XRP, the once-hopeful darling of the crypto world, has endured a prolonged, pitiful descent, shedding a staggering 46% of its once-glorious value since its peak at $3.40 on January 16.

This ignoble fall has cast many investors—particularly the short-term enthusiasts—into a dismal abyss of losses, inciting waves of panic and a chorus of dire predictions. But lo! On-chain data now suggests that the tides might be turning. Pray, read on for the details, should you dare.

The Disastrous Capitulation of the Short-Term XRP Enthusiasts

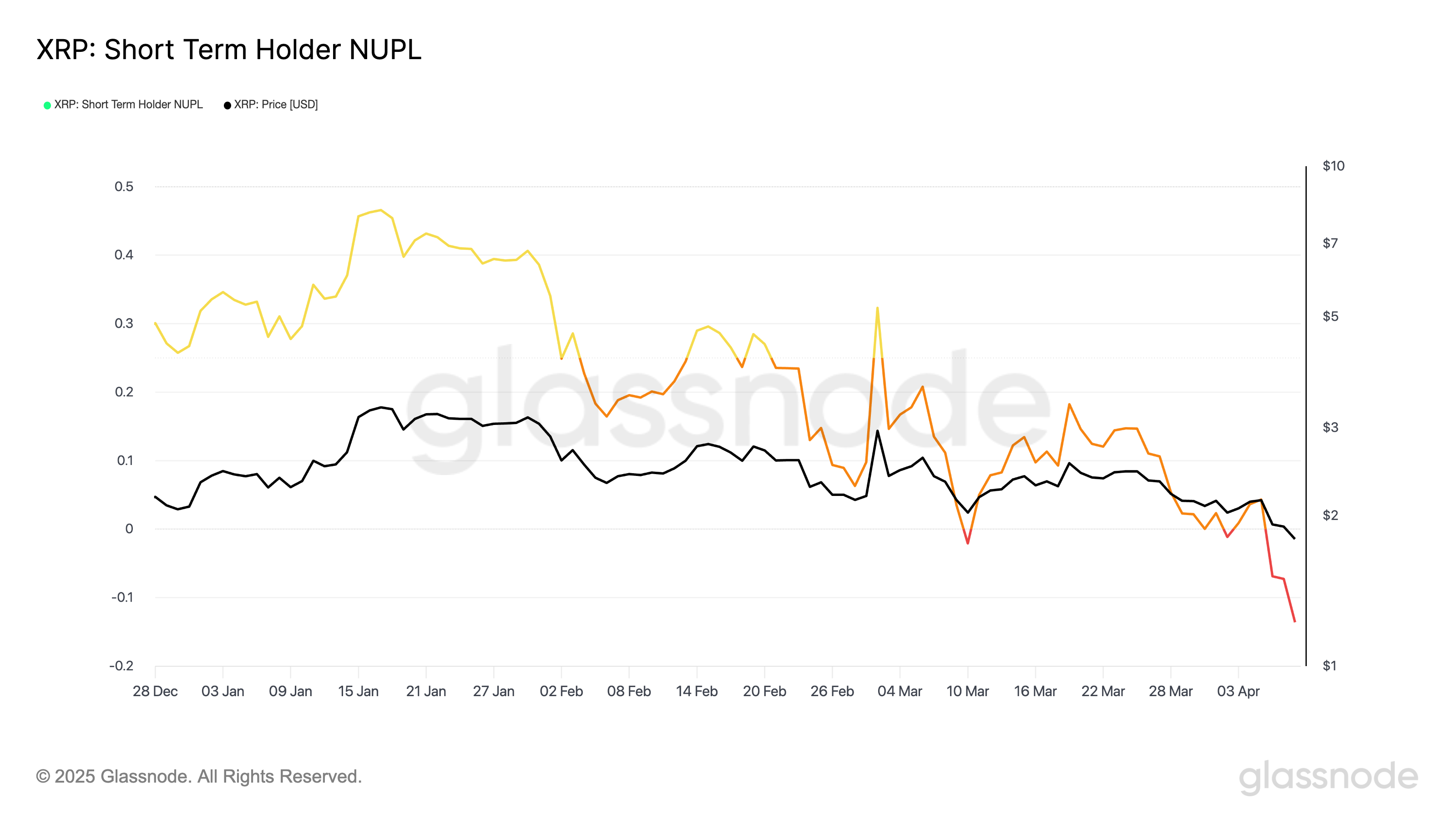

According to the sagely wisdom of XRP’s Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) metric, the inevitable capitulation is upon us.

Now, short-term holders are those zealous souls who clung to their tokens for a mere 155 days or less. These are the ones who succumb to the dreaded sensation of capitulation, often selling at a loss out of sheer panic or—perhaps more tragically—exhaustion. Presently, XRP’s STH-NUPL sits at a paltry -0.13, a value we haven’t witnessed in the entirety of this year.

Indeed, many of these short-term holders are suffering their deepest unrealized losses of the year. One might say they’ve been drowned by the weight of their own misplaced optimism. This, of course, could very well drive the price even lower, for misery loves company.

However, do not rush to despair, for there is a twist! Historically, when such capitulation occurs, it has often been a signal of the market reaching its nadir, where the faint-hearted exit, clearing the way for the truly stalwart. Could this be the moment where the “weak hands” depart, making space for those with a firmer grasp on reality (and, dare we say, the market’s future)? Only time will tell, but hope springs eternal!

