As a seasoned crypto investor with a decade of experience under my belt, I’ve learned to read between the lines when it comes to market trends and social media sentiment. The recent Bitcoin crash serves as another stark reminder that the crowd’s enthusiasm can often lead us astray.

Today, Bitcoin experienced a plunge, wiping out the advancements made during the holiday season’s rally. This downturn could potentially be signaled by trends observed on social media.

Social Media Users Got Too Hyped During Latest Bitcoin Rally

Over the festive season, I was on the edge of my seat as Bitcoin neared the whopping $100,000 milestone. However, in just the past day, the coin’s trajectory has taken a dramatic turn for the worse, with its value plummeting towards the $95,000 region.

Just as with any significant drop in prices, multiple elements might be influencing the downward trend. One possibility is the general opinion or mood expressed by traders on social platforms.

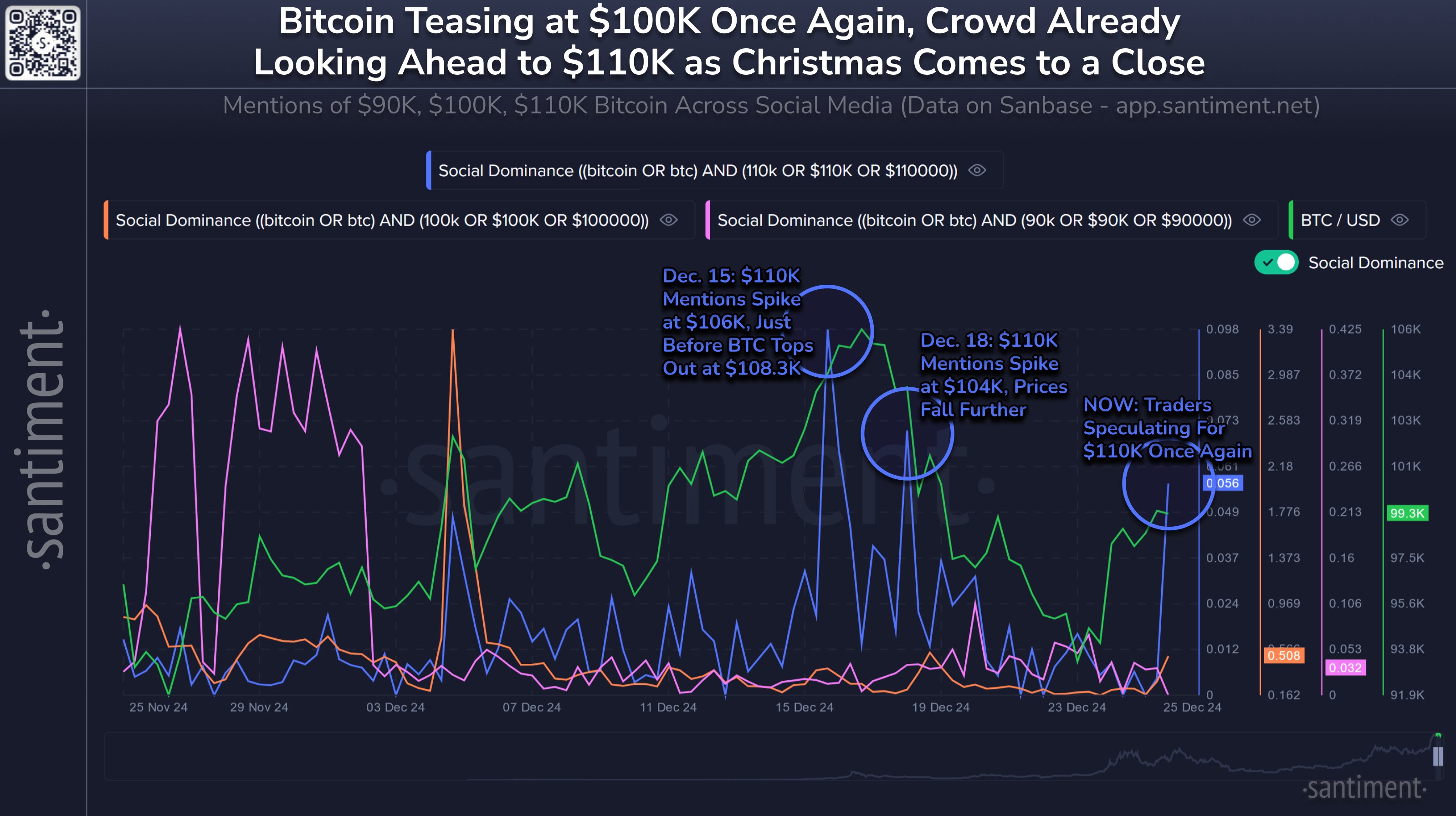

Yesterday, when Bitcoin (BTC) experienced a rally, an analytics company named Santiment posted a chart showing the public’s reaction on social media during the surge. They highlighted an indicator called “Social Influence” to demonstrate this.

The Social Dominance keeps track of the percentage of the total social media discussions related to the top 100 cryptocurrencies that a given term or topic occupies.

Santiment measures public sentiment about significant social media sites by incorporating phrases related to Bitcoin and predicted prices, specifically $90,000, $100,000, and $110,000 as the target values.

In terms of the latest Bitcoin rally, comments from investors suggesting a $90,000 target indicate a bearish outlook. On the other hand, posts predicting a $100,000 price point might express a neutral stance, while those anticipating $110,000 or higher prices would show bullish enthusiasm.

Presently, I’d like to share this graph which illustrates the pattern of Bitcoin’s social influence for these specific terms during the past month:

From the graph you see, there was a significant increase in Bitcoin’s Social Dominance when aiming for the $110,000 mark, suggesting that social media users were very optimistic about its continued upward trend towards a fresh record high (new All-Time High, or ATH).

Historically, the price of cryptocurrencies tends to go against the general predictions of the public. As traders grow increasingly confident in a specific direction, the likelihood of a countermove occurring actually increases.

In other words, while a bit of optimism might not harm a rally, too much excitement could increase the chances of a price drop occurring. Interestingly, if we look at the chart, you’ll notice that the Social Dominance level increased sharply twice in the same month, and on both those occasions, Bitcoin experienced a decrease in value.

Based on history, it’s not unexpected that the recent price surge, fueled by excessive enthusiasm among traders on social media, ultimately didn’t succeed.

BTC Price

At the time of writing, Bitcoin is trading around $96,100, down almost 4% over the last week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- XDC PREDICTION. XDC cryptocurrency

- EUR CAD PREDICTION

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- SEI PREDICTION. SEI cryptocurrency

- JST PREDICTION. JST cryptocurrency

- APU PREDICTION. APU cryptocurrency

- EUR INR PREDICTION

2024-12-27 06:41