As a seasoned crypto investor who has witnessed the ups and downs of this rollercoaster ride since its inception, I find myself both exhilarated and cautious as we approach the impending $100,000 milestone for Bitcoin. The thought of such a historic price is undeniably enticing, but the potential consequences cannot be overlooked.

Over the course of the recent events, it’s becoming increasingly a question of “when” rather than “if” Bitcoin will achieve an unprecedented six-digit value. The crypto analysis forums and discussions have been predominantly focusing on Bitcoin potentially exceeding $100,000 in the last few weeks.

Reaching a six-figure value for BTC is not just a significant achievement for the crypto world, but it also triggers “adverse” occurrences like margin call or liquidations for short sellers. Let’s explore some potential outcomes if the Bitcoin price surpasses $100,000 using on-chain analysis.

What’s Next For BTC’s Price After $100,000?

According to a recent update from blockchain analysis company Glassnode, they’ve offered insights into how Bitcoin has been faring on the blockchain since its latest surge. Although it appears that Bitcoin could reach $100,000, Glassnode predicts that the price may slow down after reaching this milestone.

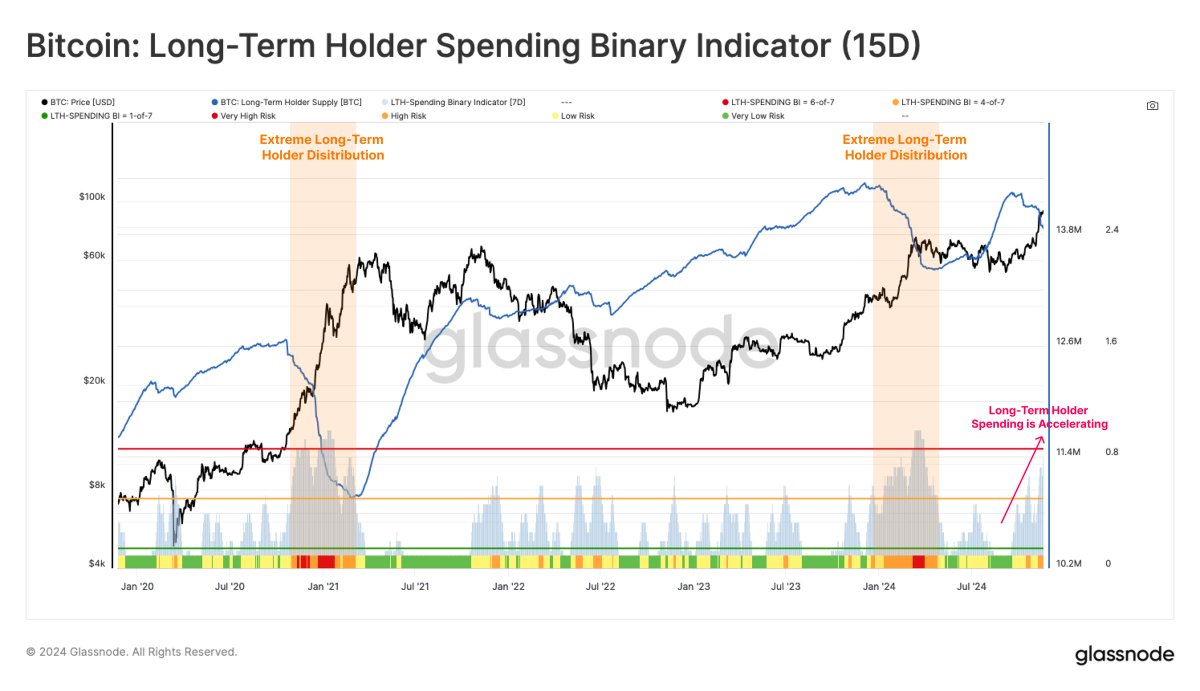

One reason for this prediction is linked to the current actions of a group of investors called Long-term Holders (LTH). As per Glassnode, these LTH investors have started selling their holdings to secure profits, and they might choose to sell even more coins as the market’s strength continues to increase.

According to the LTH Spending Binary Indicator, which monitors the selling pressure among long-term investors, these significant investors have been progressively unloading their holdings. Over the past 15 days, this Spending Binary measure indicates that the balance of long-term holders has decreased on eleven occasions.

Institutional investors, primarily through U.S. spot exchange-traded funds (ETFs), have been soaking up about 90% of the selling stress from long-term investors. However, Glassnode observed that this group’s spending rate has recently surpassed the net inflows of these ETFs. This trend was also spotted earlier in February 2024. In simpler terms, institutional investors have been buying a lot more than they are putting into these ETFs, and this was noticed before as well, back in February 2024.

As a researcher examining market trends, I find that Glassnode’s analysis suggests potential short-term price fluctuations or consolidation if sell pressure persists at a faster rate than ETF demand. In simpler terms, this means the selling pressure might be stronger than the buying pressure from ETFs, which could cause some instability in prices or lead to a period of price stability.

Starting from November 13th, there’s been more selling pressure on LTH (Long-Term Holdings) than ETF (Exchange Traded Fund) inflows, mirroring a pattern seen in late February 2024. This imbalance between supply and demand has historically led to heightened market volatility and consolidation periods.

$1.89 Billion To Be Liquidated If Bitcoin Price Crosses This Level

On November 22, well-known cryptocurrency analyst Ali Martinez issued a cautionary message to Bitcoin skeptics on platform X. Based on figures from CoinGlass, approximately $1.89 billion could be liquidated if the price of Bitcoin rises to $100,625.

Currently, the leading cryptocurrency is worth approximately $99,424, representing a 1.4% increase over the previous day. According to CoinGecko, Bitcoin has experienced a substantial rise of almost 10% during the last week.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- Luma Island: All Mountain Offering Crystal Locations

- DCU: Who is Jason Momoa’s Lobo?

- INR RUB PREDICTION

- EUR ARS PREDICTION

2024-11-24 04:41