In a curious twist of fate, the multi-billion-dollar asset manager, 21shares, has chosen to follow the illustrious path of its competitors, Grayscale and Bitwise, all while basking in the warm embrace of the Dogecoin Foundation’s endorsement. Ah, the sweet scent of ambition! 🌟

Dogecoin Foundation Backs 21shares for Dogecoin ETF

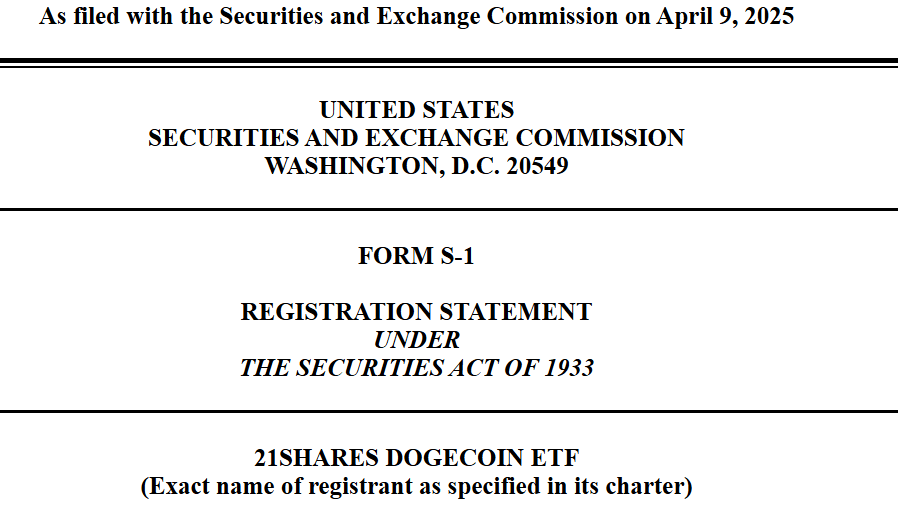

Lo and behold, the Swiss-based 21shares, a veritable titan in the realm of crypto exchange-traded funds (ETFs) with a staggering valuation of $7 billion, has taken the audacious step of filing for a spot dogecoin ETF with the U.S. Securities and Exchange Commission (SEC) on a rather unremarkable Wednesday. One can only imagine the excitement in the air! 🎉

On this very day, the firm also proclaimed a partnership with the Dogecoin Foundation’s corporate arm, the House of Doge, as if the universe conspired to bring them together. According to a press release that surely set the world abuzz, the House of Doge aims to advance “the mainstream adoption of dogecoin.” They even filed to become a publicly traded company—because why not? 📈

Meanwhile, Grayscale and Bitwise, those ever-watchful competitors, had already submitted their own spot dogecoin ETF filings to the SEC in the preceding months. Yet, one might argue that 21shares possesses a certain edge, thanks to its exclusive partnership with the House of Doge and the coveted endorsement from the foundation. A classic case of “who you know” in the world of finance! 😏

“By partnering with the House of Doge, we are taking a pivotal step in bringing transparent and institutional-grade investment options to the market,” declared 21shares President Duncan Moir, as if he were announcing the arrival of a new messiah. 🙌

In a rather amusing turn of events, the administration of U.S. President Donald Trump has ushered in a cultural renaissance at the SEC, shifting the paradigm from regulation by enforcement to a more benevolent regulatory clarity. The SEC’s Division of Corporate Finance recently issued a “Staff Statement on Meme Coins,” which essentially declares that such assets are not securities. Who knew that memes could be so liberating? 😂

From this perspective, dogecoin, that whimsical creation often dubbed as crypto’s first memecoin, stands a fair chance of having its inaugural U.S. spot ETF approved. Of course, one must also consider other factors, such as liquidity and the ever-looming specter of market manipulation, which the SEC will undoubtedly scrutinize with great fervor.

“Dogecoin was created to be a fun, accessible form of peer-to-peer money,” mused Jens Wiechers, an advisory board member at the House of Doge and co-executive director at the Dogecoin Foundation. “This initiative with 21shares provides a regulated path for institutions to participate in and amplify the ‘Dogecoin is Money’ vision, while still honoring the community’s spirit.” A noble endeavor indeed! 🐕💰

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-11 01:27