🚨💸 “ETH on the Ropes: Will Investors’ Pluck Pay Off?” 🤔

Oh dear, oh dear! Ethereum‘s been having a ripping bad time, old chap! 🤦♂️ Its price is teetering precariously near a 17-month low of $1,802. One might think the bears are having a jolly good romp, but fear not! Key investors, those stalwart fellows, remain as optimistic as a Brit at a Wimbledon final 🎾.

As Ethereum totters on the brink of this significant level, many a market participant is whispering about an impending price rebound. One’s ears perk up at the mere suggestion, don’t they? 🗣️

Ethereum Investors: The Embodiment of Steely Resolve

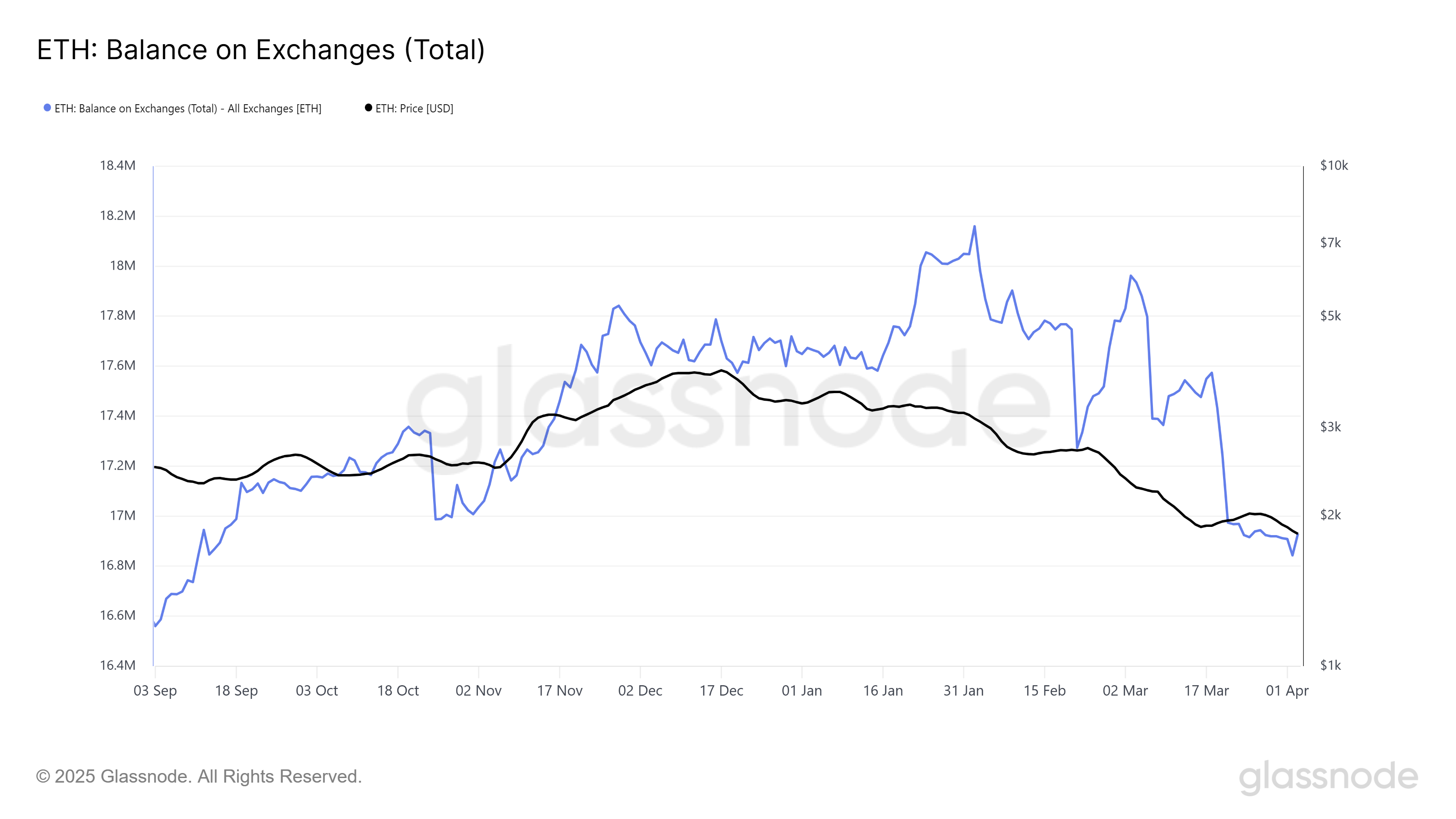

Now, observe, if you will, the exchange supply of Ethereum, which has plummeted to a six-month low. This, my friends, indicates that investors are clinging to their assets for dear life, refusing to let them slip into the waiting jaws of… well, the market 🙅♂️. A bullish sign, if ever there was one! This accumulation business suggests that Long-Term Holders (LTHs) are busy scooping up ETH like it’s going out of style, all while anticipating a future price appreciation that’ll make their eyes shine like the top of the Chrysler Building 🌆.

These investors, steadfast and true, are having none of this selling nonsense. Their conviction in Ethereum’s long-term value is stronger than a well-made gin martini 🍸. And, as an added bonus, the decrease in exchange balances implies that short-term trading activity has gone quieter than a mouse in a library 🐭.

