In the digital currency world, Bitcoin (BTC) is clearly taking charge, as its price continues to climb. As I write this, Bitcoin’s price stands at an impressive $99,399.18, representing a 1.6% increase over the past day. Since the start of the year, Bitcoin has been on a consistently bullish trajectory, although there’s been no shortage of volatility along the way.

Bitcoin price beating history

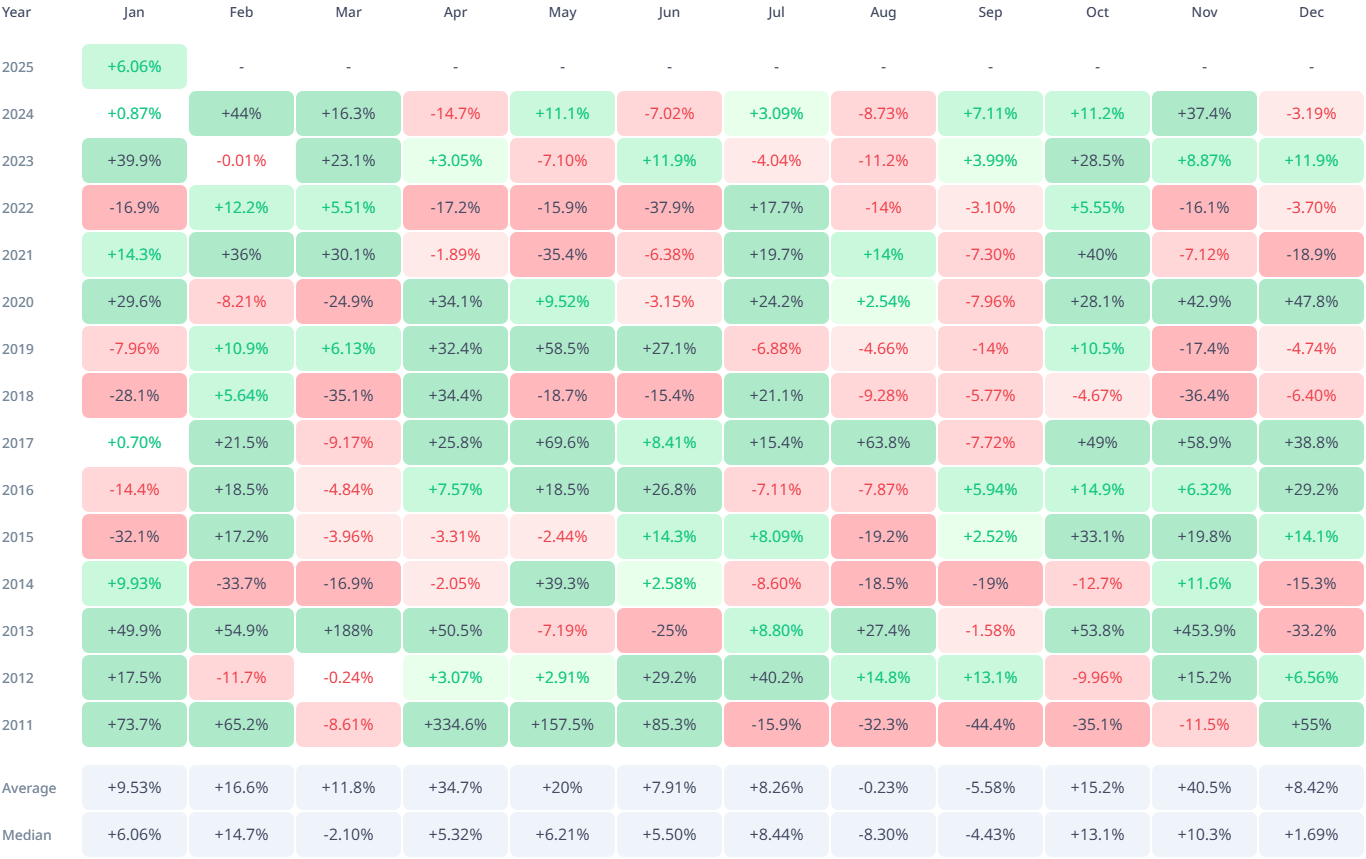

The data provided by Cryptorank indicates what we might expect regarding Bitcoin’s price this coming month. Traditionally, January has shown some positive trends for the cryptocurrency. On average, Bitcoin has experienced a growth rate of approximately 9.55% during this month.

In just six short days of the current month, Bitcoin has surged by approximately 6.32%, indicating a promising upward trend. Maintaining this pace could potentially lead Bitcoin to reach unprecedented heights, reminiscent of its peak in January 2023, where it experienced a significant increase of around 39%.

The increase in Bitcoin (BTC) is influenced by several aspects, such as the rate at which spot Bitcoin ETFs are accepted and the influence of significant Bitcoin investors known as “whales.” To date, both categories of investors have adopted a measured stance towards the coin due to repeated overbought signals.

Companies such as MicroStrategy are planning to continue purchasing Bitcoin, thus generating a consistent demand due to its restricted daily availability. However, there are skeptics who predict that the value of Bitcoin could potentially drop in the near future.

Currently, despite a negative outlook, the coin’s price doesn’t seem to be affected. It’s actually showing a 5.76% increase over the past week.

Profitability remains major factor

The price of BTC maintains strong resilience despite the intense volatility that masks its growth.

Despite traders being uncertain about the immediate future of the coin, approximately 94.82% of all Bitcoin addresses (equaling 51.21 million wallets) are currently in profit. This suggests that the chances of a mass sell-off may be minimal. However, it’s important to note that a slight resistance or “sell wall” around $100,000 price could prolong this cautious sentiment.

Should Bitcoin manage to end the day with an uptrend within this price range, it could potentially regain its previous record high of approximately $108,000.

Read More

- EUR CAD PREDICTION

- EUR MYR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- POL PREDICTION. POL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- GBP RUB PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- USD MXN PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2025-01-06 13:26