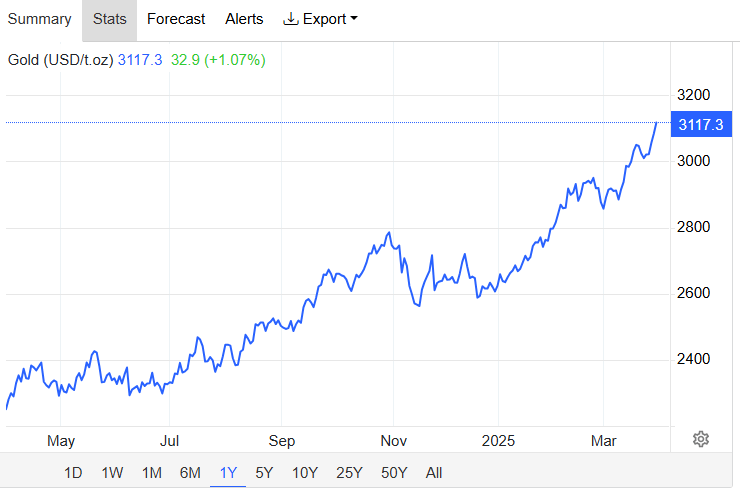

Oh, gold has skyrocketed to a jaw-dropping $3,117 per ounce, thanks to trade war fears and central banks suddenly developing an obsession with the shiny stuff. Some experts are even whispering that this might be a precursor to a bitcoin gold rush. You know, because that makes total sense, right?

Goldman Sachs Predicts Gold’s Price Will Keep Soaring – Prepare for the Glitter!

Just as U.S. President Donald Trump dubbed the upcoming day as “liberation day,” gold soared to a staggering $3,117 per ounce. A lovely little milestone that came hot on the heels of its earlier $3,100 triumph, sparking wild optimism among the gold-enthusiasts who haven’t seen a gold coin they didn’t love.

Gold’s recent surge has, predictably, led Goldman Sachs to make an upward revision in its gold price forecast. As reported by Reuters (because where else would you get the scoop?), the esteemed investment bank now expects gold to hover between $3,250 and $3,520 per ounce by year’s end. Because why stop at $3,100 when you can dream bigger?

Goldman Sachs is quick to attribute this shift to central banks in Asia buying up gold like there’s no tomorrow. And guess what? This obsession with gold isn’t going anywhere soon. They predict these gold-hungry central banks will keep shopping for gold for the next three to six years. Because, of course, the glittering allure of gold can never fade.

And, oh, the contrast between gold’s glittering success and bitcoin’s performance post-Trump’s inauguration—it’s almost poetic. Gold’s 22% year-to-date gain looks quite shiny compared to bitcoin’s 23% drop, from nearly $109,000 to just shy of $83,000. But hey, who’s counting, right?

This sad little quarter for digital assets, those misunderstood safe-havens, has fueled the critics who are just itching to pronounce Bitcoin’s reign as “digital gold” over. I mean, it must be true—bitcoin didn’t react to trade war tariffs like gold did. The nerve of it! Clearly, Bitcoin is nothing but a passing trend, right?

Bitcoin’s Digital Gold Status: A Safe Haven? Oh, Absolutely!

But not so fast, my dear cynics! Despite its less-than-glamorous performance in Q1, Bitcoin’s fans are still standing tall, proclaiming that its “digital gold” status is as solid as ever. Rena Shah, COO of Trust Machines, eloquently points out that while gold may still be the safe-haven darling of old, Bitcoin is the “only asset you’ll never sell.” Bold words for a digital currency that’s only a tad older than your average TikTok trend!

Shah continues, effortlessly reminding us that Bitcoin has been outperforming other assets, especially since the advent of bitcoin ETFs. So, what’s the problem? It’s not about to cower in the face of gold’s shiny triumph. Bitcoin’s just getting started, darling.

Ben Caselin, CMO at African cryptocurrency exchange VALR, adds a delightful twist to the saga. He suggests that the growing interest in Bitcoin by nations and central banks might just be the beginning of an international game of “let’s see who gets more bitcoin.” And gold’s rally? Oh, it’s just the warm-up for a grand bitcoin explosion. A game theory masterpiece, one might say.

And then there’s Mithil Thakore, CEO of Velar, who clearly doesn’t understand the word “defeat.” He argues that Bitcoin’s importance has only grown, as more institutions adopt it, and its staying power becomes increasingly undeniable. Gold’s resurgence? A mere endorsement of Bitcoin’s value proposition—both assets are responding to the same macroeconomic concerns. What a lovely little alliance we have here.

Luke Xie, co-founder and CEO of Satlayer, gets straight to the point: gold’s rally could just be a fleeting trend, driven by “short-term safe-haven inflows.” Meanwhile, Bitcoin’s appeal is as solid as ever, based on its finite supply and ever-expanding adoption. No big deal. Gold has its day in the sun, but Bitcoin’s legacy is set in stone (or blockchain, really).

In summary, instead of Bitcoin losing its “digital gold” crown, it’s merely evolving, improving itself like the modern marvel it is. With advancements like BTCfi, Bitcoin is carving a more secure, complementary role in today’s financial landscape—something gold just can’t claim. Better luck next time, gold!

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Top 8 UFC 5 Perks Every Fighter Should Use

- Game of Thrones Writer George R. R. Martin Weighs in on ‘Kickass’ Elden Ring Movie Plans

- Hollow Knight: Silksong is Cutting It Close on a 2025 Release Window

- Don’t Expect Day One Switch 2 Reviews And Here’s Why

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

2025-04-01 09:58