As a seasoned researcher with a penchant for deciphering market trends and a not-so-secret love for Bitcoin, I find myself intrigued by the recent surge in unrealized profits among traders. The Profit/Loss Margin, a metric that has proven its worth time and again, paints a clear picture of the situation.

The latest on-chain figures indicate a significant increase in Bitcoin earnings among traders. Let’s see if these current levels reach or surpass those seen at previous market peaks.

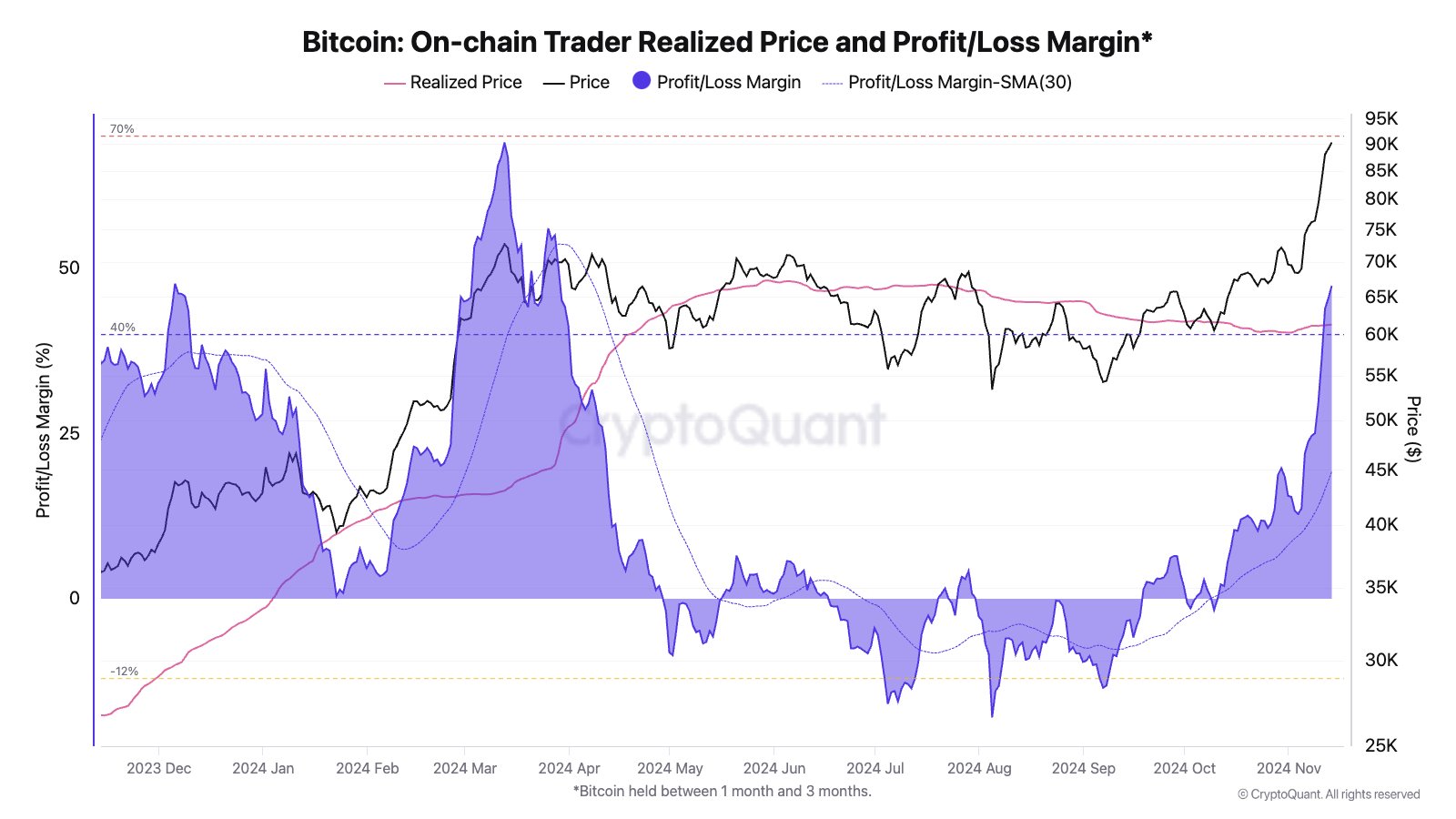

1 To 3 Months Old Bitcoin Investors Are Currently Up 47%

In my analysis as a researcher at CryptoQuant, I’ve noticed that the unrealized profits among traders have surged to substantial heights lately. The key on-chain indicator we’re focusing on here is the “Profit/Loss Margin.” This metric sheds light on the cumulative profit or loss Bitcoin investors are currently carrying.

This tool analyzes past transactions of all coins currently in circulation to determine the price at which they were last traded. If the previous transaction price for any token is lower than its current market value, it suggests that coin has an unrealized gain.

In a similar fashion, coins with a different value are often referred to as incurring a total deficit. The Profit/Loss Margin combines these gains and losses across the entire system, providing an overview of the overall state, whether it’s profitable or not.

In the scope of our ongoing discussion, we’re focusing on the Profit/Loss situation of Bitcoin traders – those who acquired their digital coins no less than 30 days and 90 days prior.

Currently, I’d like to bring your attention to a graph provided by Moreno, which illustrates the fluctuation in the Bitcoin Gain/Loss Ratio among BTC traders throughout the last year.

Looking at the graph, it shows that the profit/loss margin for Bitcoin traders has spiked significantly in the positive direction, suggesting these investors currently hold substantial profits.

In simpler terms, this group has seen a 47% increase in their overall earnings since the latest rise in prices. Generally speaking, when investors make larger profits, it tends to suggest that the peak for the cryptocurrency’s value might have been reached.

The bigger the profits, the more likely it becomes for holders to cash out for a profit, a behavior commonly known as profit-taking. This is particularly true among traders, many of whom are less experienced and may be prone to panic selling.

The graph indicates that a peak happened in March when the given indicator was approximately 69%. To date, the measure hasn’t reached such heights.

To clarify, Bitcoin reached its peak around last December, and the difference between profits and losses for traders at that time was 48%. Interestingly, this figure is merely 1% greater than the current margin.

Time will tell if the Bitcoin surge will persist amidst the possibility of traders cashing out, or if a cooling-off period will occur beforehand.

BTC Price

At the time of writing, Bitcoin is trading at around $88,800, up more than 16% over the past week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- USD PHP PREDICTION

- APU PREDICTION. APU cryptocurrency

- USD GEL PREDICTION

- DUSK PREDICTION. DUSK cryptocurrency

- EUR NZD PREDICTION

- USD COP PREDICTION

- CHEEMS PREDICTION. CHEEMS cryptocurrency

2024-11-15 22:42