In a most curious turn of events, the Ethereum ecosystem finds itself embroiled in a delightful drama, as concerns regarding leverage and liquidations have been thrust into the limelight by none other than the illustrious Justin Sun, founder of Tron. Earlier today, a wallet, which many suspect to be the property of the esteemed Ethereum Foundation, made a rather audacious deposit of 30,098 ETH into a MakerDAO vault. One cannot help but wonder if this is a stroke of genius or merely a desperate gambit! 😏

Ethereum Foundation Averts Liquidation Risk

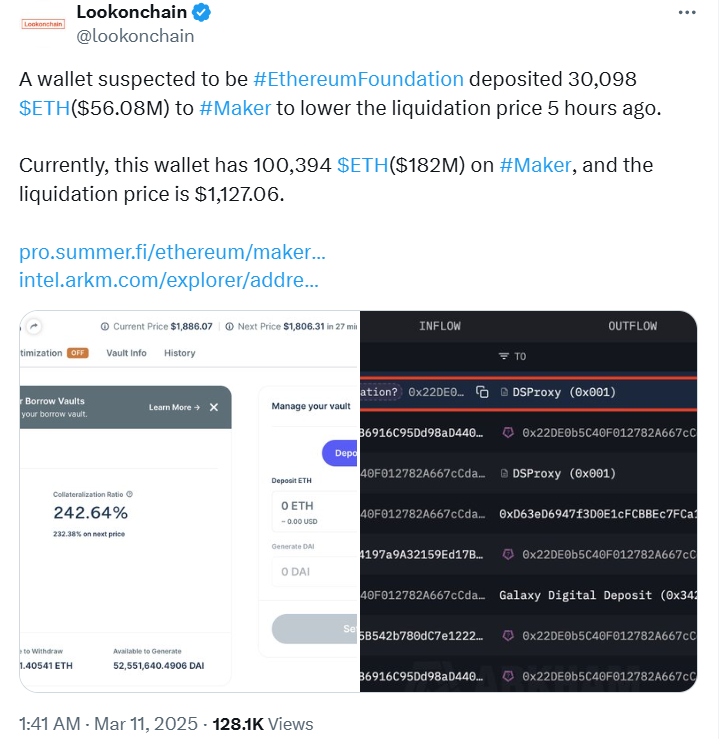

As reported by the ever-watchful Lookonchain, this deposit, which is valued at a staggering $56.08 million, was executed with the noble intention of lowering the liquidation price of its ETH on the DeFi protocol. The wallet now boasts a princely sum of 100,394 ETH, amounting to a veritable fortune of $189 million on Maker, with a liquidation price set at a rather precise $1,127.06. One might say, it is a rather precarious position to be in! 💰

However, in a twist that would make even the most seasoned novelist raise an eyebrow, independent journalist Colin Wu has clarified that the address at risk of liquidation is likely the property of an early ETH investor, rather than the Ethereum Foundation itself. How delightfully scandalous! 😲

Moreover, two prominent Ethereum developers, eric.eth and sassal.eth, have also chimed in, asserting that the wallet in question does not belong to the Ethereum Foundation. It appears that the plot thickens! 🍵

Ethereum Price Outlook

This transfer serves as a testament to the Ethereum Foundation’s role in stabilizing the ETH price within the tumultuous DeFi ecosystem. Such actions have become increasingly necessary, particularly in light of the market volatility that ensued following the infamous Bybit hack earlier in February. One must wonder if the Foundation is donning a cape and playing the role of a superhero! 🦸♂️

Meanwhile, data from the on-chain analytics platform IntoTheBlock reveals that a staggering $1.8 billion worth of ETH departed exchanges last week, marking the highest weekly amount since December 2022. A veritable exodus, one might say! 🚪

Historically, Ethereum has experienced a veritable rollercoaster of price fluctuations. In November 2021, ETH reached an all-time high of 4,878.26, yet it has since struggled to reclaim that lofty peak. How tragic! 😢

As of the present moment, CoinMarketCap data indicates that the ETH price has dipped below $1,800, as concerns regarding leverage reach their zenith. Just as the Ethereum Foundation has gallantly intervened to avert a liquidation crisis on Maker, Justin Sun has proposed a more defined solution to the leverage issues plaguing the protocol. Will he be the knight in shining armor? ⚔️

For the time being, the broader market trend conceals the overexposure in the ETH price, an outlook that analysts caution may prove unsustainable in the near future. How delightfully precarious! 🎭

Read More

- Mr. Ring-a-Ding: Doctor Who’s Most Memorable Villain in Years

- Nine Sols: 6 Best Jin Farming Methods

- Luffy DESTROYS Kizaru? One Piece Episode 1127 Release Date Revealed!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Get the Cataclysm Armor & Weapons in Oblivion Remastered Deluxe Edition

- You’re Going to Lose It When You See the Next Love and Deepspace Banner!

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Get Ready for ‘Displacement’: The Brutal New Horror Game That Will Haunt Your Dreams!

- Invincible’s Strongest Female Characters

- Prestige Perks in Space Marine 2: A Grind That Could Backfire

2025-03-11 19:04