🚨💸 “Whales on the Prowl: ETH‘s Stealthy Savior?” 🤔

As the whimsical winds of fortune whispered through the Ethereum market, a most intriguing phenomenon unfolded, dear reader. On-chain data, that great oracle of our times, revealed that the grandees of the cryptocurrency world – the Large Holders, if you will – have been surreptitiously augmenting their Ethereum holdings. 🤑

The Enigmatic Case of Ethereum’s Large Holders Netflow

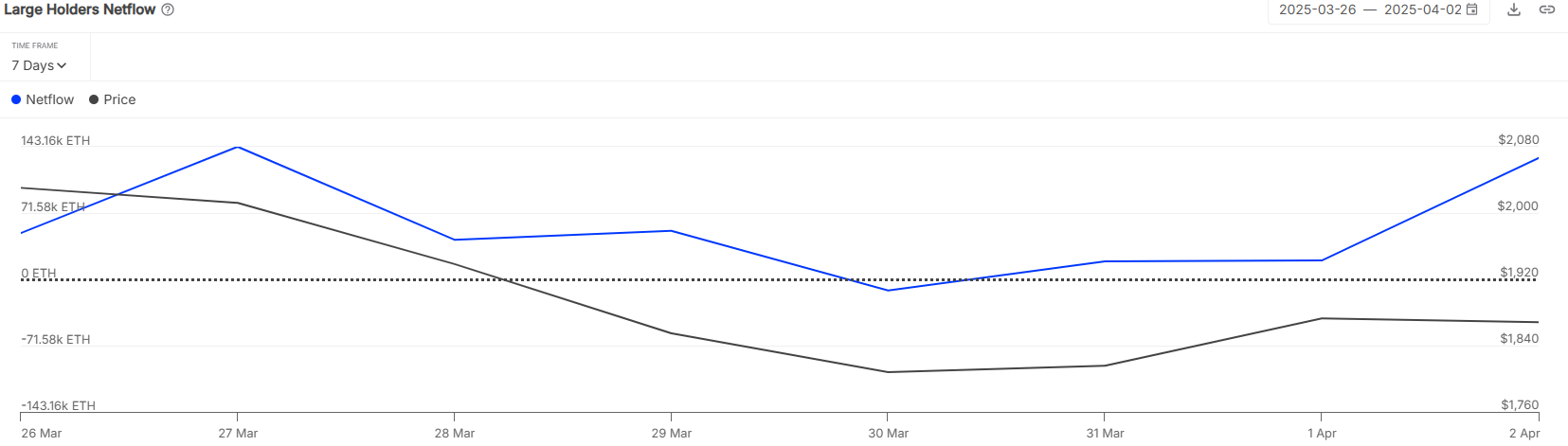

In a most enlightening dispatch on the venerable platform X, the erudite analysts at IntoTheBlock shed light upon the mystifying trends in the Large Holders Netflow for Ethereum. This arcane metric, for the uninitiated, measures the net quantity of the cryptocurrency flowing into or out of the wallets of these behemoths. 📊

IntoTheBlock, in their infinite wisdom, categorizes investors into three distinct species: Retail (those endearing innocents holding less than 0.1% of the supply), Investors (the moderately affluent, with 0.1% to 1% of the supply), and Whales (the leviathans, commanding more than 1% of the supply). 🐳

At present exchange rates, the humble threshold of 0.1% of the ETH supply – the dividing line between Retail and Investors – translates to a staggering $214 million. A sum, might we add, that elevates even the most modest of Investors to the rarefied realm of the substantially wealthy. 💸

Thus, the Large Holders, our protagonists in this tale, comprise both Investors and Whales. The Large Holders Netflow, therefore, chronicles the transactions of these two groups. A positive value indicates that these titans are receiving more deposits than they are making withdrawals – a bullish omen, if ever there was one! 📈

Now, behold! The chart shared by IntoTheBlock, illuminating the Large Holders Netflow’s trajectory over the past week:

As the graph so eloquently illustrates, the Ethereum Large Holders Netflow has lingered predominantly in the positive realm, suggesting that Investors and Whales have been busily accumulating. On the 2nd of the month, these savvy entities collectively snapped up a net 130,000 ETH (approximately $230 million). A most intriguing development, indeed! 🤔

Noteworthy, too, is that these net inflows occurred concomitantly with the cryptocurrency’s decline, leading one to surmise that these shrewd investors might perceive recent prices as a most opportune moment to enter the market. The question, dear reader, remains: will this accumulation prove sufficient to arrest ETH’s decline? 🤷♂️

In other news, the Ethereum fee has plummeted to its lowest level since 2020 this quarter, as IntoTheBlock astutely observed in another X post.

Following a precipitous 59.6% drop, the Ethereum total transaction fees now stand at a mere $208 million. According to IntoTheBlock, this trend is “primarily driven by the gas limit increase and transactions moving to L2s.” 📉

ETH Price: A Brief Interlude

Ethereum, in a fleeting moment of élan, rallied above $1,900 earlier in the week, only to succumb to the weight of its own momentum, slumping back to $1,770. Ah, the capricious nature of the markets! 📊

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- How to Unlock the Mines in Cookie Run: Kingdom

- 8 Best Souls-Like Games With Co-op

- REPO: How To Fix Client Timeout

- Top 7 Tifa Mods for Final Fantasy 7 Rebirth

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-04-05 09:44