On Monday morning, the value of the digital asset surged to approximately $85,000 following the Trump administration’s announcement over the weekend that they would not impose tariffs on imported electronic goods.

Tariff Relief Sparks Bitcoin Jump to $85K

U.S. Customs and Border Protection quietly published a notice late Friday night exempting imported electronics from President Donald Trump’s aggressive tariffs, sparking a Monday morning rally in global markets and briefly sending bitcoin above $85K.

Overview of Market Metrics

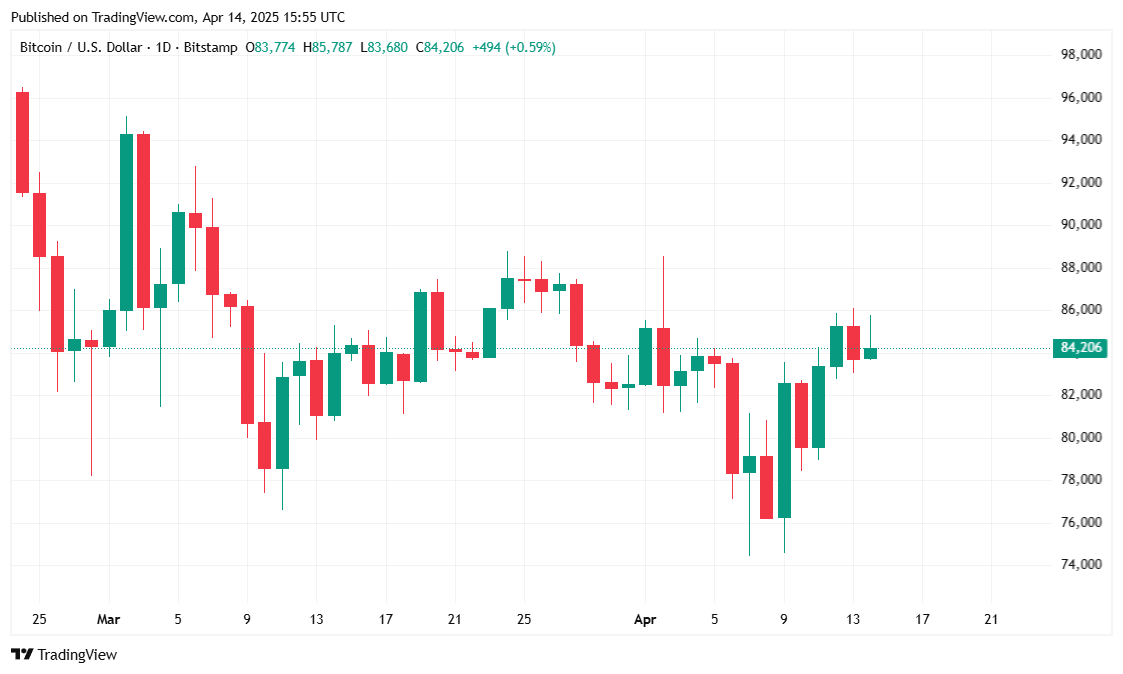

Over the last 24 hours, the value of this digital currency has gradually climbed back up, staying within a tight band between roughly $83,027 and $85,785. Currently, it’s worth about $84,176.64, marking an incremental rise of 0.45% for the day and a more substantial 7.06% growth over the past week.

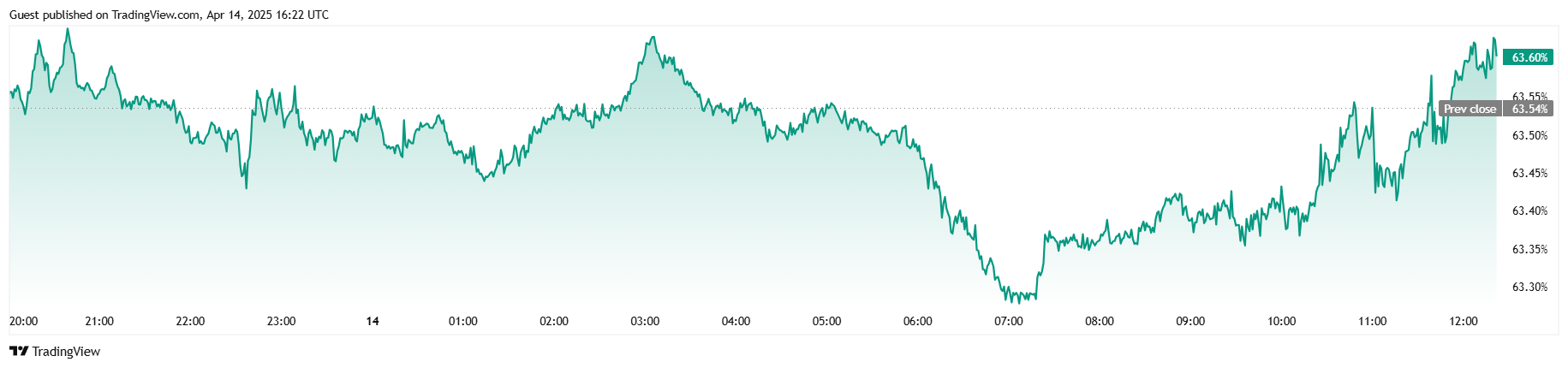

Trading activity remains robust, as evidenced by a 24-hour trading volume of $35.28 billion, up 34.77% over the past day, but mostly due to a post-weekend rebound. Despite a small decline in total BTC futures open interest (down 1.39% to $56.03 billion), bitcoin’s market capitalization has risen modestly by 0.38% to $1.66 trillion, and BTC dominance holds steady at 63.60%, up by 0.13%.

Notably, liquidation data from Coinglass shows that total liquidations amounted to $11.03 million, with a striking imbalance: Long liquidations were $10.39 million versus just $637,960 in short liquidations, clearly indicating that bullish positions bore the brunt of BTC’s volatility.

Trump Calms Tariff Fears…For Now

For the present, computer chips, smartphones, and digital storage devices imported into the country are exempt from taxes, as stated in the latest tariff exemption list released by the U.S. Customs and Border Protection on Friday evening.

Major tech companies like Apple, who depend on imported components from China, experienced a sense of relief and saw an increase in their share prices following the positive market reaction to the news that broke early Monday morning.

At the point of update, Apple shares had risen by 2.37%, with each share priced at $202.64. Meanwhile, the S&P 500 increased by 0.88%, the Dow Jones saw a slight rise of 0.74%, and the Nasdaq experienced a moderate increase of 0.40%. These changes may not be substantial, but they are all moving in an upward direction.

BTC may be able to build support at the $80K level despite the continuing changes in U.S. trade policy, as sellers have begun to show signs of exhaustion.

“Bitcoin investors have locked in losses of up to $240M over 6-hour windows during the recent drawdown, among the largest of the cycle,” crypto analytics platform Glassnode explained in an X post on Friday. “Yet with each leg lower, realized losses are shrinking, suggesting early signs of seller exhaustion.”

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Unlock the Mines in Cookie Run: Kingdom

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- 8 Best Souls-Like Games With Co-op

- Top 7 Tifa Mods for Final Fantasy 7 Rebirth

- The White Rabbit Revealed in Devil May Cry: Who Is He?

2025-04-14 20:04