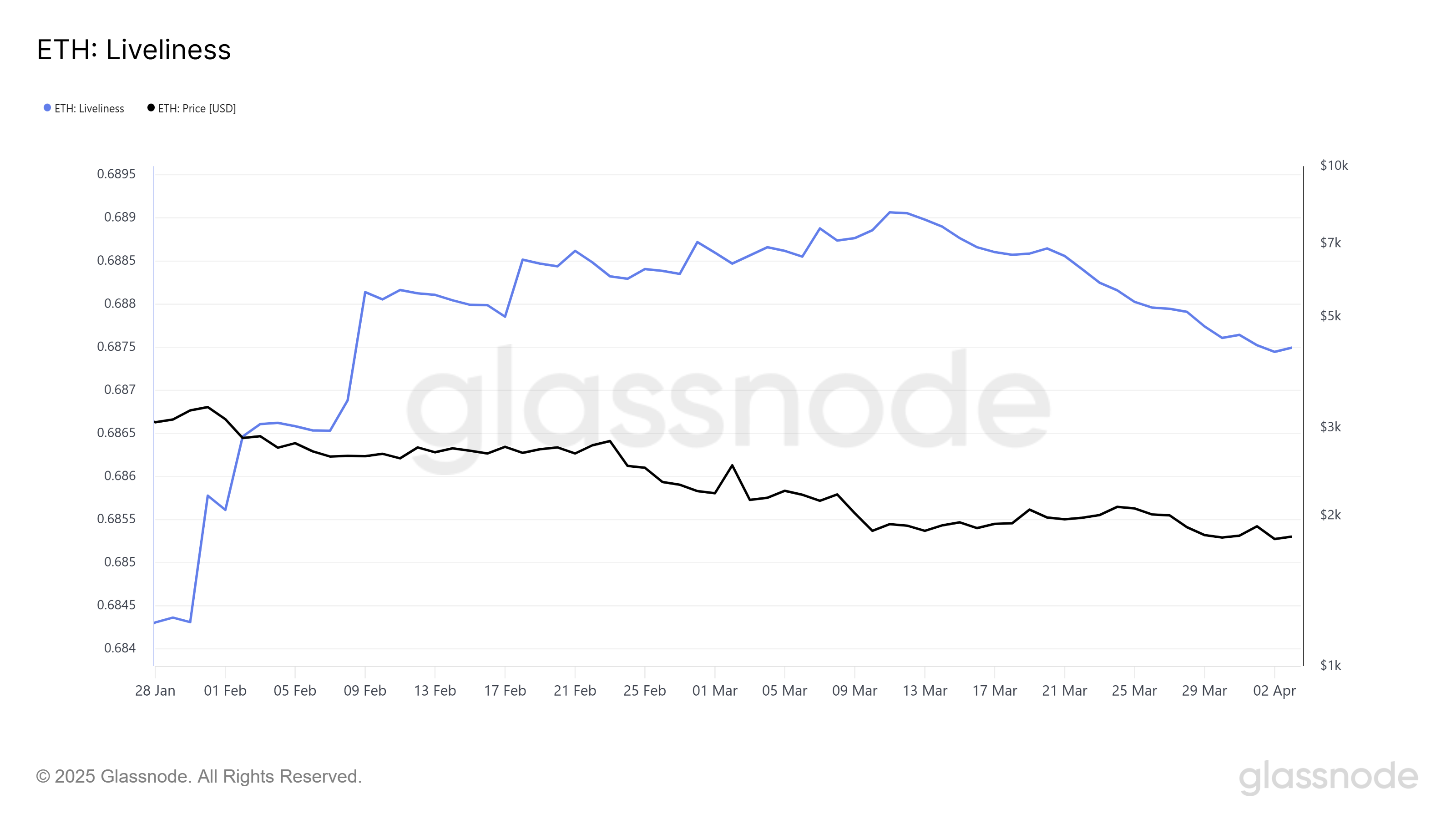

Over the past month, Ethereum’s Liveliness indicator has taken a bit of a holiday, signaling that selling pressure is weaker than a kitten’s mew 🐱. Liveliness, you see, measures the activity of those LTHs, and a decline typically points to accumulation rather than a frantic rush for the exits 🚪.

This drop, my friends, reflects the growing sentiment among Ethereum’s long-term investors, who are increasing their holdings with all the fervor of a collector chasing a rare postage stamp 📨. They’re expecting the price to recover, and soon, if the whispers are to be believed… 🗣️

This accumulation phase, in all its glory, suggests that Ethereum’s market sentiment might just be shifting, like the wind changing direction on a blustery day ⛅️. The confidence of these LTHs, who wield significant influence over the asset’s price, could lead to a strong upward momentum, akin to a runaway train (but, you know, in a good way) 🚂.

ETH Price: A Nudge in the Right Direction, Please

Ethereum, currently trading at $1,802, is hovering just below the resistance level of $1,862, like a gentleman waiting for an invitation to dance 🕺. The price has been stuck under this barrier for six weeks, continuing the downtrend that’s been the talk of the town. However, if Ethereum can break above $1,862, it might just signal the end of this confounded downtrend and the start of a price recovery, huzzah! 🎉

Given the current market sentiment and accumulation by key holders, it’s entirely possible that Ethereum will continue to gain upward momentum, like a well-oiled machine 🤖. If Ethereum successfully breaks through the $1,862 resistance, it could make a beeline for the $2,000 mark, regaining some of those losses from the previous weeks, and making everyone’s day a bit brighter 🌞.

On the other hand, should the bearish sentiment decide to throw a tantrum, Ethereum’s price might dip further toward its 17-month low of $1,745, oh dear! 🙈 Failure to secure support at this level could lead to even greater losses, extending the recent downtrend and leaving many investors exposed to a prolonged bearish market, which would be a bit of a pickle, if you ask me 🤦♂️.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Unlock the Mines in Cookie Run: Kingdom

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- USD PHP PREDICTION

- 8 Best Souls-Like Games With Co-op

2025-04-04 15:38