the average cost does not automatically signal that the strategy has failed. Custody remains stable, and the capital behind the position appears positioned for the long term rather than short-term trading.

Market direction now depends on three key factors. A clear drop in open interest could reduce selling pressure and calm volatility. A strong move back above $76,000 could shift short-term momentum higher. On the other hand, a break below key support levels could trigger additional liquidations and increase downside pressure.

Read More

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- God Of War: Sons Of Sparta – Interactive Map

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- How to Discover the Identity of the Royal Robber in The Sims 4

- Who Is the Information Broker in The Sims 4?

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2026-02-19 15:30