As a seasoned crypto investor with battle-scarred fingers from numerous market cycles, I can’t help but feel a sense of deja vu as I watch this latest correction unfold. The cryptocurrency market has always been unpredictable, and while these dips are never fun, they provide an opportunity to buy low and hold on for the long haul.

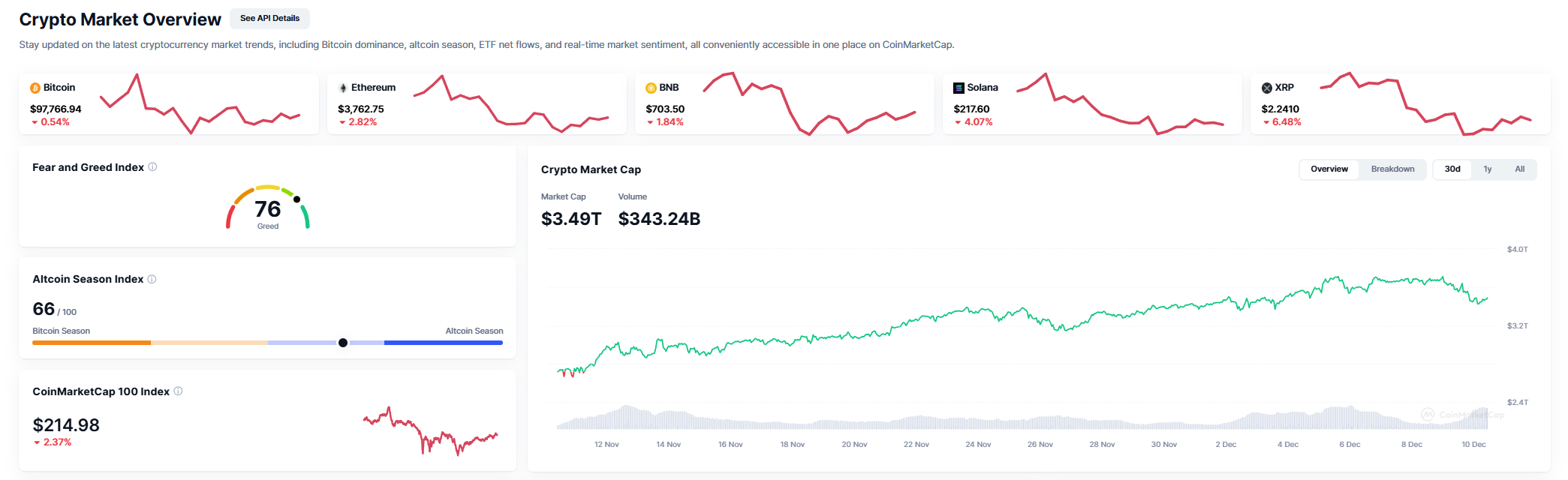

As a researcher delving into the cryptocurrency realm, I’ve observed a series of adjustments and liquidations that have taken a substantial toll on the market, resulting in a staggering $100 billion loss of market capitalization. The latest data paints a stark picture, as the total market capitalization plummeted from $3.82 trillion to $3.62 trillion within just a few hours.

This sharp drop suggests broader issues stemming from excessive leveraging throughout the market, with Bitcoin being the primary digital currency affected. Currently, its graph shows a significant corrective period, despite earlier signs of robustness.

Reaching the psychological $100,000 level has shown to be a significant hurdle, and Bitcoin couldn’t sustain its rise beyond it. As large investors begin to cash out, the initial bullish momentum seems to be fading, adding more pressure on the asset. In the short term, there’s an increased probability of further drops since Bitcoin is currently trading below crucial Moving Averages.

The main reason for this recent collapse is excessive borrowing, particularly in Bitcoin. Out of the total $1.58 billion worth of liquidations over the past 24 hours, it’s reported that $172 million can be attributed to Bitcoin. This pattern is indicative of a significant number of short positions, suggesting that the market’s overly optimistic long-term bets are facing opposition. As prices fall, this disparity amplifies market turbulence and triggers a chain reaction. Similarly, Ethereum has experienced substantial liquidations, resulting in a loss of $229 million.

Given that coins such as XRP, Solana, and Dogecoin are all experiencing a drop in value, it’s clear that the overall altcoin market is struggling. The recent surge, fueled by overly optimistic market feelings, seems precarious, as this widespread sell-off demonstrates. Many experts agree that a necessary adjustment or correction is imminent based on current market conditions.

At this point, it’s essential to correct overstretched situations and establish a stronger foundation for further growth. Initially, you may notice increased market fluctuations as adjustments are made, but despite these short-term turbulences, the long-term perspective for cryptocurrencies remains positive.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- Luma Island: All Mountain Offering Crystal Locations

- DCU: Who is Jason Momoa’s Lobo?

- Should Video Games Explore Morality?

- Pokemon Fan’s Wife Finds Perfect Use for Their Old Cartridges

2024-12-10 15:42