As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. However, the current trend in Bitcoin Large Holders Netflow has caught my attention. The fact that these large investors are continuing to accumulate even at recent highs is a positive sign that could potentially signal a continued rally for BTC.

Information from on-chain sources indicates that large Bitcoin investors, known as “whales,” have persisted in buying even during the recent peaks. This behavior could potentially signal a positive outlook for an upcoming price surge.

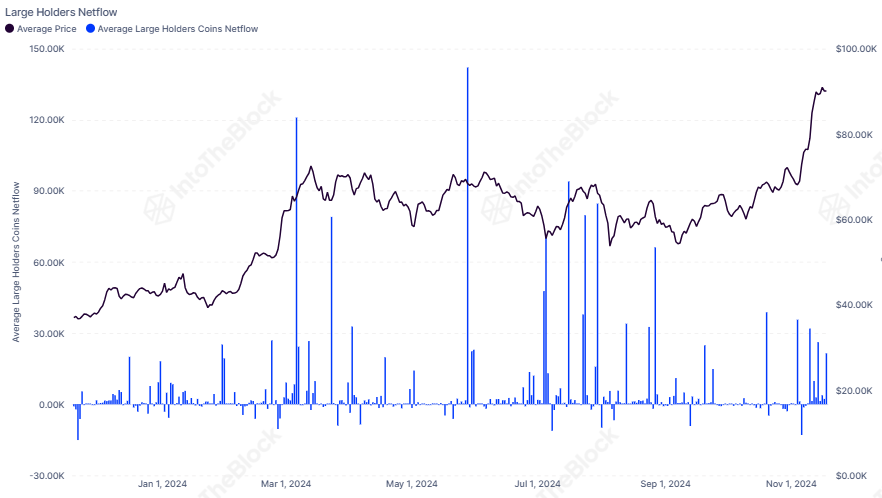

Bitcoin Large Holders Netflow Has Continued To See Positive Spikes Recently

As a researcher, I’ve noticed an uptick in the number of significant BTC holders based on data from IntoTheBlock’s market intelligence platform. The metric we’re focusing on is called “Large Holders Netflow,” which monitors the net inflow or outflow of Bitcoin to and from wallets connected to these large holders.

According to IntoTheBlock, “Large Holders” refer to investors possessing at least 0.1% of a cryptocurrency’s total supply. Given that there are approximately 19.8 million units of the asset in circulation, individuals falling under this category would need to hold at least 19,800 BTC.

In terms of today’s currency conversion, that quantity of assets translates to roughly 1.8 billion dollars. Consequently, these investors can be considered as quite substantial or significant in size.

In essence, the more cryptocurrency coins an investor holds, the greater their impact in the market tends to be. Consequently, the largest holders with substantial balances often exert significant influence over the network. Therefore, monitoring their behavior is of particular interest.

When the Netflow of coins for large investors is positive, it means they are receiving more coins than they’re sending out, indicating they are buying. This accumulation could potentially be a sign of optimism or bullish sentiment towards the asset.

Instead, the downsizing of crypto holdings by large investors could be a sign pointing towards potential bearish movements in the cryptocurrency market.

Now, here is a chart that shows the trend in the Bitcoin Large Holders Netflow over the past year:

According to the graph, there were significant increases in the outflow of Bitcoin held by large investors (or “whales”) earlier this year, indicating they were actively buying up the cryptocurrency.

As Bitcoin (BTC) surges to fresh record highs, I’ve noticed a recurring pattern – the buying indicator is showing encouraging spikes once more. The current wave of net buys might be smaller than before, but the fact that these investors are holding onto their investments instead of selling is definitely promising for BTC.

The total increase (or accumulation) clearly demonstrates the whales’ current faith in cryptocurrencies, given that their purchases have occurred when Bitcoin has already reached prices never seen before in its history.

It’s yet unclear if the ongoing accumulation by significant Bitcoin holders will lead to a further price surge or not.

BTC Price

At the time of writing, Bitcoin is trading at around $92,600, up more than 7% over the last week.

Read More

- FIS PREDICTION. FIS cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- LUNC PREDICTION. LUNC cryptocurrency

- Luma Island: All Mountain Offering Crystal Locations

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- How to Claim Entitlements In Freedom Wars Remastered

- Rumor: Potential Switch 2 Price and Launch Game Lineup Details Leak Online

2024-11-20 17:41