As a seasoned crypto investor with battle scars from multiple market corrections and bull runs, I find the latest CoinShares report both intriguing and somewhat predictable. The rollercoaster ride of inflows and outflows is nothing new to me, but it’s always fascinating to dissect these trends and understand their underlying factors.

According to the recent findings from CoinShares, a notable digital asset investment company, the weekly returns for cryptocurrency investment vehicles showed varying results.

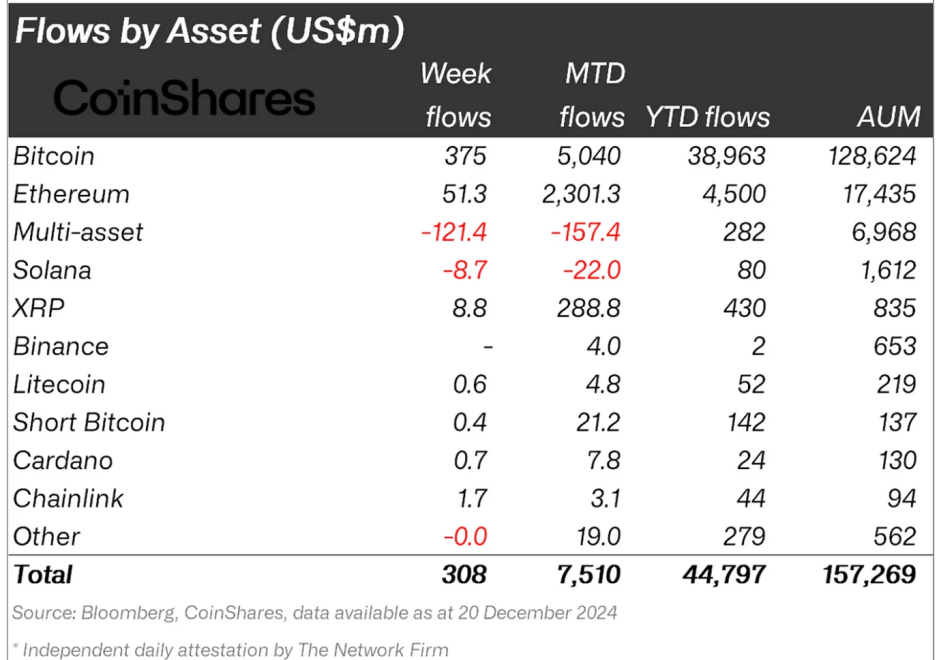

As per the latest findings, the market saw an accumulation of approximately $308 million, which aligns with ongoing favorable patterns. Yet, it’s worth noting that this was accompanied by withdrawals totaling around $1 billion.

Deciphering The Fund Flows

According to data from CoinShares, there were considerable withdrawals, with December 19 alone experiencing a one-day withdrawal of $576 million. The last two days of the week added an extra $1 billion in total withdrawals, causing some unease among market participants regarding the ongoing attitude of investors.

James Butterfill, CoinShares’ Head of Research, stated that the asset outflows occurred simultaneously with a market adjustment in prices and were subsequent to the relatively aggressive stance expressed by the Federal Reserve during their FOMC meeting.

Butterfill explains that the market responded to the updated “dot chart” which hinted at possible future increases in interest rates. However, despite significant withdrawals, the overall effect on the total assets under management (AuM) was quite small, accounting for merely 0.37% of the entire AuM.

Additionally, it’s worth mentioning that this incident is among the thirteen largest one-day drainage events ever recorded. The event with the highest outflow took place around mid-2022 following a similar Federal Open Market Committee (FOMC) announcement.

Despite a general air of market wariness as indicated by the headline figures, Bitcoin (BTC) demonstrated strength and attracted $375 million in net inflows even amidst weekly price fluctuations. Interestingly, short Bitcoin products saw very little action, suggesting that investors remain optimistic about Bitcoin’s long-term prospects.

Altcoins and Multi-Asset Investment Trends

The report also highlighted the differing results among different cryptocurrencies and mixed-asset investment items. Notably, withdrawals from multi-asset portfolios amounted to a substantial $121 million, indicating that investors have shifted towards a more targeted, individual asset selection strategy.

Investor preference is shifting towards assets that have robust foundations and the capacity for expansion, as suggested by their selective approach. Notably, Ethereum (ETH) garnered approximately $51 million in investments during the past week.

The continuous influx of funds serves to underscore Ethereum’s pivotal role within the digital assets sector, fueled by persistent institutional investment and enthusiasm for its technological advancements.

On the other hand, it’s worth noting that not every significant altcoin followed this positive trend. Interestingly, data shows that Solana (SOL) saw $8.7 million in withdrawals, which is quite different from Ethereum’s upward trajectory.

It’s important to point out that the difference in their performance could indicate a split in investor opinions about these two significant assets. This divide might be due to ongoing advancements within their respective ecosystems and varying perceptions of associated risks.

Instead, contrastingly to ETH, XRP was one of the exceptional altcoin successes, accumulating $8.8 million in investments. Moreover, Horizen (ZEN) and Polkadot (DOT) also reported inflows of $4.8 million and $1.9 million respectively, suggesting a particular interest in certain altcoins amidst broader market unpredictability.

Investor faith in the long-term prosperity of chosen blockchain environments remains steady, as indicated by these recurring investments, despite temporary market adjustments.

Featured image created with DALL-E, Chart from TradingView

Read More

- FIS PREDICTION. FIS cryptocurrency

- 13 EA Games Are Confirmed to Be Shutting Down in 2025 So Far

- Minecraft May Be Teasing a Major New Feature

- USD BRL PREDICTION

- Space Marine 2 Teases 2025 Plans

- Scream 7: Should Detective Wallace Come Back?

- Luma Island: All Mountain Offering Crystal Locations

- Fidelity’s Timmer: Bitcoin ‘Stole the Show’ in 2024

- Accidental Win – How’d You Get Up There!

- What Borderlands 4 Being ‘Borderlands 4’ Suggests About the Game

2024-12-23 23:12