Ethereum‘s Secret Savior: The Billion-Dollar Bet on Its Future

- The Ethereum price tanked 50% in three months, a feat that would make even the most seasoned gambler weep.

- But BlackRock’s BUIDL fund is having none of that, raising its ETH holdings to a cool $1.145 billion.

Ethereum’s fortunes have taken a sharp downturn in 2025, with its price plummeting nearly 50% in just three months – a drop from $4,100 in December 2024 to around $1,750 by March. It’s a fall from grace that would make even the most seasoned gambler weep.

This steep decline has coincided with a wave of outflows from U.S.-listed ETH ETFs, which saw over $760 million exit in the past month. It’s a mass exodus that would make even the most seasoned herdsman wonder if the grass is greener on the other side.

Meanwhile, Bitcoin continued to dominate investor interest, with Bitcoin ETFs attracting $785 million in fresh capital over just six days. It’s a popularity contest that would make even the most seasoned politician envious.

As Ethereum struggled to retain its footing, shifting market dynamics raised pressing questions about its long-term position in the digital asset ecosystem. Was it a flash in the pan, or a phoenix rising from the ashes?

BlackRock’s BUIDL fund holds over $1B in ETH

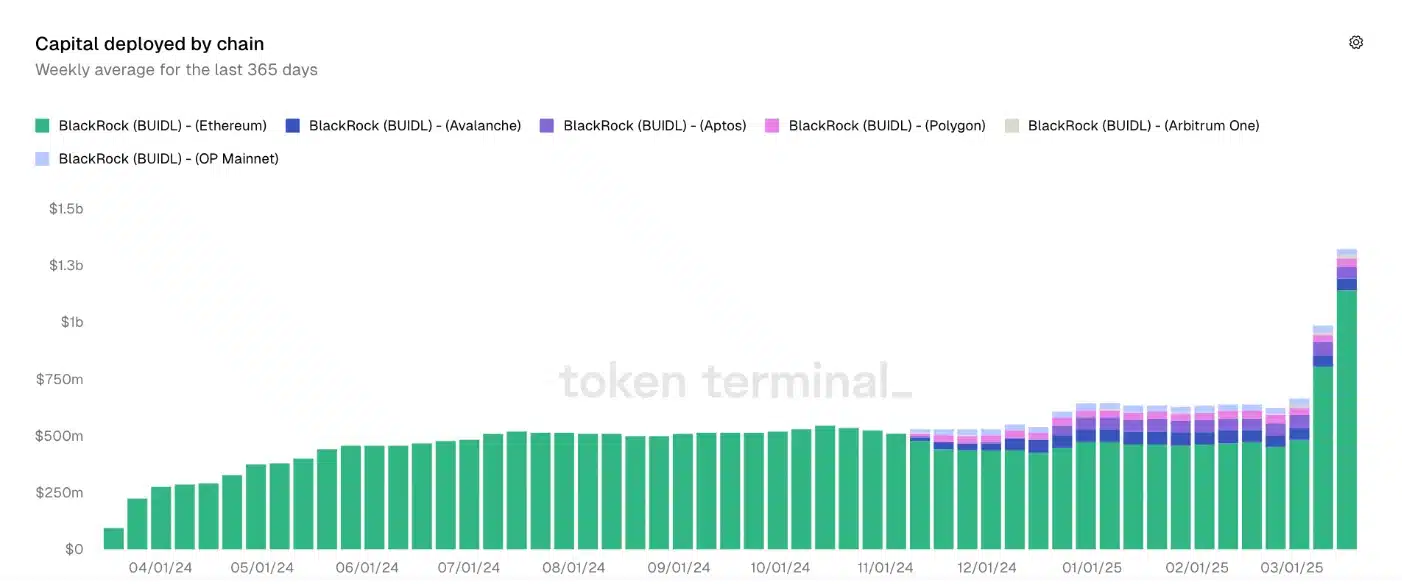

However, despite the price struggle, there has been a significant surge in institutional interest, as evidenced by BlackRock’s BUIDL fund increasing its ETH holdings to a record $1.145 billion. It’s a bet on the future that would make even the most seasoned Vegas high roller proud.

This marks a substantial rise from the $990 million recorded just a week earlier, signaling growing confidence in Ethereum’s long-term value. It’s a vote of confidence that would make even the most seasoned optimist smile.

The fund, which focuses primarily on tokenized real-world assets (RWAs), continues to maintain ETH as its dominant base layer despite diversifying across networks like Avalanche, Polygon, Aptos, Arbitrum, and Optimism. It’s a diversified portfolio that would make even the most seasoned investor proud.

Additionally, the fund’s total assets under management surged by 15%, reaching $7.63 billion as of the 22nd of March, reinforcing the narrative that institutional players are doubling down on Ethereum’s potential. It’s a bet on the future that would make even the most seasoned risk-taker green with envy.

Whale accumulation further strengthens ETH’s bullish outlook

Ethereum’s bullish momentum is further reinforced by a surge in whale accumulation, signaling growing confidence among large investors. It’s a vote of confidence that would make even the most seasoned whale proud.

On-chain data from Nansen Research reveals that since the 12th of March, wallets holding between 1,000 and 10,000 ETH have expanded their holdings by 5.65%, while those in the 10,000 to 100,000 ETH range have accumulated 28.73% more. It’s a whale-sized accumulation that would make even the most seasoned investor take notice.

Although addresses with over 100,000 ETH have remained relatively unchanged, the broader accumulation trend highlights strong institutional and high-net-worth investor conviction. It’s a sign that Ethereum’s long-term prospects remain robust, potentially setting the stage for a sustained upward trajectory.

Community reacts

Remarking on the same, an X (formerly Twitter) user-Belle noted,

“It’s obvious where $ETH is headed next.”

In conclusion, this X user put it best when he said,

So, there you have it – a $1.145 billion bet on Ethereum’s future. Will it pay off? Only time will tell, but one thing’s for sure – it’s a bet that would make even the most seasoned gambler smile.

Read More

- Unlock the Ultimate Arsenal: Mastering Loadouts in Assassin’s Creed Shadows

- REPO: How To Fix Client Timeout

- 8 Best Souls-Like Games With Co-op

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock Wild Cookie Makeovers with Shroomie Shenanigans Event Guide in Cookie Run: Kingdom!

- BTC PREDICTION. BTC cryptocurrency

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

- Classroom of the Elite Year 3 Volume 1 Cover Revealed

- Rafayel Abyssal Chaos Final Farewell Endings In Love And Deepspace

- All Balatro Cheats (Developer Debug Menu)

2025-03-24 15:03