Ah, the endless ballet of cryptocurrencies! Tron [TRX], Cardano [ADA], and even Dogecoin [DOGE], all jostling for a sip from the same fickle fountain of fortune. TRX and ADA, locked in a tango for the coveted 9th spot, like two dancers vying for the spotlight on a dimly lit stage. But Cardano, alas, lingers beneath the ominous cloud of $1, a melancholic sonnet unsung. 😔

The cold, hard data—those spectral whispers from the blockchain’s ether—reveal a certain frailty in ADA’s network, a subtle tremor beneath the surface. Daily active addresses, those bustling avenues of digital commerce, have shrunk by 30.3% year-over-year! Fee generation, once a cheerful river, has dwindled to a mere trickle of $8.1k. It’s as if the bees have abandoned the hive. 🐝

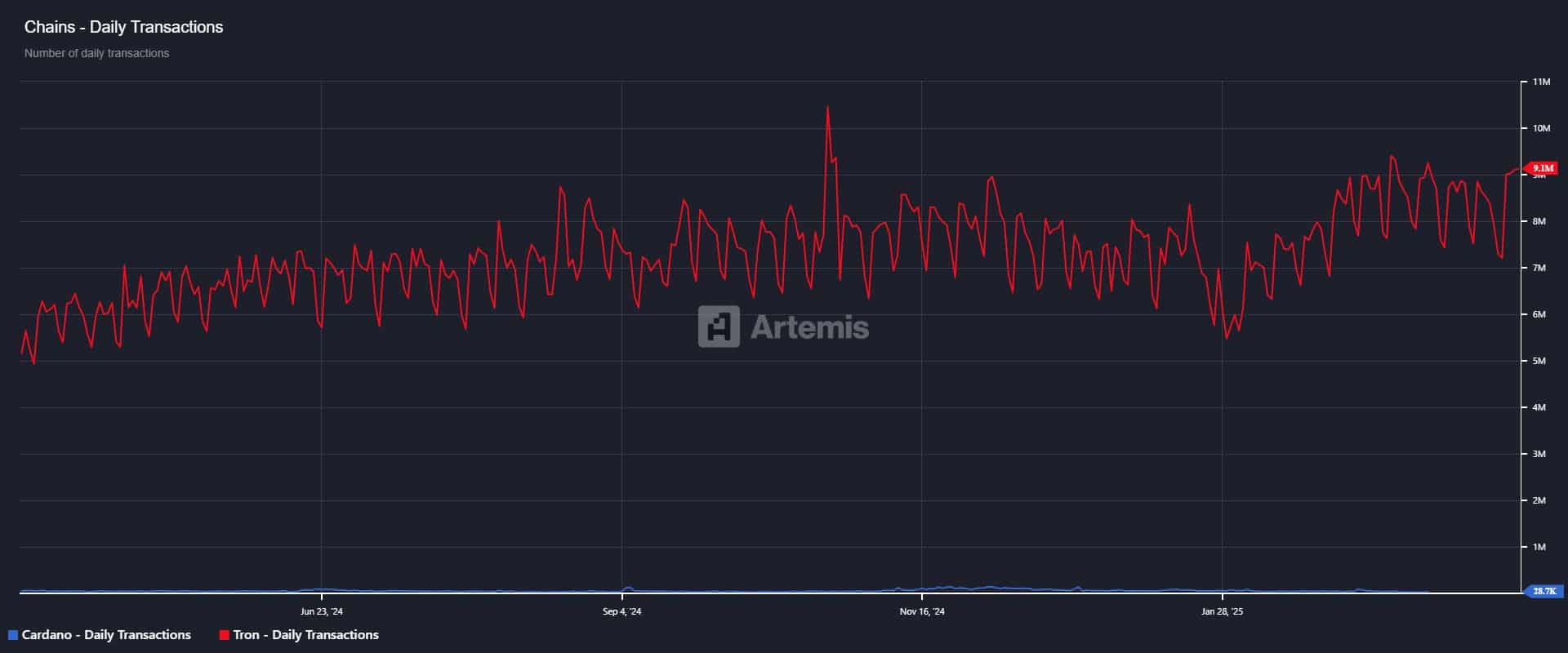

TRON’s daily transactions surged 76.8% year-on-year to $9.1 million, while Cardano’s slumped 38.8% to a mere 28.7k, a clear indication of sustained structural weakness. Ouch! 🤕

However, a twist! TRON’s Total Value Locked (TVL) dipped by 9% to $7.3 billion, suggesting that stablecoin dominance hasn’t translated into DeFi expansion. Meanwhile, Cardano’s TVL climbed 17.4% YoY to $431 million—a glimmer of hope, a sign of burgeoning DeFi adoption. 🌱

Despite the DeFi lag, TRX’s trading volume soared 179.4% daily to $955.27 million, with sustained address growth, indicating persistent market demand for the asset. The engine roars! 🚗

This data underscores a critical shift: TRON’s structural advantage over Cardano is not merely a result of ADA’s deteriorating fundamentals. No, no, it’s far more nuanced than that! 🧐

Instead, it’s a direct consequence of TRX’s expanding liquidity base, heightened settlement utility, and robust market positioning. Like a chess master strategically placing their pieces. ♟️

Price action implications – ADA vs. TRX

The structural divergence between ADA and TRX is increasingly mirrored in their price action. ADA closed Q1 with a 21% drawdown, while TRX showed relative resilience, limiting losses to a mere 8%. A tale of two cities! 🏘️

More critically, ADA’s monthly performance highlighted persistent sell-side pressure, recording a steep 15.63% decline. TRX, however, defied the broader macro headwinds, rallying by 7% over the same period. A lone wolf howling at the moon! 🐺

Yet, both assets share a post-election hangover. ADA remains 52% below its cycle high, while TRX follows closely with a 47% drawdown, suggesting that many network participants remain in an unrealized loss position. The hangover is real! 🥴

On-chain trends seem to reinforce this divide. Cardano’s rising dormant coin activity hints at potential capitulation risks as ADA breaches key support thresholds. Meanwhile, TRX has maintained price stability within its $0.25–$0.20 accumulation range for over four months. A stoic monk in meditation. 🧘

Structurally, TRX presents a more favorable breakout setup, solidifying its claim to the 9th spot in the market capitalization rankings. The stage is set! 🎬

If this trend continues, TRX could challenge the top 8, with its market cap eyeing a potential expansion beyond $24 billion. To the moon, perhaps? 🚀🌕

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- How to Get 100% Chameleon in Oblivion Remastered

- USD ILS PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Invincible’s Strongest Female Characters

- Gold Rate Forecast

2025-04-12 00:10