As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless bull and bear runs. The current state of Cardano (ADA) is intriguing, to say the least. While its price dipping below $1 might seem concerning to some, the key metrics are painting an optimistic picture.

Cardano (ADA), currently ranked as the 9th largest cryptocurrency in terms of market value, has seen substantial earnings in its storage wallets. Interestingly, even though ADA’s price has dropped below $1, this favorable trend persists.

Key Cardano metrics amid market volatility

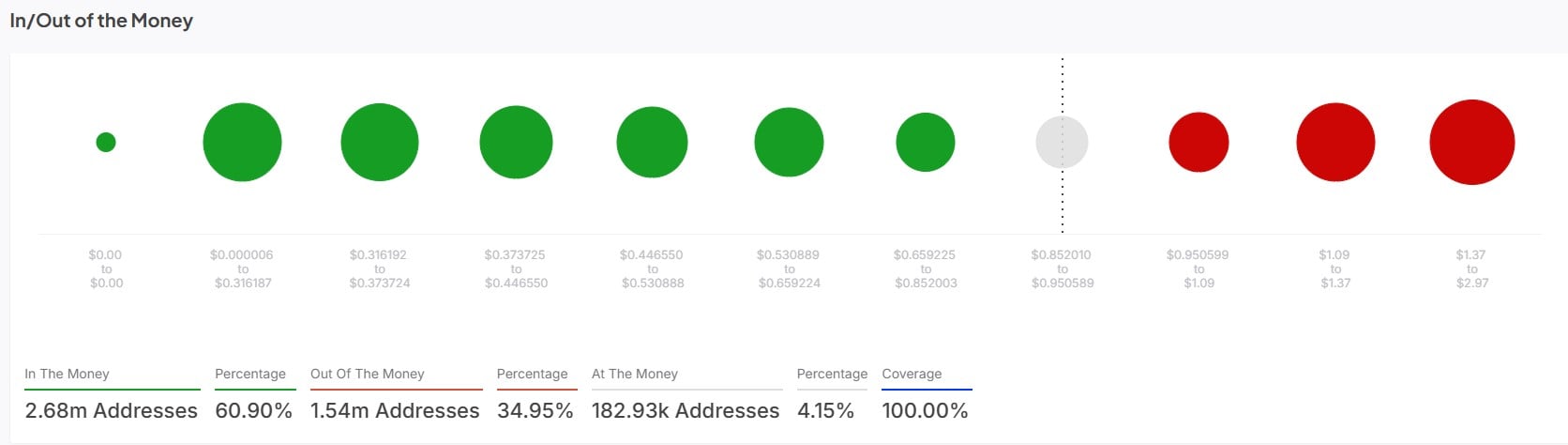

As per data from IntoTheBlock, some intriguing advancements in the performance of Cardano are highlighted by its In/Out of the Money chart.

2.68 million Cardano addresses are seeing substantial profits, which equates to approximately 60.9% of all addresses. Conversely, about 1.54 million addresses are facing losses or are “out of the money,” representing around 34.95% of the total.

Significantly, there are approximately 182,930 unique Cardano addresses in use, accounting for around 4.15% of the total number of wallets registered across the Cardano blockchain.

The positive metrics were recorded despite ADA being down by about 70% from its all-time high (ATH). It marks a significant development for Cardano, which has struggled to regain $1 in the last four days.

ADA trades at $0.8984 as of this writing, representing a 0.49% increase in the last 24 hours.

Analysts give diverging price predictions

Despite some reservations within the Cardano community, they continue to express optimism about the asset’s ability to recover and reach higher price points in the future.

As per an earlier report from U.Today, on-chain analyst Ali Martinez has hinted at potential optimism for a bullish trend. Martinez points out that past patterns might suggest a possible price increase up to $6, given the current correction. However, investors can only cross their fingers and hope that history will indeed reoccur.

On the other hand, experienced trader Peter Brandt offers a contrasting forecast for ADA’s price. He anticipates a substantial decrease in value, likening it to a potential “CAR crash” that might cause ADA to fall more than 40%.

Diverse perspectives highlight the importance of thorough investigation by both investors and traders, which can help them avoid substantial financial losses.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- APU PREDICTION. APU cryptocurrency

- USD GEL PREDICTION

- CHEEMS PREDICTION. CHEEMS cryptocurrency

- DUSK PREDICTION. DUSK cryptocurrency

- EUR NZD PREDICTION

- USD COP PREDICTION

- Best Offline PC Third-Person Shooter Games

2024-12-24 17:43