Bitcoin (BTC) has decided to offer us a brief moment of hope this week, like a bright light at the end of a tunnel, except the tunnel might be filled with quicksand.

Sure, Bitcoin has shown a bit of a “relief rally” lately, but don’t get too excited—experts are already warning that this is probably the financial equivalent of a sugar high. It’s great now, but who knows how long it’ll last.

So, Will Bitcoin’s Rally Actually Stick Around?

According to data from BeInCrypto (which sounds like a great name for a startup that you probably shouldn’t invest in), Bitcoin’s price has managed to claw back a modest 2.0% over the last week. Oh, and if you’re a bit of a gambler, the coin has jumped 5.0% over the past two weeks. At the time of writing, Bitcoin’s trading at $87,381, which is just a tiny 0.1% dip from yesterday. Feel free to get excited, but maybe don’t break out the champagne just yet.

Spot Bitcoin exchange-traded funds (ETFs) have also been getting some attention, attracting $944 million in inflows over the past nine days. Institutional investors are definitely feeling more confident, which is good news, I guess. However, analysts aren’t exactly ready to start sending out the party invitations just yet.

Fairlead Strategies, the ever-cautious research firm, thinks Bitcoin’s little rally could last another week or two, but let’s not get ahead of ourselves. Founder Katie Stockton, who probably has an excellent view of every bear market from her office window, warned that a price drop could follow at any moment. After all, we all know that nothing says “stability” like predicting doom and gloom while cautiously holding out hope for a few more days of positive momentum.

“Intermediate-term momentum is to downside, and the weekly stochastics are not yet oversold, increasing risk that the rebound is fleeting. We expect the same for most risk assets,” she wrote. Translation: “Enjoy it while it lasts, folks.”

But, she did admit that things don’t look entirely bleak. Bitcoin’s near-term momentum has improved, meaning there’s still some space for it to rise before it gets all overbought and everyone starts running for the hills. But don’t expect that to last forever—she’s got the calendar marked, and the good times might be over by the end of the month. Party’s over, folks.

In the meantime, Bitcoin might enter a phase of consolidation. This means that things could slow down as the market digests all of its recent gains, like a person who eats too much pizza and needs to take a nap. It’s not a “bounce back,” it’s more like a financial nap. 🍕

