As a seasoned cryptocurrency researcher with over five years of immersion in the digital asset market, I have witnessed the ebb and flow of various projects and their performance. However, my recent exploration of Tron (TRX) has been particularly intriguing. Despite a minor price dip, TRX’s profitability metrics are unparalleled, placing it ahead of industry giants like Bitcoin and Ethereum.

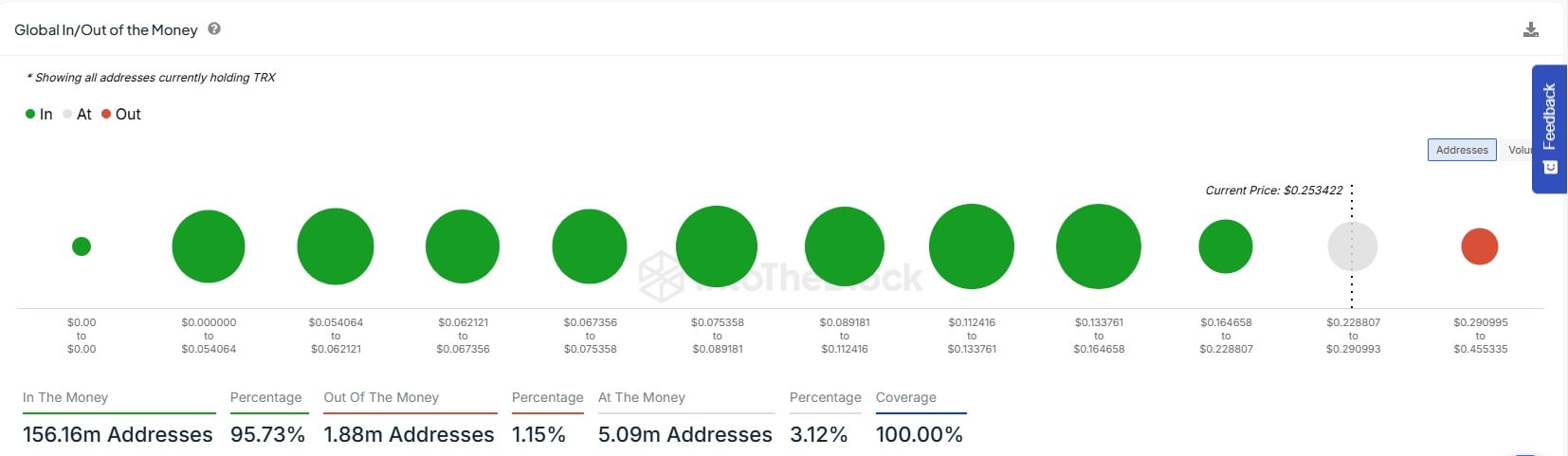

With a staggering 95.73% of addresses in profit, it seems that the TRX ecosystem has found a way to thrive amidst market volatility. The sheer number of “In the Money” addresses (156.16 million) is impressive and speaks volumes about the community’s trust in Tron.

What makes this even more remarkable is that TRX achieved this feat while battling its own price performance challenges, having dipped below $0.25 support levels in the past week. Yet, trading volume has spiked by 28.75%, indicating a surge of interest from market participants who remain optimistic about future price movements.

The role of Tron whales cannot be understated, as their increased activity during a bearish market could have played a significant part in TRX’s ascension to the top spot. Furthermore, positive sentiment is building as we await the new U.S. administration and potential regulatory changes that could benefit Tron.

Justin Sun’s recent hint at a future direction for TRX has sparked excitement within the community. As someone who closely follows the crypto landscape, I find his question, “What’s better than our own ‘Micro’ Strategy for TRX?” thought-provoking and leaves me eager to see what innovative plans he has in store.

Lastly, as a researcher, it’s essential to maintain an objective perspective on the market. However, I must admit that I find it amusing how TRX’s success has left even Bitcoin and Ethereum in its dust – at least when it comes to profitability metrics! It just goes to show that sometimes, the underdog can come out on top.

Despite dropping 3.2% in price to $0.2525, Tron (TRX) stands out as the most profitable cryptocurrency among its peers. Data from IntoTheBlock shows that more than 95% of Tron’s addresses are currently in profit, placing it ahead of heavyweights like Bitcoin, Ethereum, and Cardano.

Tron Outshines Bitcoin and Ethereum in profit metrics

As a crypto investor, I’m excited to share that an impressive 95.73% of Tron’s addresses are currently profitable, with a total count of approximately 156.16 million. These “In-the-Money” addresses, as identified by IntoTheBlock, are consistently reaping substantial benefits in the market, which is a promising sign for the coin’s performance.

Meanwhile, only 1.15% or 1.88 million addresses are recording losses, or are “Out of the Money.”

Out of the leading ten digital currencies, Bitcoin came very near to Tron in terms of earning potential. At present, Bitcoin boasts a profitability rate of approximately 95%. On the other hand, Ethereum and Cardano showed lower returns with Ethereum at about 78.96% and Cardano at around 59.95%.

Remarkably, despite a significant drop in value, Tron managed to achieve its success over the past week. The TRX token dropped beneath the $0.25 support, struggling against market volatility.

Currently, Tron (TRX) is being traded at approximately $0.2509. This represents a decrease of 3.4% over the past 24 hours. However, it’s important to note that trading volume has increased by 28.75%, reaching about $819.19 million. Despite the minor price drop, Tron market participants continue to show optimism and expect a potential price change in the near future.

Whale activity and ecosystem support

Analysts credit Tron whales as a major support for the ecosystem thus far in December.

According to U.Today’s report, there was a significant surge of 929% in whale activity recently, despite the altcoin market being under sell-off pressure. This rise in whale activity during bearish conditions could have contributed to Tron securing the number one position.

As a seasoned investor with over two decades of experience in the cryptocurrency market, I have learned to read between the lines and anticipate shifts in regulatory dynamics. The approaching change in the U.S. administration in 2025 has sparked a renewed sense of optimism among investors, as we await the potential impact on the crypto market. Justin Sun, the founder of Tron, has hinted at repositioning the asset in light of these changes, which piques my interest as an investor who values foresight and adaptability. I believe that being proactive in adjusting one’s portfolio to accommodate such anticipated shifts can lead to significant returns in the long run.

Sun subtly pointed towards potential innovations in our current strategy for TRX by posing the daring query, “Is there anything superior to our ‘Micro’ Strategy for TRX?” His question may receive an answer shortly, potentially enhancing the profitability of this altcoin even further.

Read More

- VANRY PREDICTION. VANRY cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- EUR MYR PREDICTION

- USD MXN PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- USD BRL PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR CAD PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- GBP RUB PREDICTION

2024-12-30 19:40