The growing excitement about potential Litecoin ETF approvals has caused an unexpected surge in the value of LTC. Data from IntoTheBlock indicates that around 80% of Litecoin account holders are currently making a profit, suggesting a strong upward trend.

Analyzing IntoTheBlock data

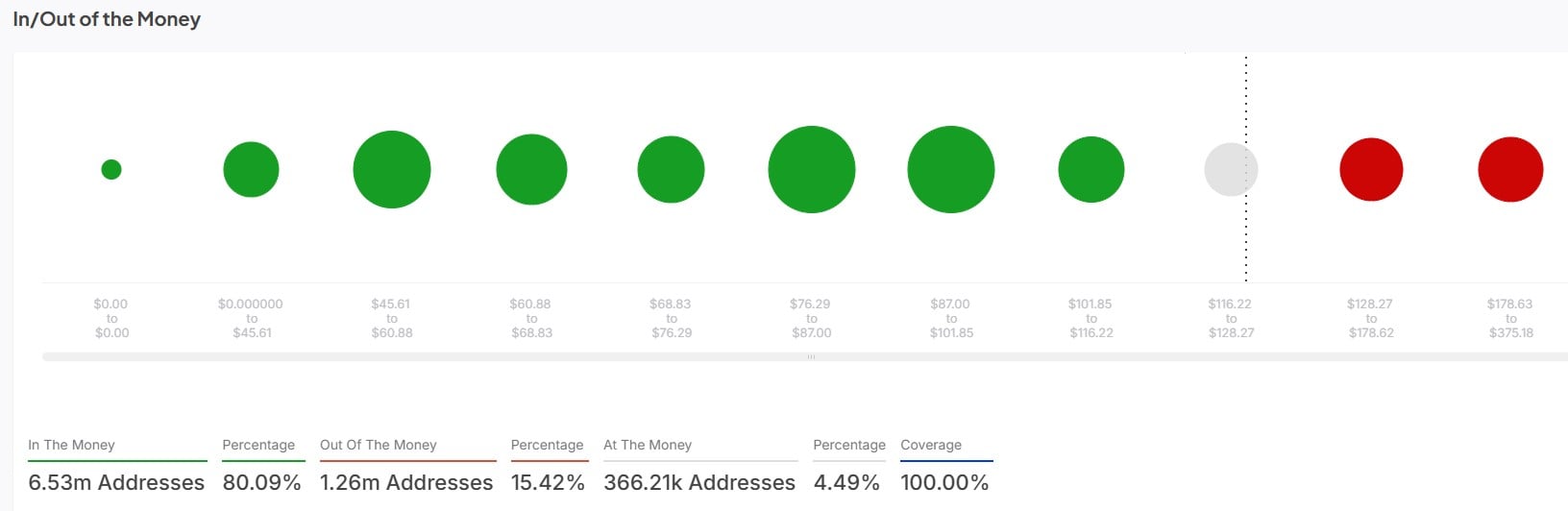

The data reveals that there are approximately 6.53 million addresses in total, and around 80% of these profitable addresses (known as “in the money”) have accumulated profit. Conversely, about 15.42% of the addresses have recorded losses or are considered “out of the money.” Interestingly, only 4.49% of Litecoin addresses have reached the break-even point where they neither made a profit nor suffered a loss.

Significantly, profits were made with increased anticipation surrounding the possible introduction of a Litecoin Exchange-Traded Fund (ETF). As previously reported by U.Today, Bloomberg’s Senior ETF Analyst Eric Balchunas suggests that Litecoin could be the next cryptocurrency to secure ETF approval.

Following the updated S-1 LTC ETF filing by Canary Capital with the U.S. Securities and Exchange Commission (SEC), analysts’ comments suggest that the SEC might be preparing to greenlight the ETF product. This action is often interpreted as a step forward in the approval process for the ETF.

According to Polymarket, there’s approximately a 54% likelihood that a Litecoin Exchange Traded Fund (ETF) will be authorized by 2025, and a 39% probability of such approval happening before July 31. Market experts anticipate that the eventual green light for a LTC ETF could potentially cause a significant increase in cryptocurrency values.

This sentiment is based on expectations of increased adoption from institutional investors.

What’s next for Litecoin

The prospects of a breakout remain relatively high since most addresses are in profits.

Despite experiencing significant downward pressure in its daily chart, Litecoin (LTC) has witnessed a 6.9% drop over the last 24 hours, pushing the price to $126.3. However, it’s important to note that LTC has seen a surge of 22% in the past week and a 14.5% increase in the past month. This upward trend suggests that Litecoin may experience even more substantial growth in the near and distant future.

In other words, the consistent drop in Litecoin’s daily price suggests it’s stabilizing following significant achievements this year. This could signal an impending recovery across the market, potentially enhancing Litecoin’s price and earnings even more.

Read More

- REPO: All Guns & How To Get Them

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- LUNC PREDICTION. LUNC cryptocurrency

- REPO: How To Play Online With Friends

- BTC PREDICTION. BTC cryptocurrency

- All Balatro Cheats (Developer Debug Menu)

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

2025-01-18 19:14