- 61.91% of top traders are delighting in shorting SHIB. A bold move, indeed.

- Traders seem to be over-leveraged, caught between the pit of $0.0000117 and the hard place of $0.00001245. What a charming predicament.

Shiba Inu [SHIB] – oh, how the mighty have fallen. Once the darling of the meme coin world, now languishing in what could only be described as a grim descent into a bearish abyss.

At the moment, the broader cryptocurrency market is caught in the throes of a deep identity crisis, with volatility wreaking havoc across top assets. Naturally, this has left traders and investors shaking in their boots, especially when it comes to the unpredictable, often comical world of memecoins.

And so, with great sadness (and just a touch of glee), we note that SHIB has dropped by 3.50% in the last 24 hours, trading at a lamentable $0.0000119.

Meanwhile, its trading volume plummeted by 17%, a clear sign that traders have all but abandoned ship. If this were a ship, we’d surely be in the “abandon the lifeboats” stage.

This steady decline suggests waning enthusiasm, both from the common trader and the high-brow institutions. It’s a beautiful thing to behold – if you’re a bear, that is. 🐻

Shiba Inu’s Technical Analysis – Or, How to Make Money Off a Falling Star

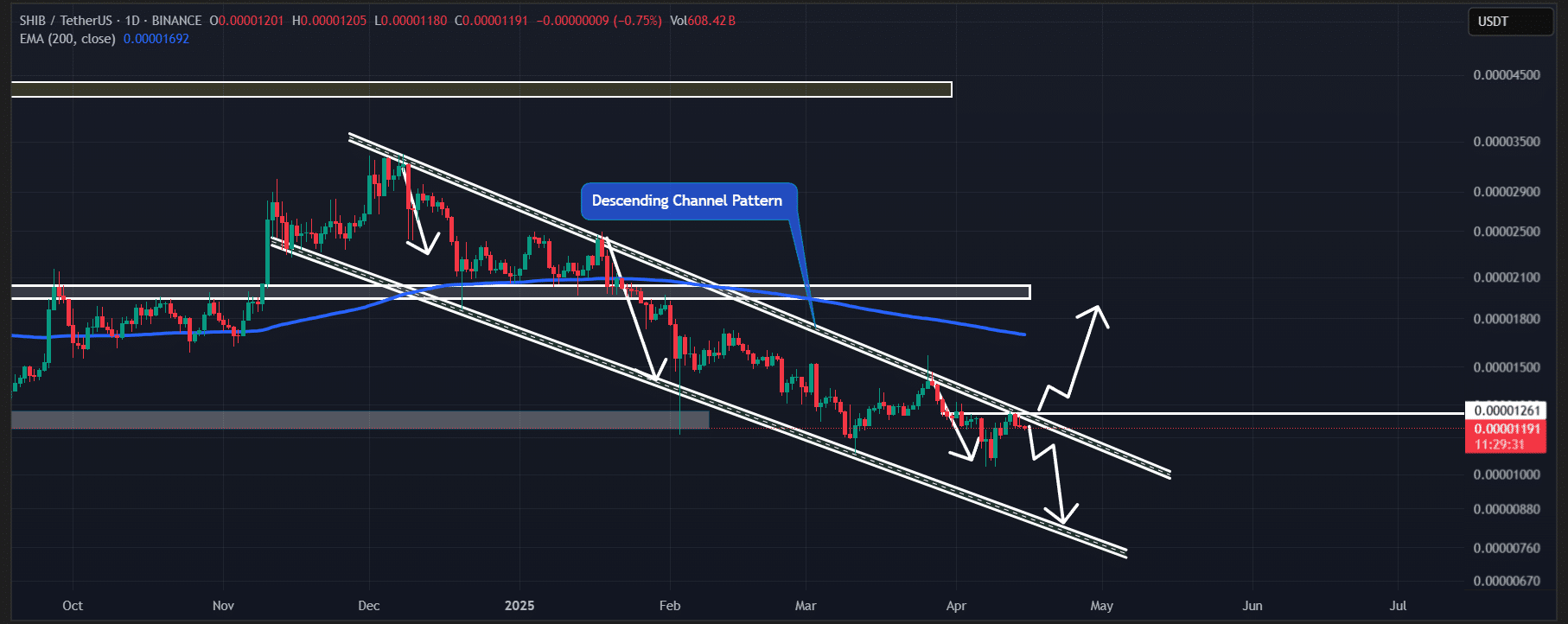

According to the ever-diligent analysts at AMBCrypto, SHIB has been following a bearish descending channel pattern since December 2024. This downward spiral has been as predictable as a soap opera plot, with lower highs and lower lows stacking up like bad decisions at a poker table.

In a brief moment of hope, SHIB tried to break free from this trap, aligning itself with the brief optimism of a broader market recovery. But alas, it was all for naught. The price continues to hover near the upper boundary of this channel, which has historically been a trigger for price reversals. Let’s be honest – if SHIB had a chance, this was it. But nope. 🙄

If SHIB fails to break the upper boundary again, brace yourselves for a potential 30% decline, heading straight for the lower boundary at $0.0000084. Think of it as a shopping sale, but for losing positions.

Low trading volume only adds to the drama. A sudden dip could be just around the corner, especially if the broader market decides to join in on the fun and apply some selling pressure.

For those with a keen eye, SHIB is currently trading below both the 50 and 200 Exponential Moving Averages (EMA). This suggests an unwavering bearish trend, with not a single sign of upward momentum on the horizon. A true masterpiece of market misfortune.

However, in a world where miracles occasionally happen, SHIB could only turn bullish if two things occur: First, a drastic shift in market sentiment (don’t hold your breath); second, a daily candle closing above $0.0000128. So, basically, we’re in the realm of fantasy here.

62% of Traders Bet on SHIB’s Miserable Downfall

If you needed any further confirmation that SHIB is trending downward, look no further than the current market sentiment. According to the sharp-eyed analysts at Coinglass, traders are almost unanimously betting on a decline. What a sight to behold.

As of now, SHIB’s Long/Short Ratio sits at a rather despondent 0.615, indicating an overwhelming bearish sentiment. It’s practically a stampede in the direction of doom.

And yes, 61.91% of top traders are holding short positions, while a mere 38.09% are long – it’s like a bear party, and everyone’s invited.

As for the traders themselves, they’re heavily leveraged at two levels: $0.0000117 for support and $0.00001245 for resistance. Long positions have a modest $375K staked, while short positions boast a slightly more robust $952K. Guess who’s winning this tug-of-war?

In conclusion, short sellers reign supreme in this game. If they have their way, SHIB’s price will keep tumbling like a bad reality TV show, and we’re all just spectators, watching the drama unfold. 🎭

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-16 11:11