As a seasoned analyst with over two decades of experience in the financial industry, I’ve seen my fair share of market trends come and go. Yet, the surge of interest in digital asset investment products like Cardano (ADA) has managed to pique my curiosity once more.

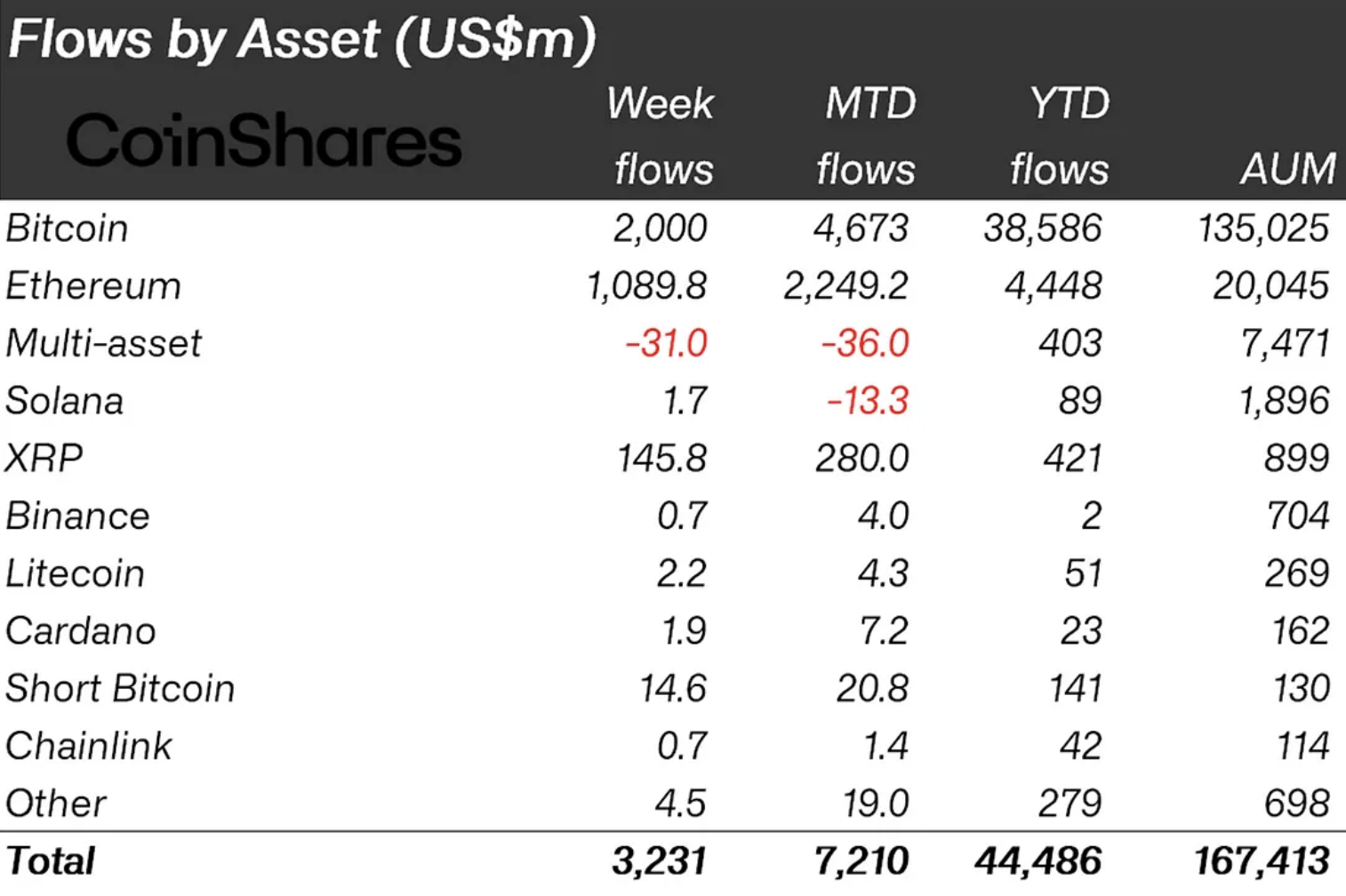

In recent times, with increasing interest in digital investment products, Cardano (ADA) has been drawing attention and making waves. Last week, it was among the top performers in terms of inflows, distinguishing itself in a highly competitive market. As reported by CoinShares, there was an influx of $3.23 billion into digital asset ETFs, marking the 10th consecutive week of growth. This brings the year-to-date total to a remarkable $44.5 billion, surpassing the figures from any previous years.

Bitcoin led the pack with a massive $2 billion in investments, yet Ethereum maintained its consistent rhythm. For seven weeks straight, Ethereum-related products accumulated $1 billion each week, amounting to a total of $3.7 billion for that period. Meanwhile, other altcoins experienced less dramatic but still significant inflows. XRP drew in $145 million due to optimism surrounding a potential ETF.

Amidst the bustling landscape, Cardano stands out as a noteworthy contender due to its impressive track record. Over the past week, Exchange-Traded Products tied to ADA recorded inflows totaling $1.9 million. Although these increases may seem minor next to the market heavyweights, they underscore a consistent and growing curiosity towards this asset.

Over the course of this year so far, approximately $23 million has been poured into Cardano investment offerings, with nearly a third ($7.65 million) being added just last month (December). It’s clear that the surge in interest is genuine, pushing the total value of assets managed by Cardano ETPs up to an impressive $162 million.

The data indicates that Cardano is maintaining its position quite well. While it may not have the same scale as Bitcoin or the same level of excitement surrounding Ethereum, being listed among cryptocurrencies with Exchange-Traded Products (ETPs) is still a significant achievement. It’s relatively uncommon for a digital asset to receive this level of institutional recognition, and even more so for it to sustain that recognition over time.

As a researcher observing the cryptocurrency market, I noticed significant inflows for Polkadot and Litecoin, totaling approximately $3.7 million and $2.2 million respectively. However, what caught my attention was the steady growth and constant demand for Cardano. This suggests that it remains a relevant choice amidst an increasingly diverse range of altcoin investment opportunities.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Luma Island: All Mountain Offering Crystal Locations

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- How to Claim Entitlements In Freedom Wars Remastered

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- 13 EA Games Are Confirmed to Be Shutting Down in 2025 So Far

2024-12-16 18:13