As a seasoned crypto investor with a knack for deciphering market trends and understanding the nuances of on-chain data, I find myself both intrigued and cautious by the recent Bitcoin price action. The rapid retracement to $95,000 from the Christmas Eve high is reminiscent of a rollercoaster ride, albeit one that’s particularly exhilarating in the crypto world.

In the last day, Bitcoin experienced a significant drop to around $95,000, with data from the blockchain suggesting that large investors (whales) have been transferring their Bitcoins to cryptocurrency exchanges.

Bitcoin Has Almost Entirely Retraced Its Gains From Christmas

Bitcoin sparked investor enthusiasm as it approached the $100,000 threshold during the holiday rally on Christmas Eve and Christmas Day. However, in the last 24 hours, the value of this digital asset has plummeted, dampening those optimistic expectations.

According to the graph, Bitcoin has dropped to around $95,700, which isn’t significantly above the $94,100 price point it was at before the recent surge.

It’s not completely surprising that the market is trending downwards, given the information we’ve been getting from the blockchain data.

BTC Whales Have Made Massive Exchange Inflows Recently

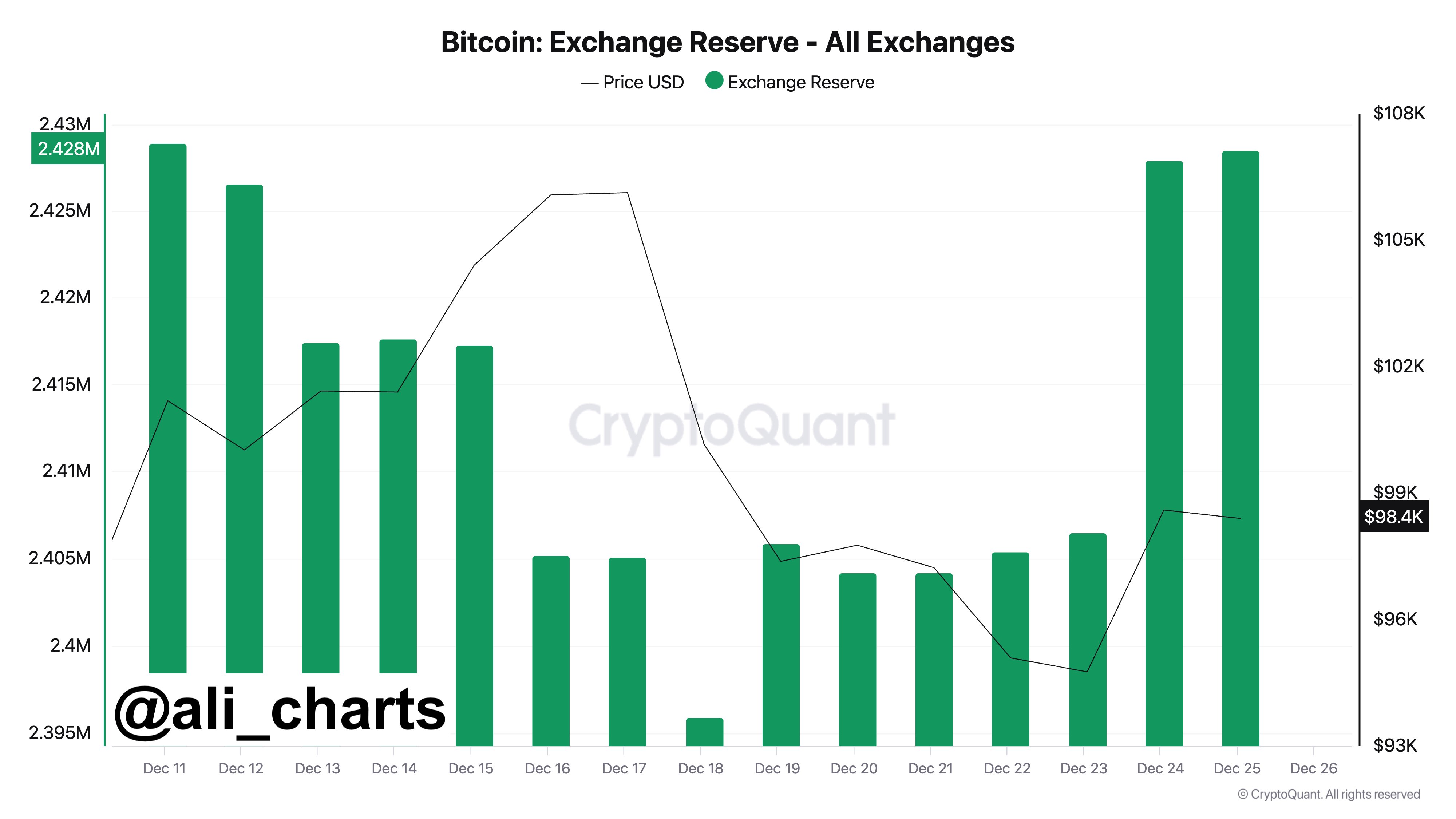

According to analyst Ali Martinez’s latest post on X, a significant influx of Bitcoin has been observed in cryptocurrency exchanges over the past week. The key measure here is the “Exchange Reserve,” which monitors the collective Bitcoin balance held across all centralized exchange wallets.

Whenever I see an increase in this particular metric, it’s a sign that investors are depositing more into these platforms than they’re withdrawing – or making net inflows. Since many investors use exchanges primarily to sell their assets, such a trend could potentially indicate bearish sentiments towards the cryptocurrency.

Conversely, when the indicator decreases, it suggests that outgoing transactions are exceeding incoming ones, resulting in a net addition of the asset to exchange-linked wallets. This pattern could indicate that investors are amassing the asset, potentially signaling a positive outlook for its price increase.

Currently, I’d like to draw your attention to a graph provided by the cryptocurrency analytics company, CryptoQuant, which was recently posted by Martinez. This chart illustrates fluctuations in the Bitcoin Holdings on Exchanges during the last few weeks.

During the initial part of the month, as indicated by the graph, the Bitcoin Exchange Reserves were decreasing. This suggests that investors were actively purchasing Bitcoins, thereby contributing to the surge in its price.

Contrary to what might have been expected during the Christmas rally, this indicator showed an enormous surge rather than a decline. In fact, investors collectively deposited about 33,000 BTC into these platforms over the past week, equating to roughly $3.15 billion at the present exchange rate.

As an analyst, I noticed that a significant portion of these deposits occurred on Christmas Eve, as evident from the graph. This pattern suggests that the ‘whales’ may have been strategically positioning themselves to sell, likely anticipating a rise in price around the holiday. Following what appears to be their estimation of a suitable price peak by Christmas, they seemed to execute their sell-off, leading to the subsequent price drop.

Keeping a watchful eye on the Bitcoin Exchange Reserve is advisable now, since any changes in direction on its chart could indicate that investors believe the prices have dropped sufficiently for another round of purchasing.

Read More

- EUR CAD PREDICTION

- EUR MYR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- POL PREDICTION. POL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- GBP RUB PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- USD MXN PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2024-12-27 03:41