Ah, Ethereum (ETH), the digital currency equivalent of a soap opera. Plot twist after plot twist, and just when you think it’s going to finally pull itself together—BOOM! Another dramatic plunge. Over the last 24 hours, the whole crypto market decided it was feeling too optimistic and went full-on doomsday mode. Bitcoin (BTC) and Ethereum led the plunge, with Ethereum making a theatrical 7% nosedive. 🪂

Ethereum (ETH): Highs, Lows, and “Am I a Joke To You?” Key Levels

So here’s the scoop. According to the wise tea-leaf readers of the crypto world (a.k.a. technical analysts), ETH has waddled down to $1,820 for the second time this month. This isn’t exactly a glorious homecoming—it’s more of a “don’t trip over the rug” moment. If ETH can’t muster up the courage to hang out above $1,800, it might just slide all the way to $1,490. Who knew numbers could be so sad? 😢

Again, just for the drama, ETH already failed to impress on the weekly time frame. It’s trading below the 200 EMA. And if you’re wondering what that means—it’s kind of like knowing the party is over because the last snacks are gone. Not a good look for ETH.

In March 2025, ETH tried adding some excitement by showing upward momentum. Unfortunately, its upward attempts were about as sturdy as a wet paper bag. It retested a breakdown level, frowned at the result, and decided it might like to plummet further, potentially opening the trap door to $1,200 or lower. 💥

Price Action: The Meltdown Chronicles

As of this very moment—a moment likely to be outdated by the time you finish this sentence—Ethereum trades near $1,870. It’s already had a 7% haircut over the past day. Meanwhile, trading volume spiked by 50%! That’s right, it seems everyone’s showing up for the circus performance. 🎪

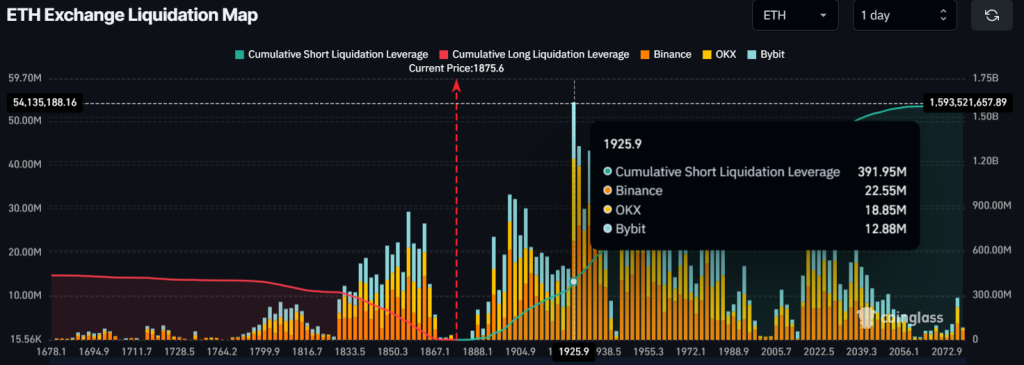

The $391 Million Spectacle in Short Bets

Traders, you rascals, what are you up to? Coinglass (aptly named—it’s like your digital crystal ball) says that bearish traders are having the time of their lives. Short positions are over-leveraged at $1,925 to the tune of $391 million (yes, million with an “M”). Meanwhile, optimistic—or possibly delusional—long traders are over-leveraged at $1,855 with $120 million riding on the hope train. 🚂💨

So what’s the bottom line? The bears are practically sharpening their claws. They’re sipping their coffee, grinning maliciously, and waiting for ETH to stumble so they can liquidate long positions and push ETH’s price even lower. It’s almost poetic, really. If poetry involved a lot of math and despair. 📉

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Unlock the Mines in Cookie Run: Kingdom

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- 8 Best Souls-Like Games With Co-op

- Top 7 Tifa Mods for Final Fantasy 7 Rebirth

- The White Rabbit Revealed in Devil May Cry: Who Is He?

2025-03-28 22:07