- Bitcoin’s supply on exchanges dropped by 7.53%, which is either a sign of genius or folks just lost their passwords. 🤷♂️

- Network activity is buzzing like a bee in a flower shop, hinting that Bitcoin might be gearing up for a wild ride. 🐝

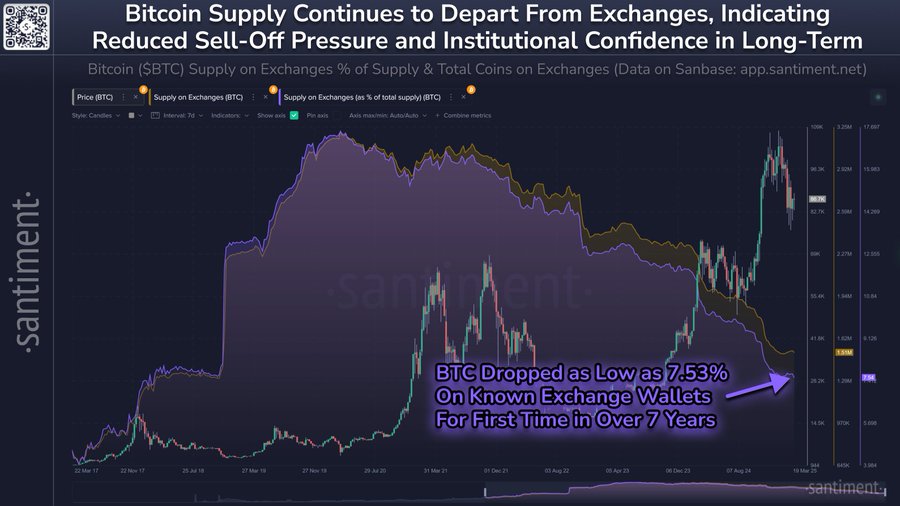

Well, folks, Bitcoin’s [BTC] supply on exchanges has taken a nosedive to a measly 7.53%, the lowest since February 2018. At the time of writing, Bitcoin was trading at $87,075.28, down a smidge by 0.95% in the last 24 hours. 📉

Seems like more investors are choosing to ‘hodl’ their BTC tighter than a miser grips a penny. This shrinking supply is a clear sign that folks are betting big on Bitcoin’s long-term value. But with fewer people willing to sell, the market could get as volatile as a cat on a hot tin roof. 🐱

Why is Bitcoin’s exchange supply shrinking?

Well, it’s simple. Investors are holding onto their Bitcoin like it’s the last slice of pizza at a party. This shift in sentiment shows they’re confident Bitcoin’s future is brighter than a lighthouse on a clear night. 🍕

With less Bitcoin available, prices could swing like a pendulum in a hurricane. Increased market confidence means fewer folks are willing to sell, making Bitcoin’s exchange supply scarcer than hen’s teeth. 🌪️

How active is the Bitcoin network?

