- ETH’s price has flirted with its realized price, igniting whispers of a possible bottom.

- But alas, weak demand for spot ETH ETFs and a flat network growth could throw a wrench in the works.

Ah, Ethereum’s [ETH] price, the perennial subject of speculation, has once again graced the headlines. It has touched a significant level, reminiscent of past market bottoms, stirring a flicker of hope for a reversal in this altcoin’s fate. One might say it’s like watching a soap opera—full of drama and unexpected twists!

According to the ever-astute CryptoQuant analyst, Kriptolik, ETH has dipped below its ‘realized price’—the average cost basis for most buyers. This level, dear reader, is often a harbinger of market shifts. The analyst boldly proclaimed,

“These periods have consistently been followed by strong recoveries — making them strategic accumulation points for long-term investors.”

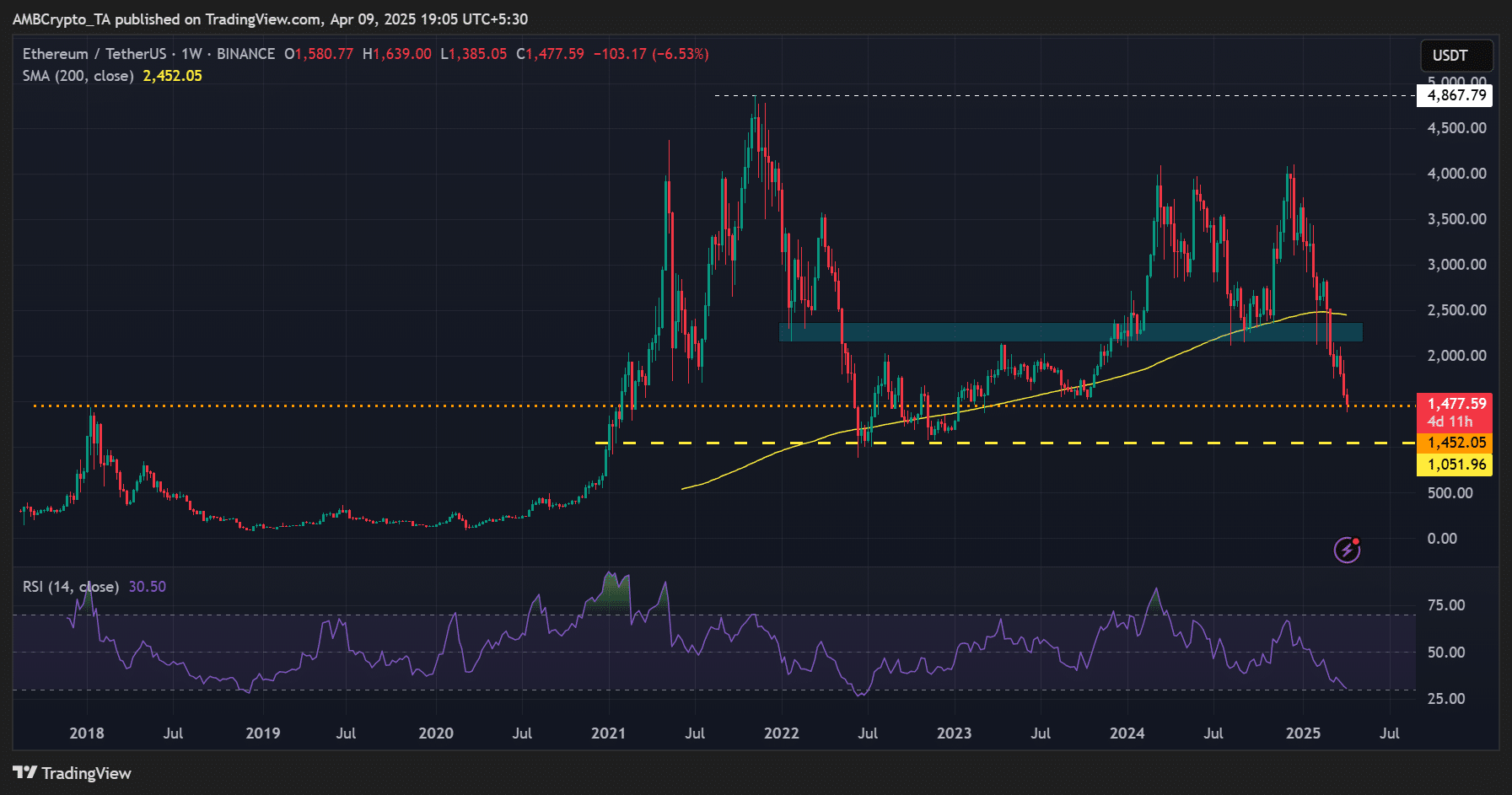

The accompanying chart, a veritable tapestry of market history, reveals that the realized price has indeed seen rebounds in the years 2018-2020. However, let us not get too carried away; this level could also serve as a resistance in the short term. Should ETH’s price fall below it, brace yourselves for a potential surge in panic selling—because who doesn’t love a good market meltdown? 😅

What’s next for ETH?

