The market sits like a patient, uneasy patient waiting for a report, its heartbeat muted to a low-grade jazz of numbers. Bitcoin, once that silver‑glinting slice of ingenuity, has descended a modest hill, and the mighty holders-those stoic titans among us-keep their faces as placid as a pond disturbed only by a fish that hasn’t yet heard a splash. Amid the wobble of graphs, a certain investor turned the veil of speculation into an angry, binary monologue: either we die in our wallets or we clothe ourselves in unthinkable riches.

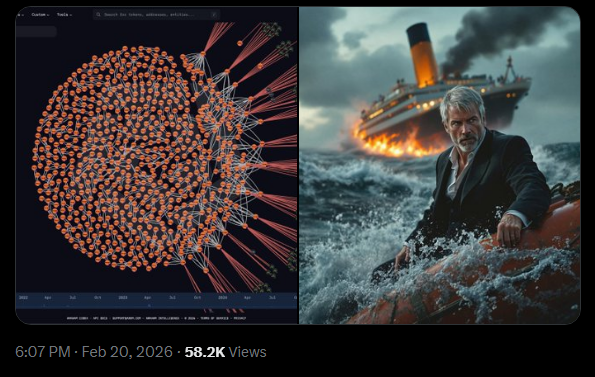

Saylor’s Binary Bet

Michael Saylor, gentleman of mystic conviction, argues that Bitcoin is a soul stripped to two poles: either it dissolves into oblivion, or-like a phoenix reborn-it soars to a million dollars per coin. He offers no quick gamble, but rather a slow compulsion fueled by the scarcity of a finite coinage and the inexorable pull of lenders with temples of money. He lifts a glass of institutional greed, swirling in a cocktail of fresh banks, shimmering ETFs, and corporate sums, and declares, with the pliant gravity of a professor: “As the markets find delivery systems, the future gathers weight.” He plays the future like a deck of cards, forcing centers to face a pile of anticipation.

“If it’s not going to zero, we’re going to a million.”

– Michael Saylor, March 2026

A Warning From The Other Side

Not everyone entertains this lofty parody. Bloomberg’s Mike McGlone sketches a more somber choreography-perhaps a dance of bearish shadows, plunging to a hushed $10,000, thanks to fiscal storms and the ominous sighs of macroeconomics. History whispers that markets are dragons: they can snap, they can hiss, and they can trust us to lick their wounds. Short bursts can bruise fiercely, long vibrations can unfurl in whispers, but both perspectives spin onto the same writhing axis of risk and destiny.

Under this bleak prophecy, the firm whispering Saylor’s chorus still calls the draught of its own debt. They hold 717,131 BTC with a cost average of $76,027 per coin, thereby sinking in the lake of the market. Yet, as Arkham Intelligence notes, this financial<|reserved_200293|>ouser is clinging to convertible bonds, preferred shares, and an oddly generous dividend policy that postpones an eviction. The cash flows may keep the house dusted for a while, but the desperation of a stone‑cold market remains as unyielding as winter snow.

“SAYLOR IS UNDERWATER. BUT WILL HE SELL BTC?”

“Saylor is more than 10% underwater. What could truly force a sale?”

– Arkham, March 2026

The $1 million prophecy is a lecture in numbers: 21 million coins set the ceiling. If institutions and treasuries keep purchasing, a simple arithmetic paradox pushes the price higher. Saylor muses that, with a unique portion of the total coinage in the company’s paws, the titanic number might even slide into $10 million under a heavier concentration of ownership. Yet these are not dice rolls but moral riddles, conditional on a perfect confluence of adoption, regulation, and price dynamics over a dozen years.

Bitcoin might crawl like a fern, rope around regulators, and linger in a tight corridor for an epoch, or it could shoot up with a take‑off rocket as new buyers paddle in. Politics, rule‑making, and restless global capital will choreograph the steps we take. Institutional traffic has rewritten the market’s journey, but the path is still paved with the jagged stones of possible large losses.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- I Used Google Lens to Solve One of Dying Light: The Beast’s Puzzles, and It Worked

2026-02-21 12:50