As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that this latest Bitcoin surge has me both excited and cautiously optimistic. The steady growth and measured response from long-term holders remind me of the early days of Bitcoin, back when we were all huddled around our computer screens, eagerly watching the price ticker like a stock market newbie.

Yesterday, Bitcoin hit an unprecedented peak of $90,243, driven by a week of significant demand. This recent spike has ignited enthusiasm throughout the cryptocurrency world, as people predict that its potential increase might reach even greater heights.

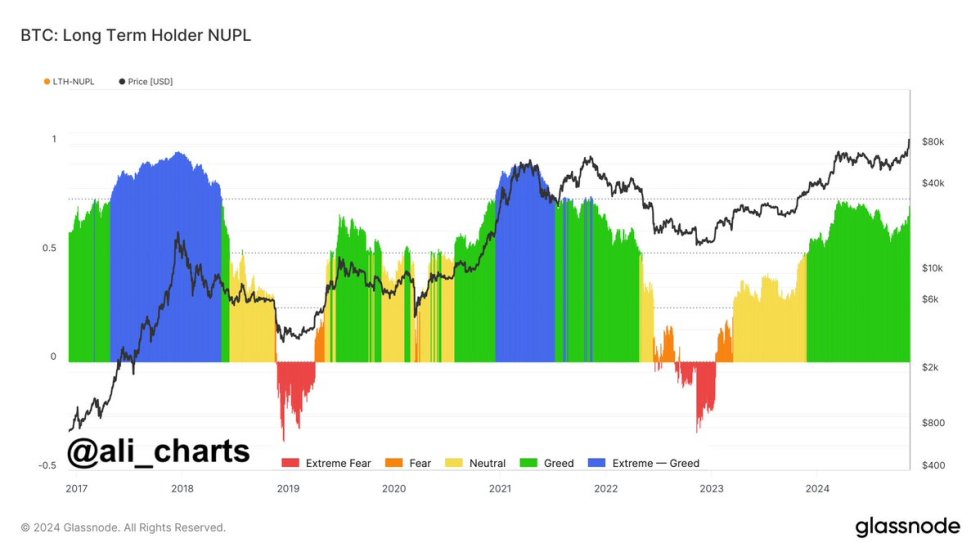

As Bitcoin nears this significant level, there could be a short period of stabilization before another surge ensues. Interestingly, information from Glassnode suggests that long-term investors exhibit little indications of excessive greed or immediate profit-taking, even with the swift price rise.

Long-term investors seem to be adopting a guarded optimism, implying they view this surge as just the beginning, not the pinnacle, of an extended bullish trend. Unlike past instances where frenzy reigned and investors rushed to cash out their profits, the present mood indicates a calculated belief in Bitcoin’s capacity for prolonged growth.

Experts are keeping a keen eye on Bitcoin (BTC) to determine if it can form a new base of support around $90,000. This could pave the way for additional price increases. As BTC stabilizes at this point, the general market feeling suggests that the upward trend might have ample potential to expand, particularly if long-term investors continue to hold strong.

Bitcoin Rally Starting

After eight months of holding steady and experiencing selling pressure, Bitcoin is now moving into the anticipated uptrend phase, characterized by increasing prices.

The price has surged by 20% above its previous all-time high set in March and is now testing uncharted territory. This breakout has sparked optimism in the market, with many anticipating that Bitcoin’s price could continue to rise as it moves further into price discovery.

As a crypto investor, I’ve been closely watching the latest findings by Glassnode and analyst Ali Martinez on Bitcoin (BTC). Despite BTC’s significant price surge, long-term holders are yet to exhibit extreme greed, implying that we may be in the early stages of this bullish market phase. This insight underscores the importance of staying informed and patient during these exciting times for cryptocurrency investors like myself.

The current state of the Net Unrealized Profit/Loss (NUPL) metric, a tool that measures the profitability of coins held by long-term investors, is within what’s known as the “greed” range. However, it hasn’t hit the “extreme greed” levels observed in past market cycles. This suggests that investors are optimistic and holding onto their investments, but they haven’t yet reached the level of excessive enthusiasm that usually precedes a market peak.

The information indicates that major market participants, such as institutional investors and long-term holders, continue to express a positive outlook for Bitcoin’s future performance over the next few weeks.

Not having excessive greed suggests there’s potential for more expansion, since the market hasn’t achieved the same intensity that typically signals major adjustments or corrections. Given Bitcoin’s ongoing surge towards unprecedented heights, this cautious optimism might foster a prolonged bullish trend.

BTC Consolidates Below $90,000

Currently, Bitcoin is being traded at approximately $87,600, following its new record high of $90,243. After a week filled with strong purchasing activity, it appears that the price has temporarily peaked and may be preparing for a period of stabilization below the $90,000 threshold. Traders will keep an eye on crucial levels during this phase to determine if the upward trend can persist.

If Bitcoin (BTC) maintains its position above $85,000, it’s likely we’ll see another test at this level. If this level holds as support, Bitcoin might push even higher, indicating that the bullish trend remains strong and suggesting a new surge in price is on the horizon.

If the price doesn’t manage to stay above $85,000, Bitcoin might experience a pullback to less active buying zones, approximately at $82,000. A decline below this point could signal a more significant correction, with potential tests of lower support levels before traders start purchasing again.

Over the next few days, the price movements near these crucial points will indicate whether Bitcoin will surge ahead or pause for a moment before resuming its upward trend. It’s essential for investors to remain vigilant and keep an eye on how the prices are changing.

Read More

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- ADA PREDICTION. ADA cryptocurrency

- HBAR PREDICTION. HBAR cryptocurrency

- ORDI PREDICTION. ORDI cryptocurrency

- UNI PREDICTION. UNI cryptocurrency

- TWT PREDICTION. TWT cryptocurrency

2024-11-14 00:42