As a seasoned crypto investor with battle-hardened nerves and a knapsack full of lessons from past market cycles, I find myself standing at a crossroads as Bitcoin maintains its steady march above the $100,000 mark. The cryptocurrency world is abuzz with excitement, reminiscent of the days before a major storm or the hush before a thunderous roar in a bull market.

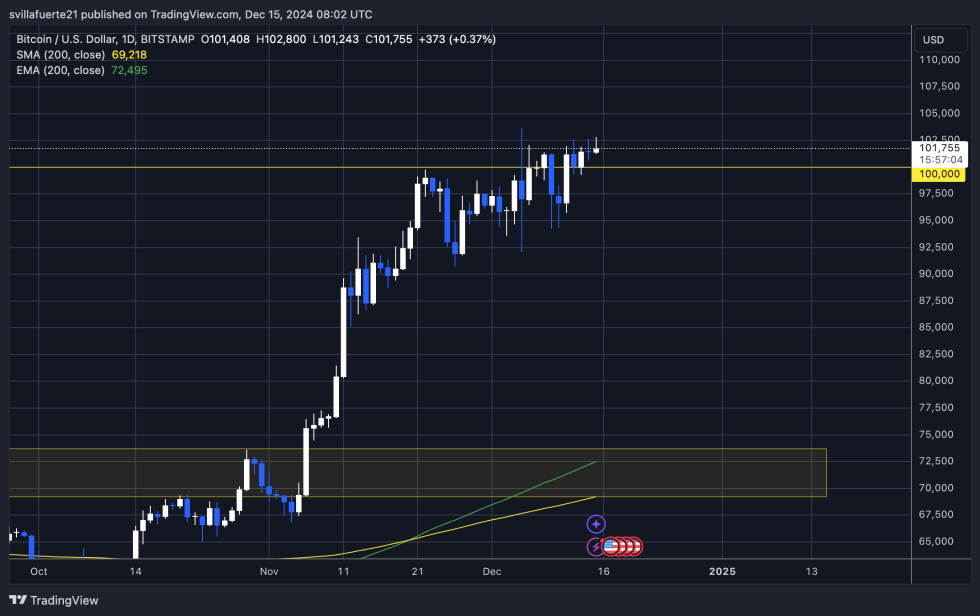

Over the past weekend, Bitcoin has continued to hold steady above the $100,000 threshold, having surpassed this significant marker midweek and reaching new record highs in the process. As a researcher closely monitoring the crypto market, I can sense an undercurrent of excitement as Bitcoin consolidates near its historic levels. Traders and investors are on tenterhooks, eagerly waiting for Bitcoin’s next step, with anticipation building in the air.

Boosting the anticipation, CryptoQuant analyst Maartunn has recently underscored noteworthy information about CME Options Open Interest (USD) – Position-wise stacked. This data indicates a rise in institutional trader activity, hinting at a potential large price shift approaching. In the past, similar surges in open interest have signaled significant volatility in Bitcoin’s value, making this statistic worth keeping a keen eye on.

Over the past weekend, Bitcoin’s tranquility offered some relief to market participants. However, underlying indications hint that this peace might not persist for much longer. With Bitcoin approaching its record-breaking highs, there’s growing debate among investors about whether it will maintain its rising trend or experience a temporary dip.

Regardless of which direction things go, it seems we’re in store for an exciting week, given the indications of increased action in major markets. Keep an eye on developments, as Bitcoin’s next step may well shape the storyline across the entire crypto sector.

Bitcoin Open Interest: Calls Stacking Up

Since November’s end, Bitcoin has been moving upward within a strong trend, reaching successively higher peaks but yet to make a significant breakthrough. Its movement has remained relatively consistent, as it continues to ascend towards new heights. Although the overall trend is positive, the market is on edge, eagerly watching for a clear signal that will propel its price further upwards. Meanwhile, many traders are keeping a keen eye on Bitcoin’s potential to surpass its all-time highs (ATH).

More simply, the crypto analyst Maartunn has provided some important information about X, pointing out a notable change in Bitcoin’s market arrangement. As per Maartunn, the amount of BTC held by investors who are betting against a price increase (stacked put positions) has reached record levels over the past few years. This might suggest potential turbulence ahead.

In his analysis, he presents a chart showing the rising activity in put options, often reflecting a build-up of high-leverage positions. This type of market behavior tends to precede massive price movements, especially when leveraged positions are liquidated.

As Bitcoin climbs higher, the market finds itself in a delicate balance. If Bitcoin doesn’t surpass its all-time high and stays within the current price range, there’s a considerable chance of a pullback. Such a correction might occur, particularly if highly leveraged positions begin to unwind. Furthermore, the rising number of open put options adds to the uncertainty.

BTC Testing Liquidity In Price Discovery

Currently, Bitcoin is being traded at approximately $101,750, having been held back for several days below the $102,000 threshold. Although its price has shown resilience, it’s had trouble surpassing significant resistance points. To keep their advance going, bullish investors need Bitcoin to convincingly exceed $103,600. A substantial push beyond this level would suggest the uptrend is ongoing and could lead to even higher prices.

If Bitcoin (BTC) doesn’t manage to surpass $103,600, there’s a high chance it will revisit lower support areas. The next crucial area to focus on is approximately $95,500. If BTC can’t break above $103,600, this could signal that the bears are regaining strength and Bitcoin might experience a more substantial correction as traders start selling during weakness.

Over the next few days, traders will pay close attention to any indications of either a surge or a dip in Bitcoin’s price. If Bitcoin manages to surpass $103,600 significantly, it might initiate an upward trend. However, should Bitcoin weaken and drop near $95,500, the market could become more turbulent, potentially leading to further declines.

Read More

- USD PHP PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- Pokemon Go Used Data to Train AI According To Developer Niantic

- LUNC PREDICTION. LUNC cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- ONDO PREDICTION. ONDO cryptocurrency

- First ETF with XRP Exposure Is Possible, Top Expert Says

- ZIG PREDICTION. ZIG cryptocurrency

- POL PREDICTION. POL cryptocurrency

- APU PREDICTION. APU cryptocurrency

2024-12-15 19:11