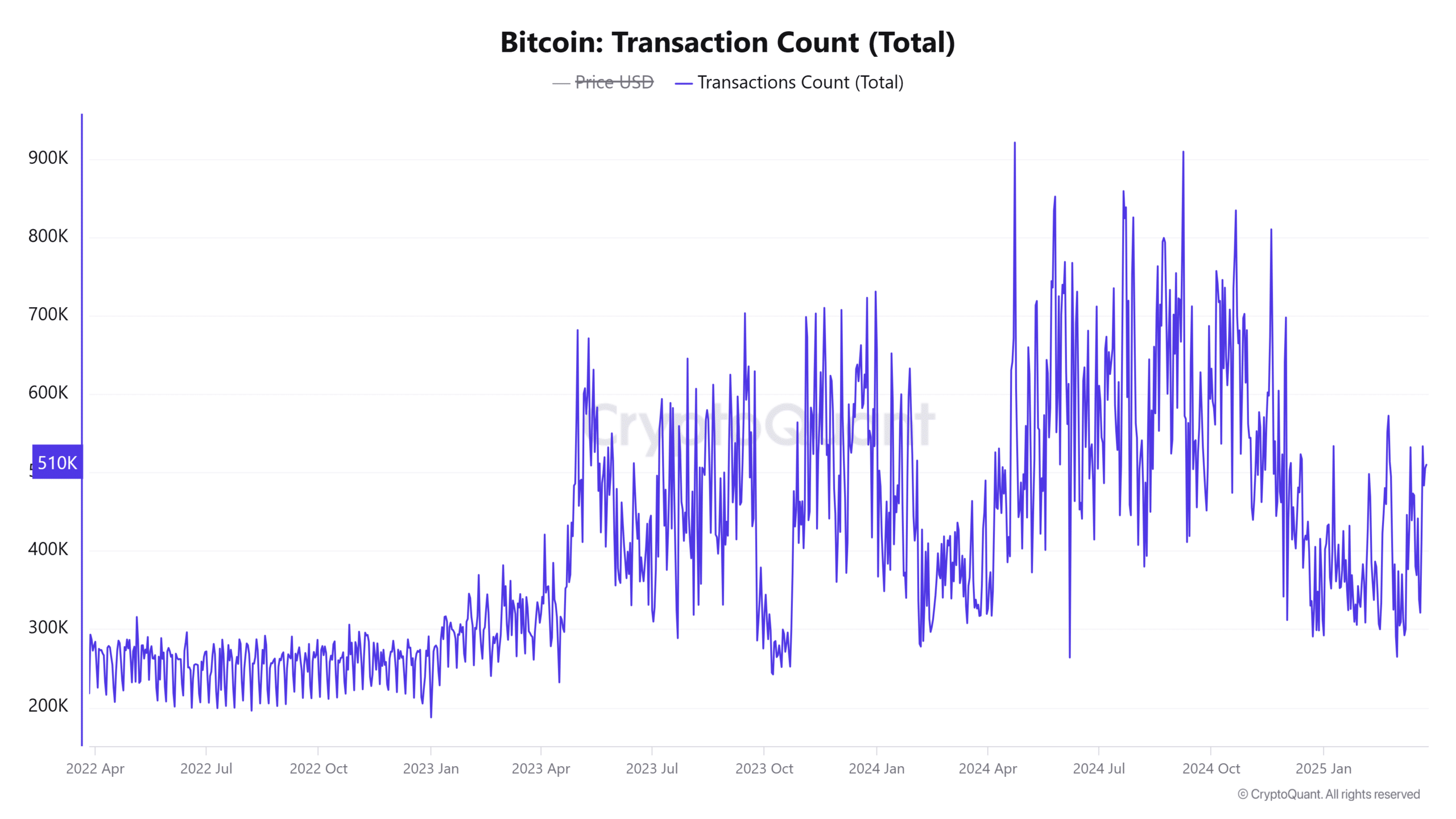

Bitcoin’s network is busier than a one-armed paper hanger. Active addresses have increased by 1.16%, hitting 10.17 million. This uptick shows more folks are getting in on the action, whether they’re sending or receiving funds. 📈

On top of that, the transaction count has risen by 0.74%, totaling over 418,000 transactions. This surge in activity means more people are jumping on the Bitcoin bandwagon, which could drive demand and prices skyward. 🚀

