As a seasoned crypto investor with a decade of experience navigating the volatile and unpredictable world of digital currencies, I can’t help but marvel at BlackRock’s strategic play in amassing such a staggering amount of Bitcoin. Having witnessed the rise and fall of countless altcoins, I’ve learned to respect the power of patience and foresight in this industry.

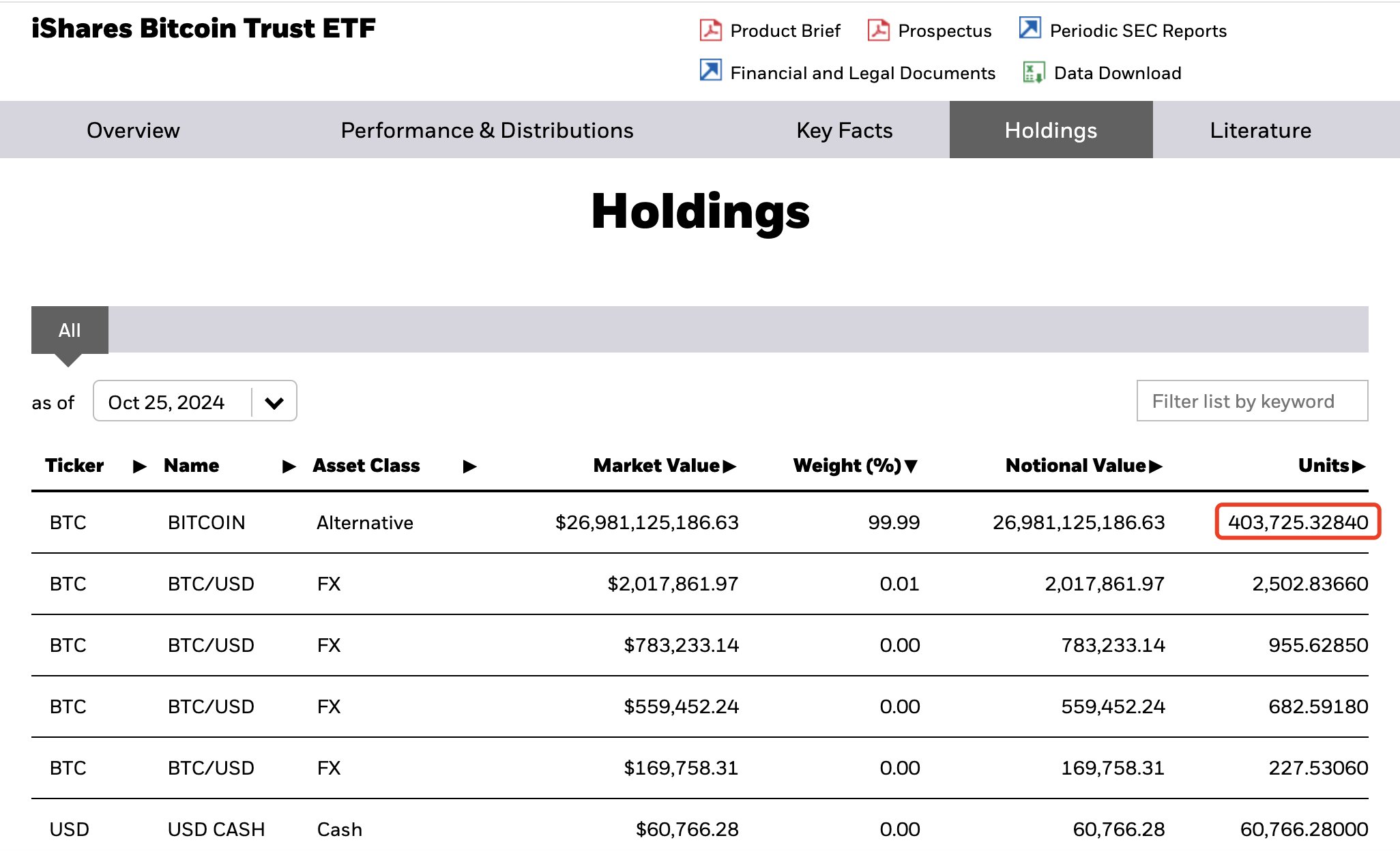

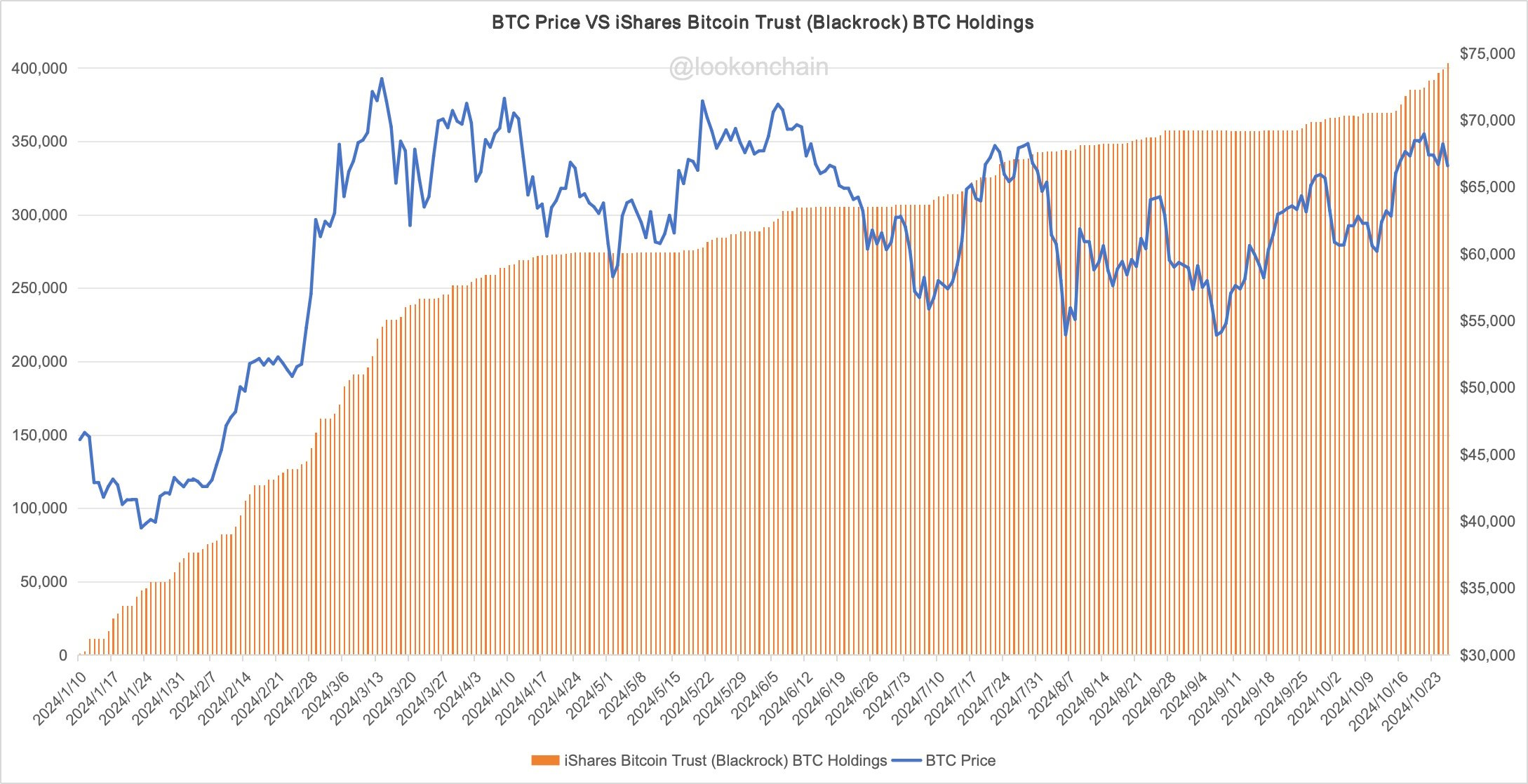

BlackRock, a leading hedge fund, has hit a significant mark in its Bitcoin reserves, now holding more than 400,000 BTC. At present, these assets are valued at approximately $26.98 billion, amounting to 403,725 BTC. This substantial increase in holdings occurred through the purchase of an additional 34,085 BTC over the last fortnight, according to Lookonchain, which is roughly equivalent to $2.3 billion.

The continuous investments into Bitcoin Exchange-Traded Funds (ETFs) are boosting BlackRock’s influence in the cryptocurrency market, solidifying it as a leading player. This suggests that Bitcoin ETFs are increasingly serving as a significant avenue for institutions to acquire BTC. As BlackRock expands its assets in Bitcoin, some speculate that the digital currency’s trajectory may shift.

BlackRock to take over Bitcoin?

There are growing speculations about potential future conflicts over Bitcoin, with some warning of a scenario where financial giant BlackRock might split off from the original Bitcoin chain and advocate for their separate version as the authentic one. This could be plausible given BlackRock’s immense resources, but in the present context, it appears more like a speculative conspiracy theory.

As a researcher observing the dynamic world of cryptocurrencies, I find myself pondering over the pace at which Bitcoin is amassed, leading me to question when giants like BlackRock might decide to set boundaries in their quest for supremacy within this digital asset market.

From my perspective as a crypto investor, I find that giants like BlackRock aren’t the only players in the Bitcoin game. Influential figures such as Michael Saylor and his company MicroStrategy, mining entities, early adopters, and countless individual investors create a vast, decentralized market presence. Whether we collectively have the power to stand up to BlackRock remains to be seen.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- FLOKI PREDICTION. FLOKI cryptocurrency

- USD ILS PREDICTION

- VINU/USD

2024-10-27 16:51