In a world where digital dreams dance with the tangible, the tokenized gold has pirouetted past the $1.2 billion mark, driven by the golden gleam of soaring prices and the capricious allure of blockchain assets.

The enchantment with tokenized gold is but a chapter in the grand novel of financial revolution, where the old and new worlds collide, spinning tales of modern storage, trading, and utilization.

Gold’s Digital Debut: A Blockchain Ballet

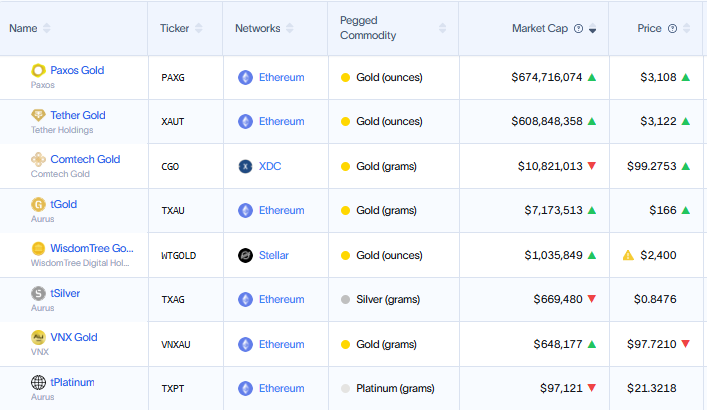

As gold prices waltz beyond the $3,000 per ounce milestone, digital twins of precious metals, such as Tether Gold (XAUT) and Paxos Gold (PAXG), have captured the hearts and wallets of investors.

Don Tapscott, the blockchain bard from the Blockchain Research Institute, muses that tokenized gold might just rewrite the $13 trillion epic of the gold market, introducing transparency, liquidity, and avant-garde financial models.

He whimsically queries why gold still languishes in vaults, a relic of the1800s, while assets like Bitcoin (BTC) and stablecoins frolic in the digital meadows. Blockchain, he opines, could be the alchemist turning gold’s financial role into something magical.

“Imagine, if you will, the US government tokenizing its gold reserves, ensuring their immutability, and employing them in ways most innovative,” Tapscott muses.

This, he suggests, would usher in an era of fractional ownership, on-chain verification, and universal accessibility to investors, a democratization of gold, if you will.

Meanwhile, titans like Paxos and Tether are leading this charge, with Paxos commanding a51.74% market share, and Tether not far behind at46.69%.

Matador Technologies, a publicly listed entity, adds flair to the narrative by tokenizing gold on the Bitcoin blockchain, offering a digital claim to both physical gold and exclusive digital art—a fusion of the tangible and the virtual.

“The financial powerhouses of the future are being forged in the fiery furnaces of the tokenization revolution. It’s early days, and the arena is vast. Matador and its ilk have seized the bull by the horns,” Tapscott quips in his latest opus.

A Gilded Policy Shift in the Land of Liberty?

This golden wave has even reached the shores of US governance. Following President Trump’s executive order for a Strategic Bitcoin Reserve (SBR), the winds of change hint at modernizing gold holdings.

Treasury Secretary Scott Bessent’s nod towards “monetizing assets” has set tongues wagging about a possible tokenization of Fort Knox’s gold.

“Scott Bessent assures us, all the GOLD is present, though he has no desire to visit Fort Knox or reassess GOLD reserves for a sovereign wealth fund. His words echo on ‘Bloomberg Surveillance,’” notes Erik Yeung.

Senator Cynthia Lummis, not to be outdone, proposes swapping part of the US gold reserves for Bitcoin, a bold move considering the outdated $42 per ounce book value against the market’s $3,000+.

As the US flirts with tokenization, geopolitical rivals like China and Russia are rumored to be concocting a gold-backed stablecoin, a move that could shift global financial tectonics.

“The BRICS nations, led by Russia, China, and India, are poised to counter a US hegemonic stablecoin with a gold-backed counterpart. The global market’s preference for a stable, inflation-proof asset like gold over the USD is clear. Even Sharia law favors gold. A BTC-backed stablecoin, alas, is deemed too volatile,” Max Keiser proclaims.

Should such a stablecoin emerge, it could challenge the USD’s dominance, leveraging the combined might of China and Russia’s50,000 tonnes of gold reserves.

The Gold vs. Bitcoin Saga: A Tale of Two Havens

Gold’s meteoric rise has reignited the age-old debate: gold or Bitcoin? While Bitcoin’s volatility keeps risk-averse investors at bay, gold basks in its glory as the preferred safe-haven asset amidst economic turmoil and tariff wars.

Yet, the emergence of tokenized gold signifies a harmonious blend of the old and new, a coexistence of gold and Bitcoin in the financial symphony of the future.

Through tokenization, gold-backed stablecoins, or government blockchain initiatives, the financial landscape is undergoing a metamorphosis.

As traditional bastions embrace blockchain, we stand on the cusp of a transformation in how the world values, trades, and safeguards gold in relation to Bitcoin.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- REPO: How To Fix Client Timeout

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- How to Unlock the Mines in Cookie Run: Kingdom

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

2025-04-02 11:58