In the grand theater of finance, U.S. stocks and crypto, including our dear ETH, have reacted like risk-on assets to the latest Trump tariff updates. A potential bottom, it seems, could only be hastened by a favorable macro shift. How delightful!

In a plot twist worthy of a Chekhovian tale, institutional investors have been fleeing the altcoin for six consecutive weeks, as evidenced by the steady outflows from U.S. spot ETH ETFs.

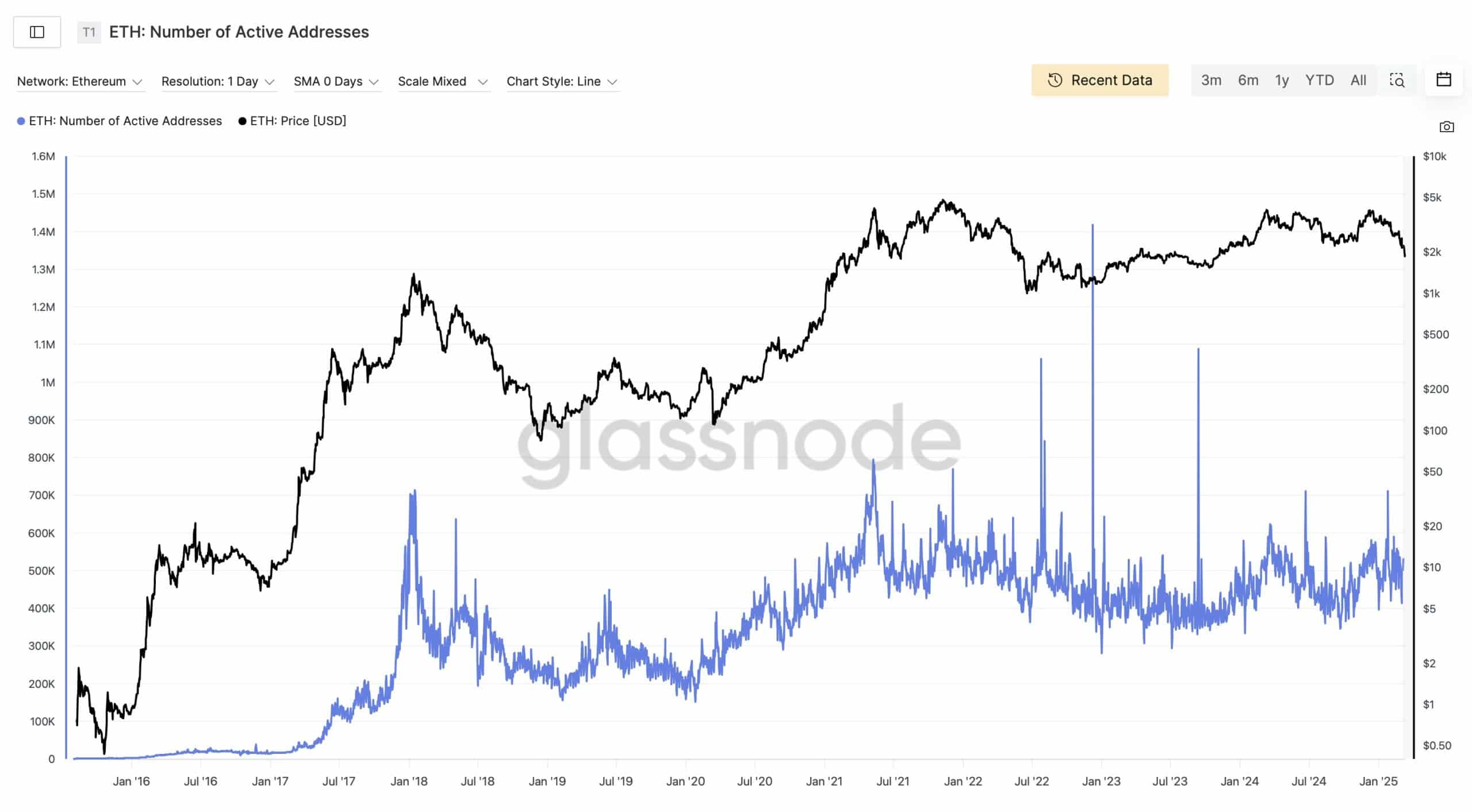

Another cautionary note from analyst Stacy Muur reveals stagnant active users. It appears that Ethereum’s active addresses have been as flat as a pancake for four years. Critics argue that users have migrated to L2s, but stagnant network growth could very well cap ETH’s recovery prospects. Oh, the irony!

From a price chart perspective, ETH has plummeted to a two-year low below $1.5k, down a staggering 64% from its peak of $4k. It’s like watching a tragic play unfold, where the hero meets his demise.

With the ongoing macro uncertainty, one cannot rule out a further decline to $1k in the short term. The suspense is palpable! 🎭

In summary, the altcoin has reached a pivotal point, especially when viewed through the lens of its realized price. However, the macro front currently reigns supreme over market direction, potentially delaying any rebound if uncertainty lingers. And let’s not forget the seven-week streak of ETH ETF outflows—clearly, the demand is as weak as a cup of cold tea. ☕️

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- REPO: How To Fix Client Timeout

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-04-10 09:15