As a seasoned crypto investor who has weathered numerous market cycles, I must admit that MicroStrategy’s (MSTR) meteoric rise during premarket trading, fueled by Bitcoin’s all-time high above $75,000, has caught my attention. Having closely followed Michael Saylor’s bold crypto strategy, it’s hard not to be impressed with the results.

In premarket trading MicroStrategy’s stock MTSR surged an impressive 13%, riding high on the heels of Bitcoin’s most recent all-time high above $75,000. The company’s audacious plan to closely link its value to Bitcoin’s performance is reflected in this spike in MSTR.

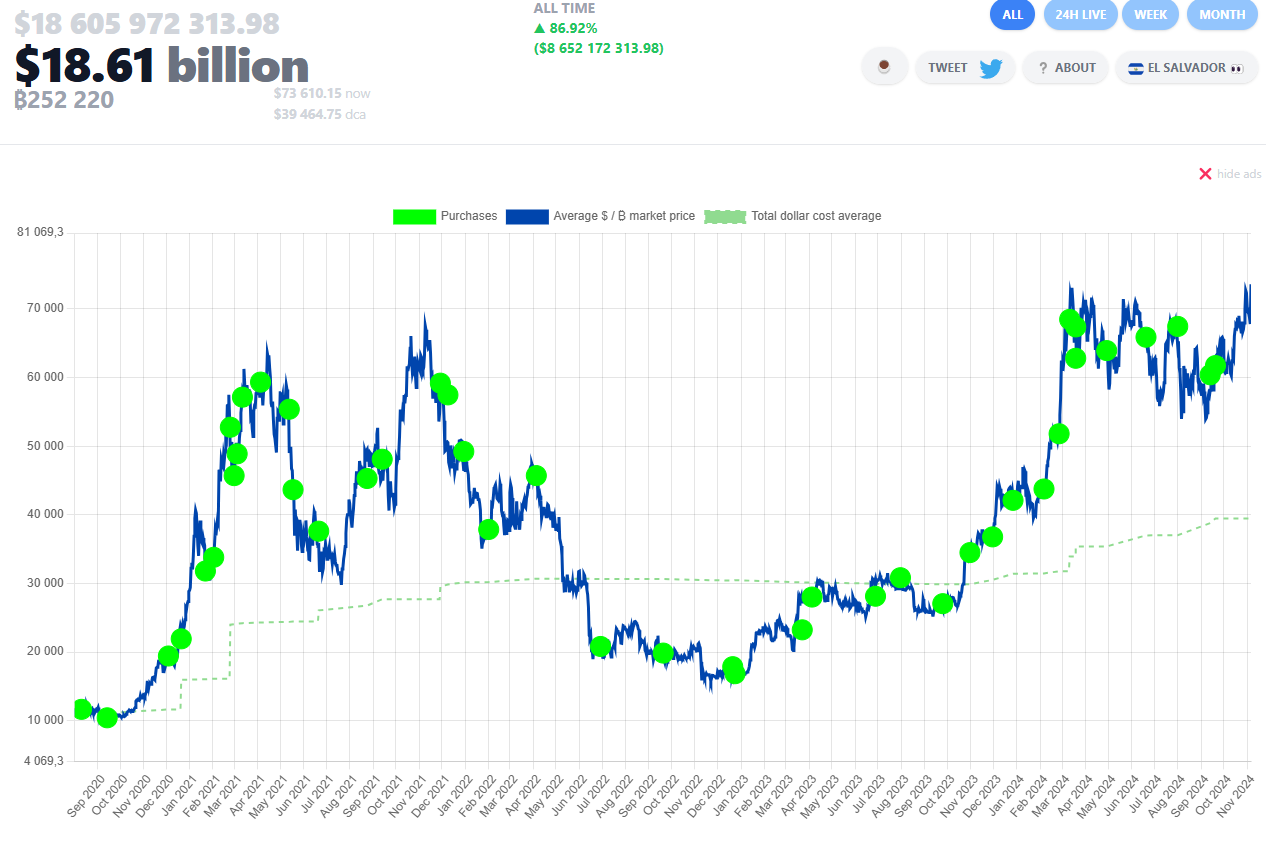

Beyond underscoring the value of MicroStrategy’s substantial Bitcoin investments, the escalating price of Bitcoin serves as a testament to Michael Saylor’s effective approach towards cryptocurrency investment. Presently, MicroStrategy holds approximately 158,245 Bitcoins, which equates to more than $11 billion in value.

As a crypto investor, I’m thrilled to see my company’s holdings yielding substantial profits. This success underscores the effectiveness of dollar-cost averaging and my long-term bullish stance on Bitcoin. The recent surge in Bitcoin’s value seems to have bolstered MicroStrategy’s financial health, making its balance sheet look even more robust. This strengthened position undeniably boosts the confidence of shareholders like me, who believe in the potential growth of this digital currency.

The surge in Bitcoin’s price chart surpassing $75,000 might indicate a build-up of bullish energy. If Bitcoin manages to sustain itself above this level, there could be potential for it to reach $80,000 and beyond, boosting MicroStrategy’s stock growth. Investors are likely keeping an eye on the support levels around $68,000 to $70,000, waiting to see if Bitcoin maintains its power.

Increasing the price toward $80,000 suggests a robust continuation of the bullish momentum for Bitcoin, which would undoubtedly be beneficial for MSTR. Furthermore, MicroStrategy’s positive trajectory underscores a broader recovery pattern within the overall cryptocurrency market, suggesting a strong link between its stock value and that of Bitcoin.

With Bitcoin’s growing influence and the market showing optimism, MicroStrategy’s shares may persistently climb and benefit from the thriving digital asset sector. It’s essential for MSTR investors to monitor Bitcoin’s significant price points closely since fluctuations in the cryptocurrency’s value are likely to have an immediate impact.

This strong foundation makes a case for MSTR as a substitute investment for those seeking Bitcoin exposure. It offers a unique opportunity for both institutional and individual investors to capitalize on Bitcoin’s growth, particularly given MicroStrategy’s close link to Bitcoin’s market trends.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- TON PREDICTION. TON cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- Strongest Magic Types In Fairy Tail

- GLMR PREDICTION. GLMR cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- USD ZAR PREDICTION

2024-11-06 15:25