The data from the blockchain indicates that retail investors may be becoming less engaged with Bitcoin, as there’s been a significant drop in trading activity by this group over the past month.

Bitcoin Retail Investor Volume Has Seen A Significant Drop Recently

In my recent exploration of the crypto market, I’ve noticed a striking reversal in Retail Investor Demand as pointed out by Maartunn in his latest post on X. This “Retail Investor Demand” is essentially a tool that monitors the demand for utilizing the network from within the retail community.

Small-scale individual traders, or retail investors, typically conduct transactions that are relatively low in value due to their status as the smallest players on the network. Consequently, a high volume of transactions under $10,000 can often be traced back to the trading activities of these investors.

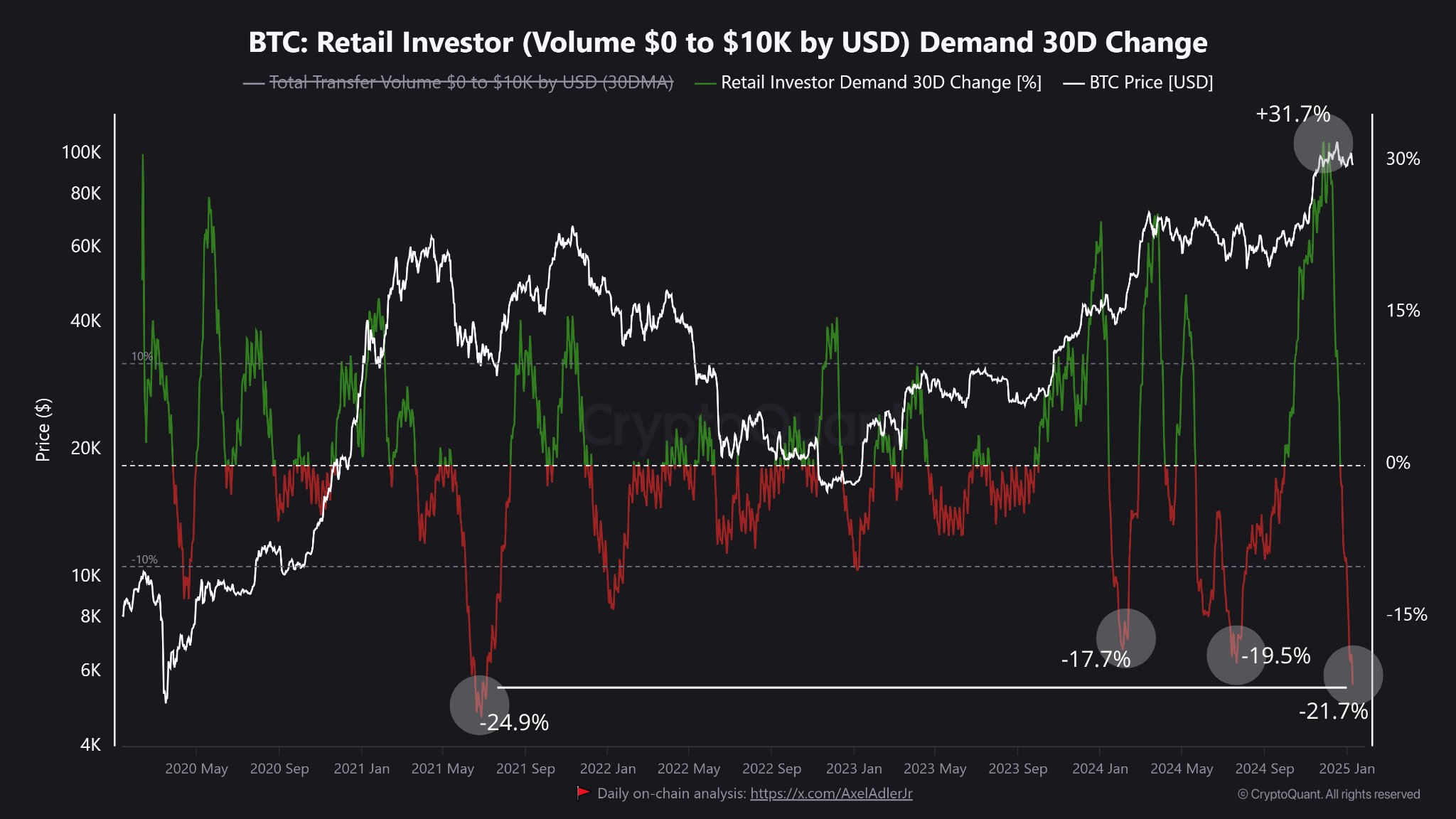

The retail investor’s value is determined by adjusting its volume over a 30-day period. Here’s a chart displaying the metric’s historical trend, as analyzed by experts, for the recent years.

Over the past few months of 2024, I’ve noticed an unprecedented surge in Bitcoin retail investor demand as evidenced by the graph above. This spike indicates that the bull rally drew significant attention from the general public, leading many to actively participate and make numerous transactions on the network.

It’s not surprising that such a pronounced spike occurred, given that investors often find rapid market movements intriguing and tend to increase their activity. What made this instance stand out was the substantial scale of the spike – the metric peaked at an impressive 31.7%.

After reaching a peak, the influx of retail investors started to decelerate. As the trend for cryptocurrencies turned bearish, the 30-day change in its value plunged directly into negative figures.

In the year 2025, there’s been an even more noticeable drop in the number of these shrimps, with Retail Investor Demand hitting a record low of -21.7%, indicating less interest.

Over the past 30 days, this figure suggests a 21.7% reduction in the transactional activity within the group, which represents the most significant decline we’ve observed for this metric since the middle of last year (mid-2021).

As a crypto investor, I’ve come to realize that the recent cooling down of enthusiasm from retail investors might not be all that detrimental to Bitcoin. In fact, the significant dip we saw in 2021 seemed to coincide with a price bottom. So, while it may seem unsettling in the short term, this pause could potentially pave the way for future growth.

Meanwhile, it’s worth noting that over the past week, there has been a significant increase in Ethereum (the world’s second-largest cryptocurrency by market capitalization) being withdrawn from exchanges, as reported by the market intelligence platform IntoTheBlock.

Over the last week, a total of $1.42 billion worth of Ethereum has been moved out from centralized exchanges, indicating that investors might be in a period of stockpiling or accumulating more Ethereum.

BTC Price

Yesterday, Bitcoin dipped close to $91,000, but it seems to be recovering today, with its current trading value hovering around $93,800.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- USD DKK PREDICTION

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

- EUR AUD PREDICTION

2025-01-11 15:41