Ah, the price of BTC, that capricious creature, seems to be ensnared in a rather tedious game of consolidation, much to the chagrin of its most ardent admirers. The latest on-chain data, like a gloomy harbinger, reveals that the Bitcoin Coinbase Premium Index has once again plummeted below the dreaded zero. One must ponder, what does this dismal metric portend for our beloved cryptocurrency?

Is The Bitcoin Price At Risk Of Downward Movement?

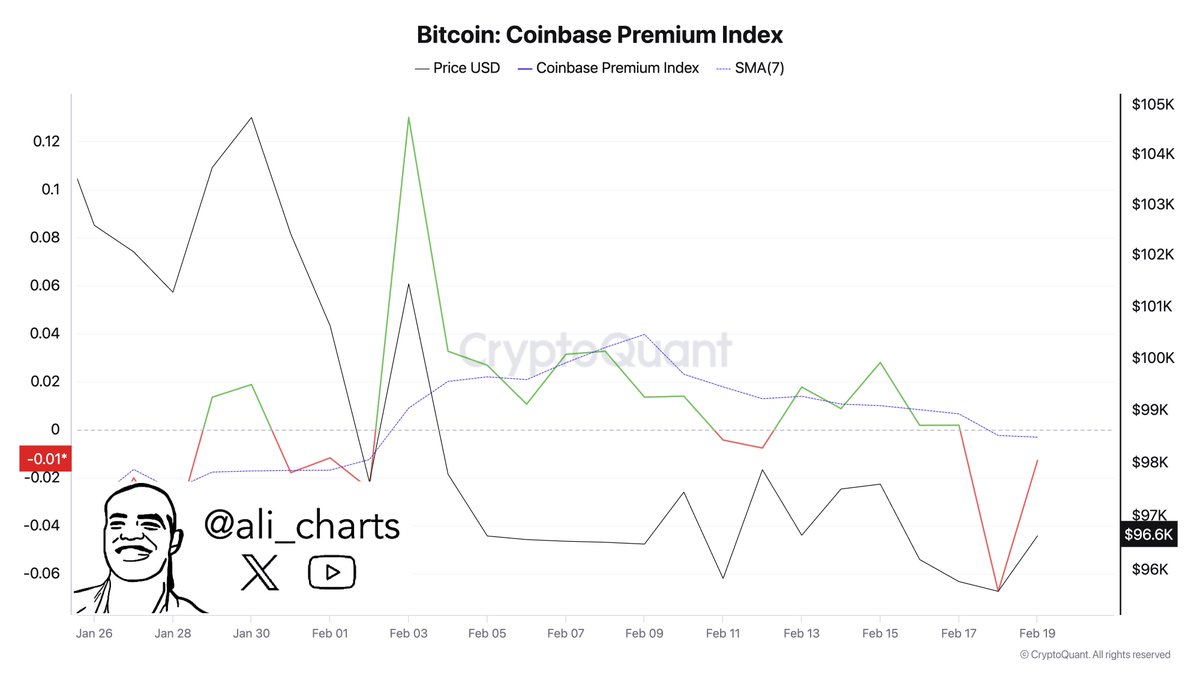

In a recent missive on the X platform, the ever-astute crypto oracle, Ali Martinez, has divulged that the Bitcoin Coinbase Premium Index has been on a downward trajectory, slipping back beneath a rather critical threshold in recent days. This index, dear reader, is not merely a number; it is a reflection of the difference between the BTC price on Coinbase (the USD pair) and that on Binance (the USDT pair). Quite the mouthful, isn’t it?

But wait, there’s more! This indicator serves as a window into the buying and selling behaviors of investors on these two illustrious trading platforms. The Bitcoin Coinbase Premium Index, in all its glory, mirrors the sentiment of US institutional entities—those grand players on Coinbase—and how their whims diverge from the global trading populace.

Typically, when the Bitcoin price premium on Coinbase ascends to lofty heights, it suggests a burgeoning demand from US investors, who, bless their hearts, are willing to part with more of their hard-earned dollars than their global counterparts to acquire the flagship cryptocurrency. Conversely, when the Coinbase Premium Index takes a nosedive below zero, it indicates that our dear US investors are, alas, purchasing less than their international brethren.

This lackluster buying activity is further underscored by the rather dreary performance of spot BTC exchange-traded funds in recent weeks. The latest market data reveals that the US Bitcoin ETF market has experienced a staggering outflow of $559 million in the past week. Quite the spectacle, wouldn’t you agree?

With institutional and large US investors seemingly reluctant to accumulate Bitcoin at current prices, one can only surmise that the market leader may find it challenging to muster any genuine bullish momentum. Historically, a sustained decline in the Coinbase Premium Index has been synonymous with a period of consolidation or, dare I say, potential downside risk for the BTC price in the not-so-distant future.

BTC Whales Offload Assets

In a separate revelation on X, our dear Martinez has noted that a certain class of Bitcoin investors has been rather busy trimming their holdings in recent weeks. According to the ever-reliable Santiment data, whales—those grandiose beings holding between 10,000 and 100,000 coins—have offloaded a staggering 30,000 BTC (worth approximately $2.9 billion) in the past ten days. One can only imagine the frenzy!

This level of selling activity, my friends, provides a rather plausible explanation for the sluggish price action of Bitcoin in recent weeks. As of this very moment, the price of BTC hovers just above the $96,500 mark, reflecting a modest 0.8% increase in the past 24 hours. However, it is worth noting that the premier cryptocurrency is down by 1.1% over the past week, according to the ever-reliable CoinGceko.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- REPO: How To Fix Client Timeout

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

2025-02-24 06:13