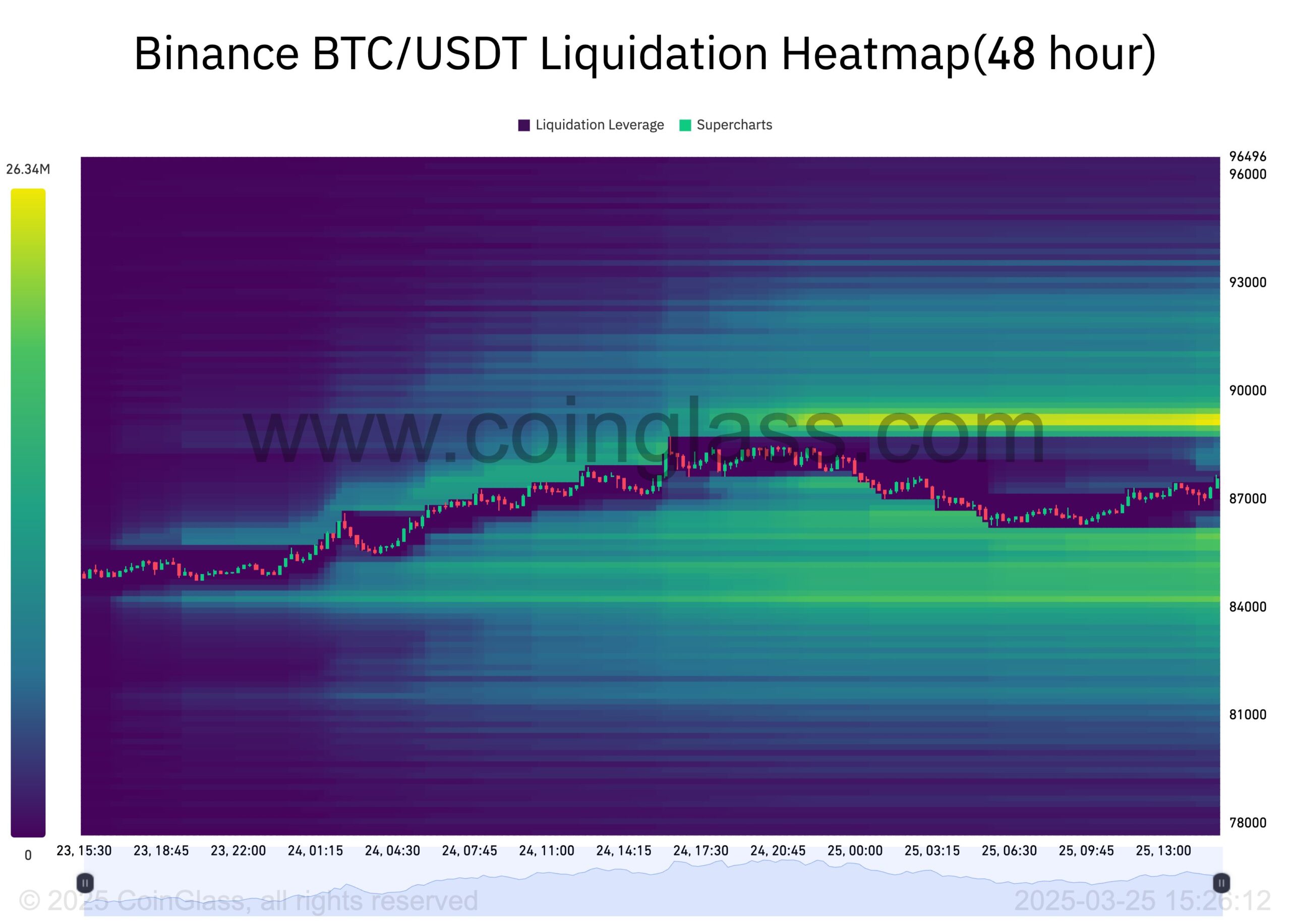

Other analysts are also keeping things real with their predictions. Koroush AK, posting on X (formerly Twitter—because we’re all still in denial about that one), looked at Bitcoin’s potential price movements using a fancy liquidation heatmap.

He noted that there’s major selling pressure around $89,000 (cue the ominous music) and some buying interest around $85,000 (well, at least someone is still hopeful).

“The idea of a HTF dead cat bounce is still valid if price reverts at the highs around the ≈$90K key zone,” he wrote. In other words, a brief rally that goes nowhere fast. Hold your applause, please.

For those of you wondering what a “dead cat bounce” is (don’t worry, it’s not as gruesome as it sounds), it refers to a brief recovery after a long downturn—before the inevitable plunge back down. Sounds like a fun ride, right? But hey, if Bitcoin manages to break past the resistance level, the doom and gloom might just be canceled. Fingers crossed.

Of course, let’s not forget that external factors might mess everything up. We’ve got the looming threat of US President Donald Trump’s upcoming tariff announcements scheduled for April 2. K33 Research is worried that these tariffs could send shockwaves through the market. And as we all know, nothing gets traders more nervous than a big, looming tariff announcement. Cue the collective anxiety.

“Tariffs remain the primary producer of market-moving headlines, rendering most traders risk-averse as we approach a big day of tariff announcements on April 2,” the report read. In other words, if you’re holding your breath for a good outcome, you might want to invest in a paper bag to hyperventilate into.

So, just a friendly reminder: don’t use leverage (unless you want to pretend you’re on an emotional rollercoaster). This period of uncertainty could be a real ride, and not the fun kind where you win prizes at the end. We can only hope for the best. Maybe Bitcoin will soar, maybe it will plummet. Either way, it’ll be a spectacle!

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- REPO: How To Fix Client Timeout

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-03-27 12:32