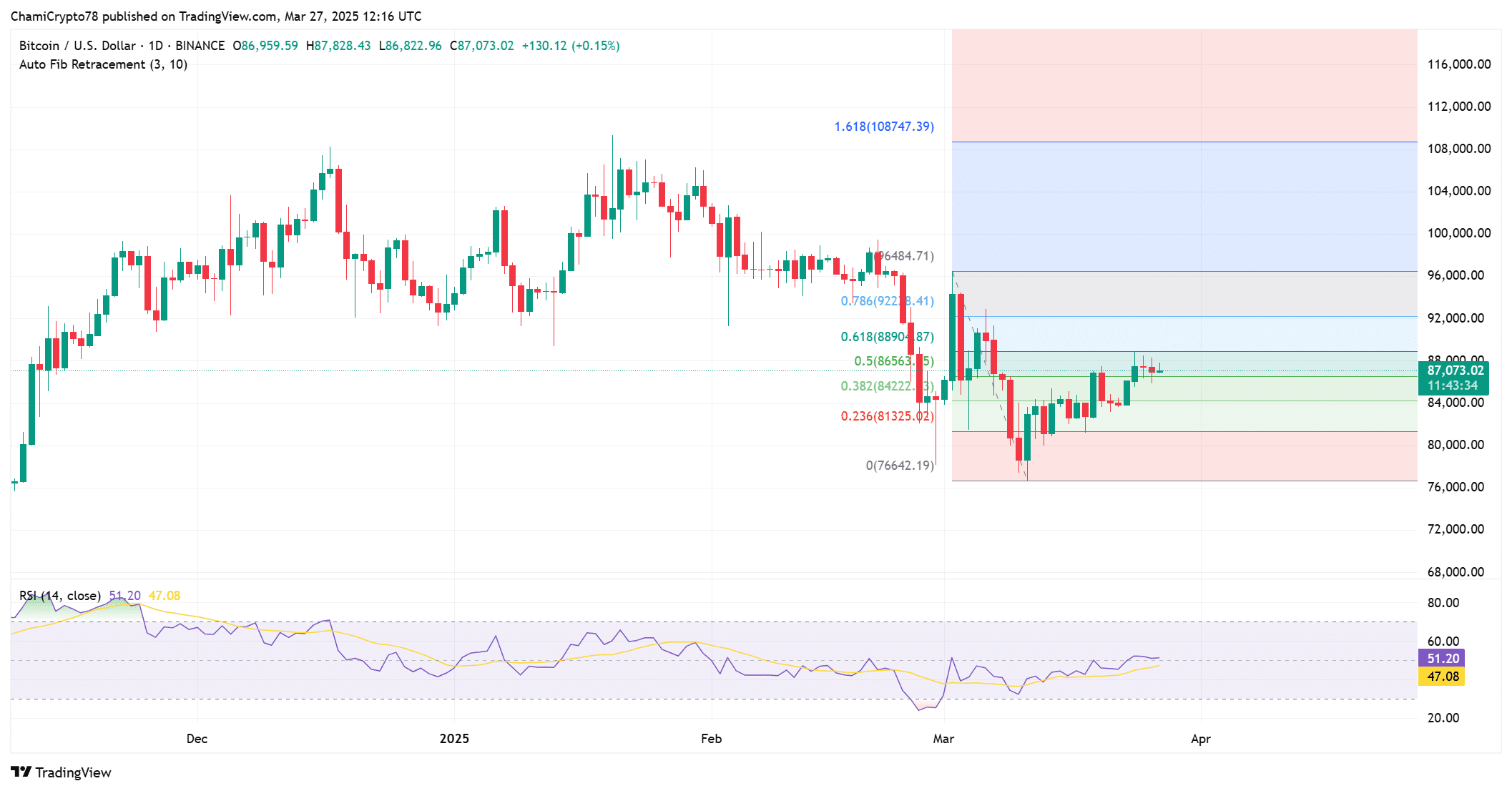

Technical indicators: Is BTC ready for a breakout?

Looking at the charts, Bitcoin’s got some promising signs. The Fibonacci retracement levels suggest Bitcoin has found support at the 0.236 level, around $81,325. 📊

Plus, the RSI is sitting at 51, which means Bitcoin’s neither overbought nor oversold. This suggests there’s still room for movement, and a breakout could be on the horizon if Bitcoin holds above key support levels. 🎯

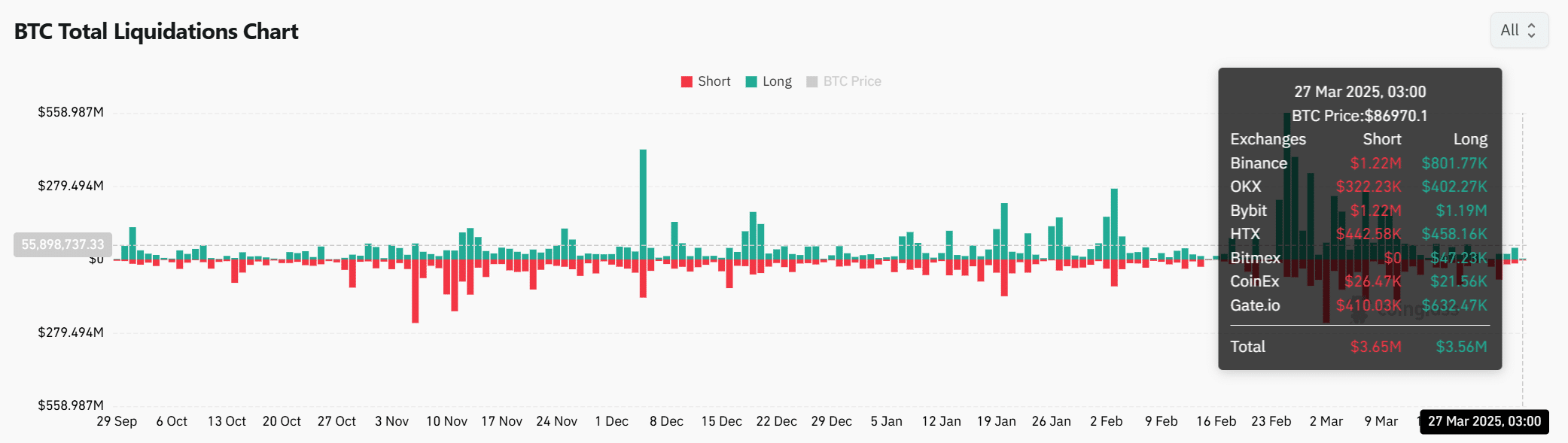

Long vs. short liquidations

Bitcoin’s liquidation data shows long and short liquidations are nearly neck and neck, with $3.65 million in long liquidations and $3.56 million in short liquidations. ⚖️

This balance suggests the market is as steady as a rock, with both optimistic and cautious traders adjusting their positions. The equilibrium in liquidations means the market is waiting for the next big move. 🪨

In conclusion, Bitcoin’s low supply on exchanges, buzzing network activity, and encouraging technical indicators suggest that Bitcoin might be gearing up for a bullish phase. 🐂

The growing number of holders, combined with key support levels, points to upward momentum. So, it’s likely Bitcoin will continue to see positive price action, though short-term volatility could still shake things up. 🌟

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Reach 80,000M in Dead Rails

- How to Unlock the Mines in Cookie Run: Kingdom

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- REPO: How To Fix Client Timeout

- 8 Best Souls-Like Games With Co-op

2025-03-28 01:15