As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed the evolution of digital assets from mere curiosities to a significant part of the global economy. The recent statement by Richard Teng, the head of Binance, about potential Bitcoin strategic reserves by governments is not surprising, considering the asset’s growing influence and its increasing resemblance to gold.

As a crypto investor today, I found myself pondering over a significant discussion sparked by none other than Richard Teng, the current leader at Binance. This topic has been a hot speculation within our community for years – the nations that hold the primary cryptocurrency, Bitcoin (BTC). Given its resemblance to gold, which was recently endorsed by Jerome Powell, the head of the U.S. Federal Reserve Board, many crypto enthusiasts like myself view BTC as a valuable asset that could potentially be included in strategic reserve baskets.

As the upcoming U.S. administration draws near, such discussions have become more prevalent. While there’s no definitive information about their plans yet, the market is showing signs of a potential similar scenario, as Bitcoin has surged by more than 136% since the start of the year and has even flashed a six-figure price tag.

Amidst the ongoing discourse, I found myself pondering about the possibilities. I posed a question to my audience, inquiring which nations might be strategically holding reserves of cryptocurrencies.

US is thinking of a #BTC strategic reserve.

Which countries might be next?

— Richard Teng (@_RichardTeng) December 10, 2024

Bitcoin and governments

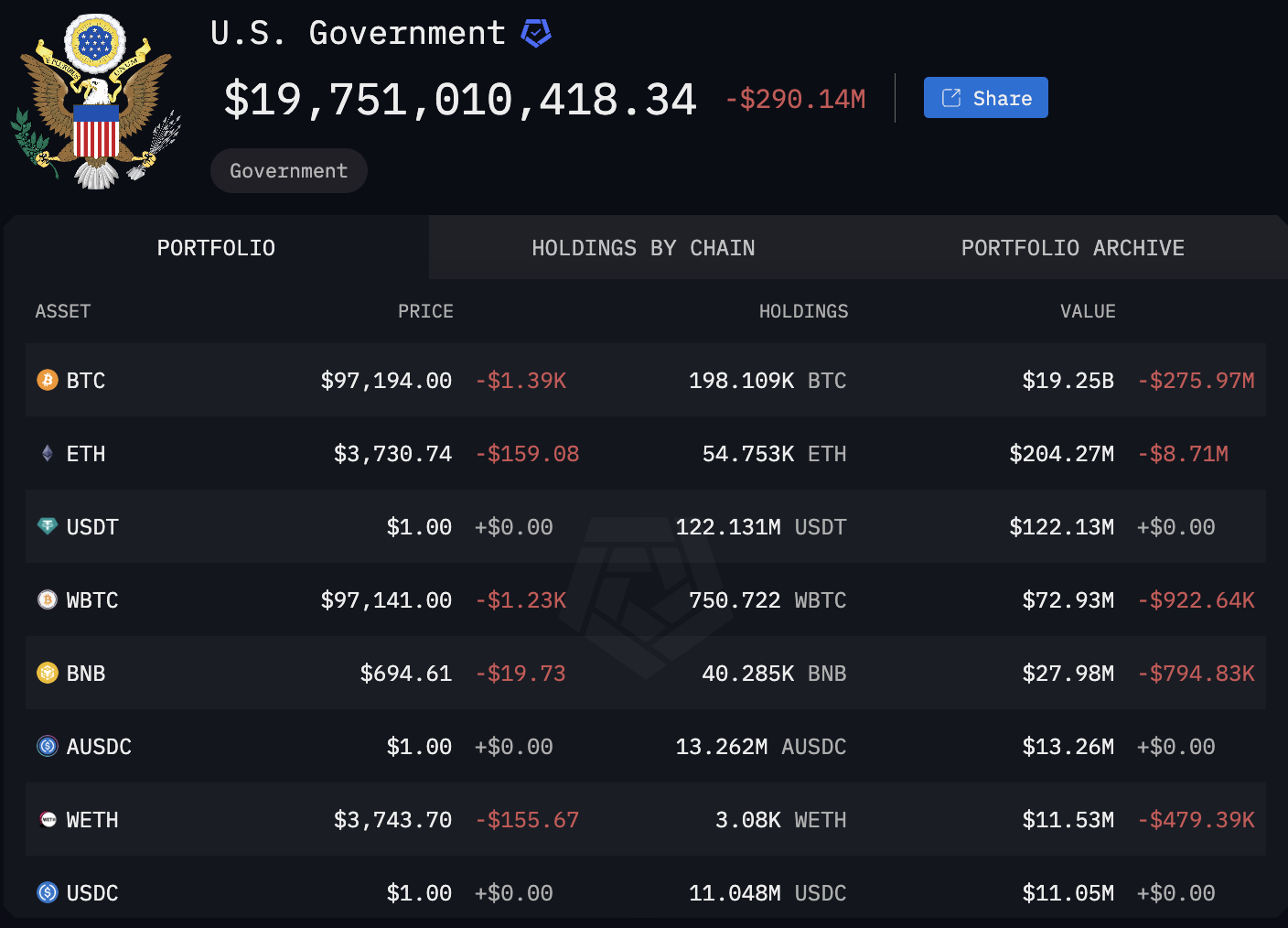

While it’s uncommon, several nations have incorporated Bitcoin into their financial reserves, though not all follow conventional methods. For instance, the United States owns approximately 198,109 Bitcoins, currently valued at around $19.25 billion.

Furthermore, Arkham states that approximately $500 million worth of diverse cryptocurrencies are held by the U.S. government in their wallets. The majority of these assets were obtained through seizures related to various criminal investigations, such as the closure of Silk Road or the hack on Bitfinex in 2016.

On the other hand, Bhutan and El Salvador hold significant amounts of Bitcoin. Specifically, they possess 11,688 Bitcoin worth approximately $1.14 billion and 5,960 Bitcoin valued at around $579.25 million respectively. Their acquisitions were made through Bitcoin mining activities and purchases on the open market.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- DCU: Who is Jason Momoa’s Lobo?

- OSRS: Best Tasks to Block

- Luma Island: All Mountain Offering Crystal Locations

- EUR ARS PREDICTION

- INR RUB PREDICTION

2024-12-10 11:44