As a seasoned researcher who has witnessed the rollercoaster ride of the cryptocurrency market, I can confidently say that MicroStrategy’s surge in premarket trading is nothing short of astonishing. With my fingers still recovering from the constant typing of Bitcoin price updates, I find myself amazed yet again at Michael Saylor’s audacious strategy. It’s like watching a master chess player outsmart his opponents with every move.

In premarket trading MicroStrategy’s stock MSTR surged an impressive 13%, riding high on the heels of Bitcoin’s most recent all-time high above $75,000. The company’s audacious plan to closely link its value to Bitcoin’s performance is reflected in this spike in MSTR.

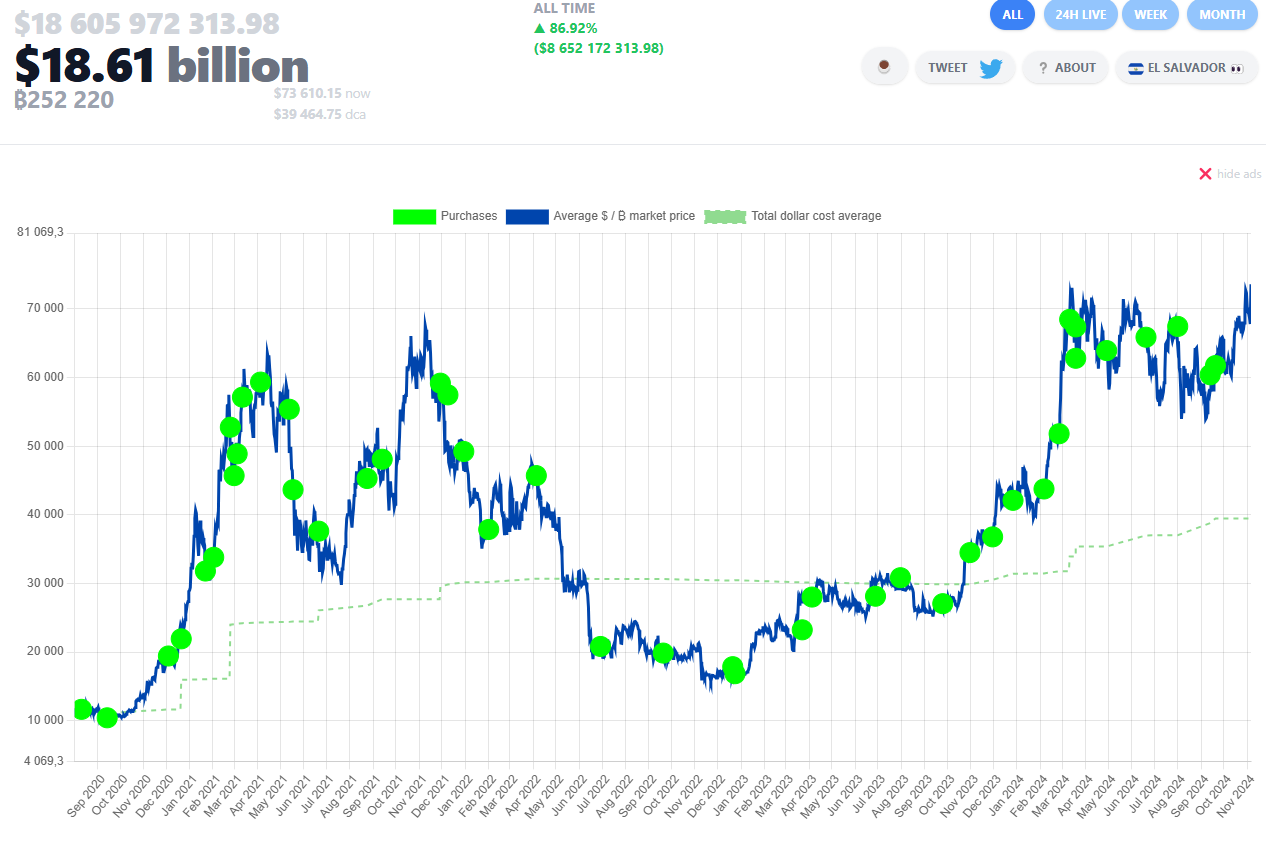

Beyond underscoring the value of MicroStrategy’s substantial Bitcoin assets, the increasing value of Bitcoin also showcases the effectiveness of Michael Saylor’s cryptocurrency investment approach. Currently, MicroStrategy holds approximately 158,245 Bitcoins, equating to more than $11 billion in value.

As a researcher, I find it noteworthy that our company’s substantial profits from its holdings indicate a successful implementation of the dollar-cost average strategy and a long-term bullish stance on Bitcoin. The recent upsurge in Bitcoin has seemingly bolstered MicroStrategy’s financial standing, lending credence to shareholder trust.

The latest surge over $75,000 on the Bitcoin price graph indicates a potential increase in bullish power. If Bitcoin manages to sustain levels above this point, it could pave the way for a climb towards $80,000 or even higher, potentially boosting MicroStrategy’s stock growth path. Investors are likely focusing on crucial support zones of $68,000 to $70,000 to assess whether Bitcoin retains its strength.

Increasing the price to around $80,000 suggests a robust extension of the Bitcoin bull run, which bodes well for MSTR. This upward movement not only underscores the relationship between MSTR’s stock and Bitcoin but also hints at a broader recovery pattern in the overall cryptocurrency market.

With Bitcoin’s growing influence and the positive market sentiment, MicroStrategy’s stock may further increase, profiting from the thriving digital asset sector. It is essential for MSTR investors to closely monitor Bitcoin’s crucial price points as fluctuations in its value could instantaneously impact its performance.

This solid foundation makes a case for MSTR as a substitute for owning Bitcoins, offering a unique opportunity for both institutional and individual investors to gain from Bitcoin’s rise, particularly since MicroStrategy’s performance closely mirrors that of Bitcoin.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- USD COP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- LUNC PREDICTION. LUNC cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- THL PREDICTION. THL cryptocurrency

2024-11-06 16:19