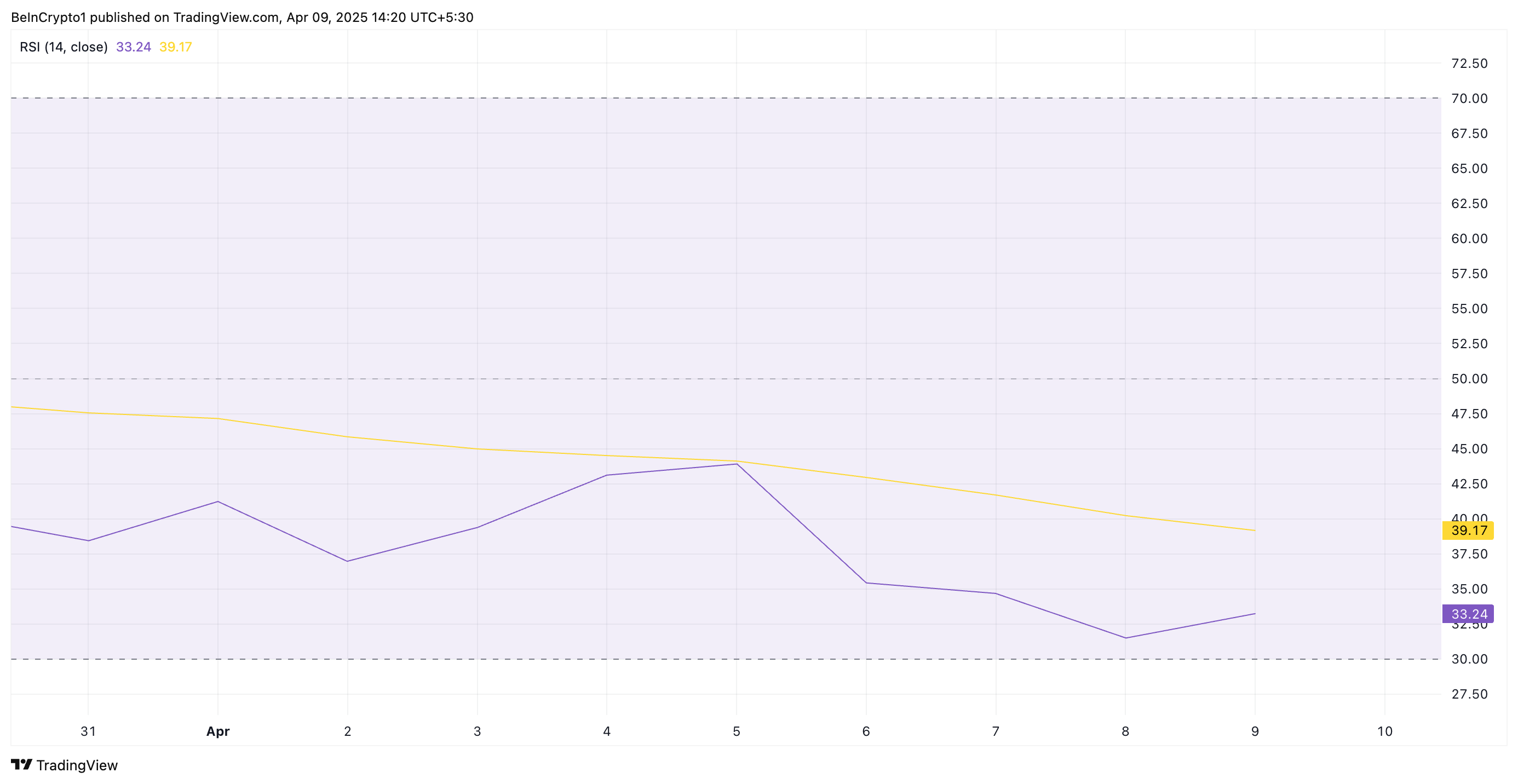

Moreover, the RSI—our faithful friend—indicates a near-oversold condition, pointing towards a possible end to the sellers’ reign. As of now, XRP’s Relative Strength Index (RSI) is on the verge of plummeting below 30, often the harbinger of sellers’ exhaustion. Ah, the sweet smell of a potential reversal.

The RSI, that noble indicator, is designed to measure whether an asset is overbought or oversold. When it graces the upper echelons (above 70), one might assume the asset is ripe for a fall. Yet, when it descends below 30, it signifies that the asset might be so thoroughly trounced that a rebound could be imminent. Who doesn’t love a good comeback story?

As XRP nears the edge of the oversold abyss, a clever investor might seize this opportunity to acquire what others have foolishly discarded. Is it time to be greedy when others are fearful? Indeed, it might just be.

XRP’s Bearish Tale Continues—But Will It End in Redemption?

On the daily chart, XRP continues its sad, downward march within a descending parallel channel. This channel has served as a grim reminder of its relentless descent since January 16, a portrayal of the token’s ongoing struggle.

When an asset languishes within a descending parallel channel, it signifies a long, drawn-out battle of lower highs and lower lows, a persistent downward spiral that shows little sign of stopping. If this bearish tale continues, XRP may well fall further, perhaps toward the dreaded $1.61.

And yet, all is not lost! If fresh demand were to arrive—perhaps summoned by the gods of market sentiment—XRP might find itself reborn, its price recovering towards the lofty heights of $1.89. Oh, the drama of it all!

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-09 19:27