As a seasoned crypto investor with a decade under my belt, I’ve seen the rollercoaster ride that is the digital asset market. Yesterday’s launch of BlackRock’s Ethereum ETF (ETHA) was nothing short of impressive, making waves in the industry and landing among the top four ETF launches of 2024. With a daily net inflow of around $81.6574 million, it’s clear that institutional interest in Ethereum is on the rise.

On December 10th, BlackRock’s Ethereum ETF (ETHA) created quite a stir, placing it among the top four ETF debuts of 2024, as reported by Nate Geraci, President of the ETF Store. In just 12 days since its launch, ETHA has attracted approximately $81.6574 million daily, demonstrating steady growth and establishing itself as a significant force in the rapidly growing cryptocurrency market.

Yesterday’s figures indicated that approximately $305.74 million flowed into Ethereum spot ETFs, with a significant portion going to BlackRock’s ETHA account, amounting to around $81.65 million. However, it was Fidelity’s ETF (FETH) that took the lead, attracting about $202 million.

For eight consecutive days, substantial investments were made into the iShares Ethereum ETF, amounting to over $1 billion in total. This impressive inflow placed it among the top four most successful ETF launches of 2024, out of approximately 675 other ETFs introduced that year.

— Nate Geraci (@NateGeraci) December 11, 2024

BlackRock’s ETHA has been steadily increasing its influence, mirroring wider patterns in the crypto investment market. This week alone, Ethereum-centric investment vehicles witnessed unprecedented influxes, amassing a total of $1.2 billion and surpassing their previous peaks from July.

Will BlackRock launch Solana (SOL) ETF, though?

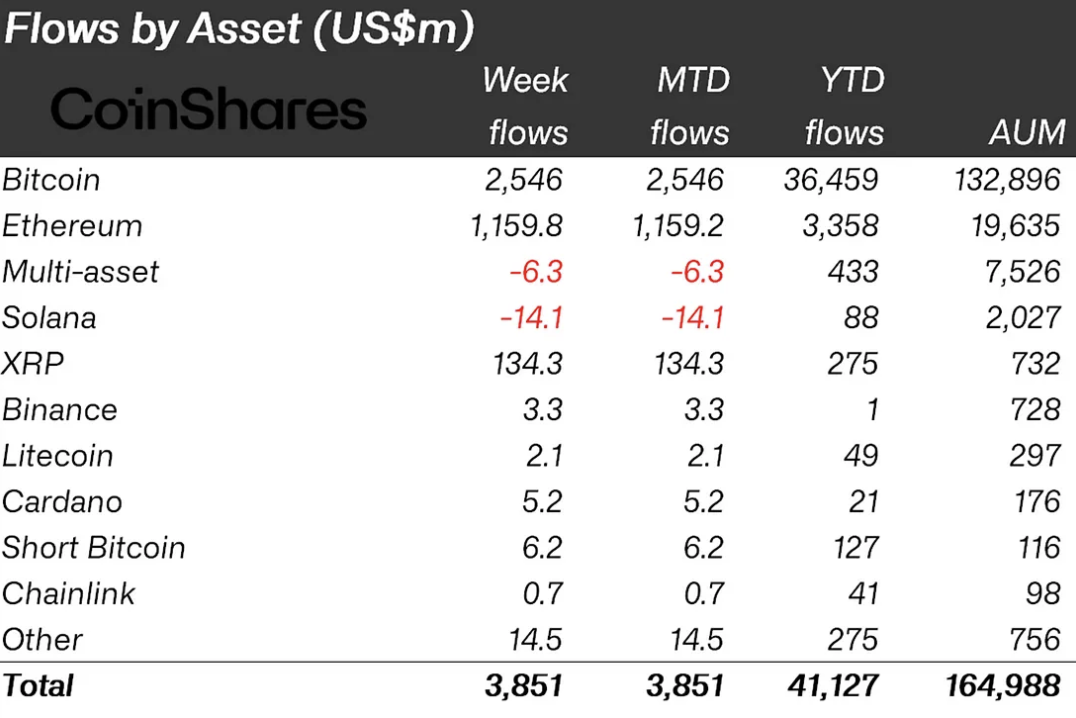

Over the past two weeks, there have been continuous withdrawals of around $14 million from Solana, as reported by analyst James Butterfill from CoinShares. This trend has resulted in a decline of Solana.

BlackRock’s overall performance has been quite remarkable. In fact, their Bitcoin ETF, IBIT, now matches the total assets of around 50 European ETFs. This underscores the fact that BlackRock’s impact is not confined to Ethereum-focused investments, but extends far beyond.

Currently, ETHA ranks fourth among Exchange Traded Fund (ETF) launches, following leaders such as IBIT and FBTC. With its robust growth, ETHA might bridge the gap and potentially take the third spot among all ETFs by year-end.

BlackRock’s Ethereum ETF (ETHA) stands out in a crowded market, offering investors an opportunity to invest in Ethereum’s development. As it continues to attract funds and gain recognition, ETHA is becoming a formidable choice for those interested in digital asset investment.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- Luma Island: All Mountain Offering Crystal Locations

- DCU: Who is Jason Momoa’s Lobo?

- INR RUB PREDICTION

- EUR ARS PREDICTION

2024-12-11 17:46