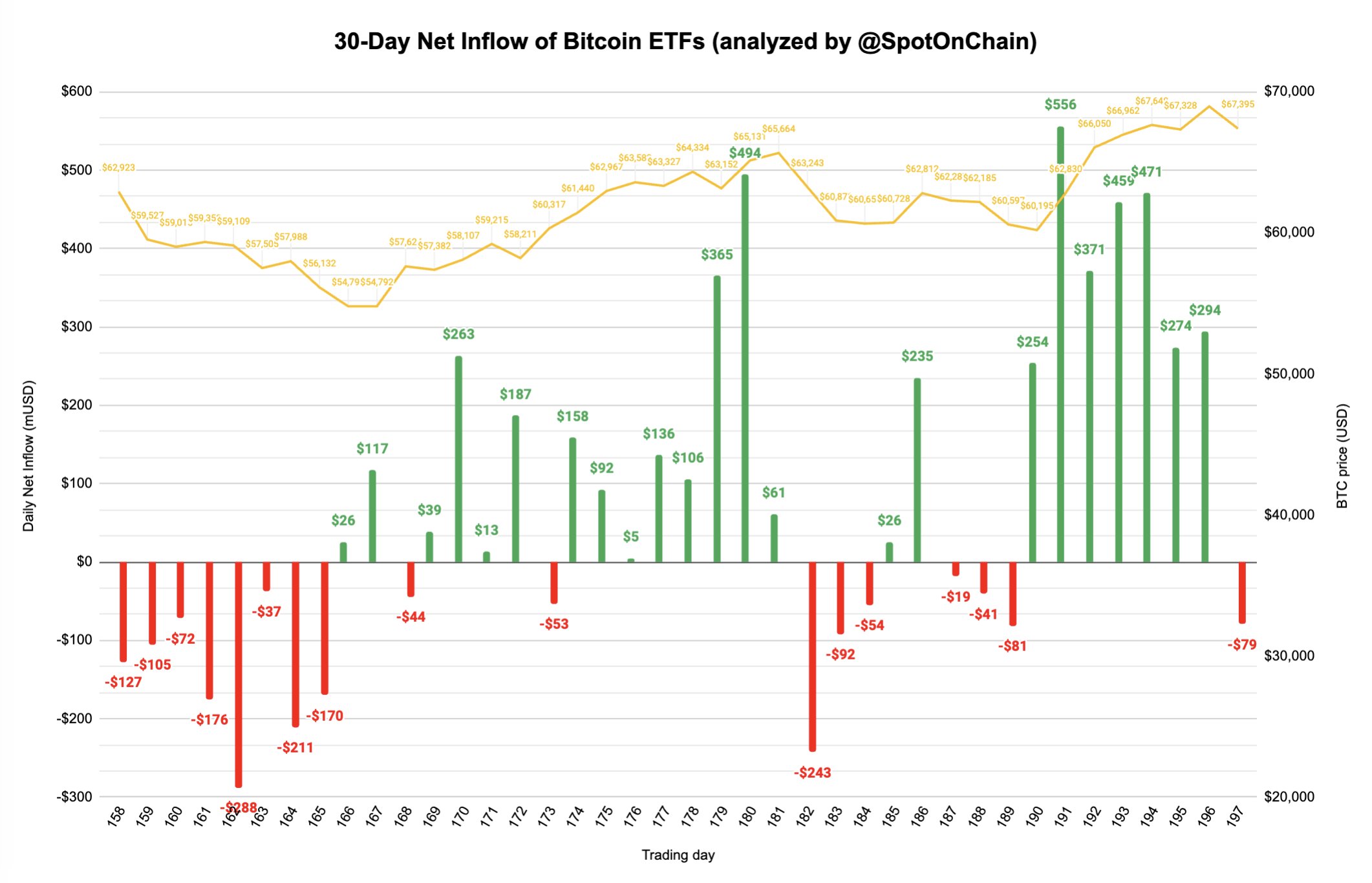

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I’ve learned to never get too comfortable or complacent – and the recent market shifts have certainly reminded me of that! The outflows from spot Bitcoin ETFs on Oct. 22 were a stark contrast to the inflows seen just days earlier, leaving me scratching my head trying to decipher the ever-changing market sentiment.

On October 22nd, Bitcoin spot ETFs experienced a significant outflow of approximately $79.1 million, marking a stark change from the previous day’s inflow of $294.3 million. In contrast, Ethereum spot ETFs saw a relatively small influx of $11.9 million, rebounding from the preceding session’s outflow of $20.8 million.

The most recent analysis by Spot on Chain indicates a significant change in the market, as U.S. Bitcoin ETFs have seen withdrawals following a streak of seven days with substantial investments. However, BlackRock’s IBIT has persistently increased its holdings, purchasing an additional 22,480 Bitcoins worth approximately $1.51 billion during the past week, raising its total Bitcoin reserves to 392,121 coins.

This new development follows on the heels of a report by CoinShare, which disclosed substantial investments into cryptocurrency exchange-traded products (ETPs). Over the past few days, the market has seen an influx of around $2.2 billion, representing the largest investment since July.

Despite Ethereum’s positive performance, a change in Bitcoin ETF investments indicates a sense of caution among investors in the crypto market. Withdrawals, though less than $100 million, fuel apprehensions about decreasing confidence in the cryptocurrency sector.

Bitcoin (BTC): Price outlook

The fluctuating cost of Bitcoin has increased doubt, since the primary digital currency keeps on breaking through crucial support points. At present, it seems poised to test the flexible resistance in the vicinity of the $65,000 range again.

Over the past week, a significant decline in the value of various altcoins has been observed, as indicated by the decrease in the TOTAL2 index, which monitors the market capitalization of all non-Bitcoin cryptocurrencies, amounting to over $40 billion.

Regardless of BlackRock’s active purchasing, investors exhibit caution and are quick to respond to updates in the market. The current exits hint at lingering uncertainty, even with influential institutions such as BlackRock maintaining a robust position.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- FIS PREDICTION. FIS cryptocurrency

- EUR ARS PREDICTION

- ULTIMA PREDICTION. ULTIMA cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- INR RUB PREDICTION

- Pokemon Fan’s Wife Finds Perfect Use for Their Old Cartridges

- EUR CAD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Marvel Rivals Shines in its Dialogue

2024-10-23 15:06