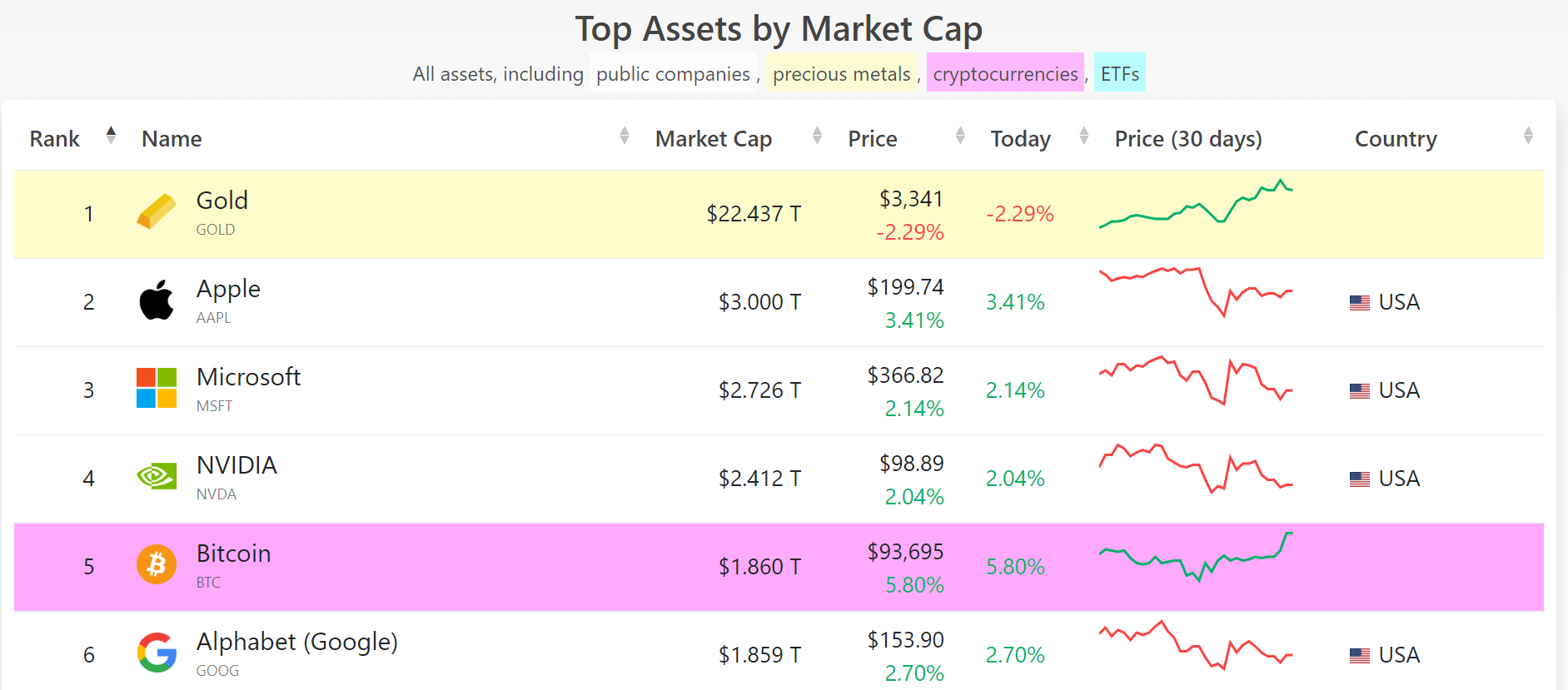

Bitcoin, that digital enigma your tech-uncles won’t stop talking about, just elbowed its way past Google and Amazon in market cap, crowning itself as the fifth largest asset in the world. This happened just a day after BTC flirted with $94,000 like it’s no big deal—because why not?

On April 23 around 11:20 AM UTC—because apparently Bitcoin keeps perfect time—its market cap spiked to $1.86 trillion after hitting a $94,320 price tag. Suddenly, Bitcoin was the new kid on the block surpassing Google’s $1.859 trillion and Amazon’s $1.837 trillion, leaving them wondering if they should start accepting BTC for Prime shipping.

It didn’t stop there. Silver, that shiny old-timer safe-haven asset with a market cap of $1.853 trillion, also got politely cut out of the VIP section.

But before you start printing “Bitcoin is king” t-shirts, BTC still has a long, winding data-driven journey ahead. NVIDIA is chilling at number four with $2.41 trillion, Microsoft’s holding strong at three with $2.72 trillion—these guys still get invited to the cool parties.

Apple’s second place throne, worth $3 trillion, remains firmly on its head, while gold continues to hoard the crown (and maybe some dragon’s hoard gold envy) at $22.4 trillion. Yeah, gold is basically the grandpa who’s seen it all and refuses to let go of his rocking chair.

Within the exclusive top 10 club of assets, Bitcoin is the only crypto that made the cut. Ethereum, dear ETH, is sulking back at 61st place with a paltry $217.5 billion. It’s the kid who tried out for the varsity team but ended up on JV, for now.

In the 24 hours leading up to press nirvana, Bitcoin’s price climbed a modest 5.8%, currently juggling around $93,701. It did have a brief, flirtatious peak at $94,320, sparking a market cap increase north of 6%. If Bitcoin were a person, it’d be that show-off at the gym who lifts heavy just to humiliate the rest.

Cathie Wood Is Betting Bitcoin Will Make Gold Its Sidekick

Cathie Wood, the CEO of ARK Investment Management, is basically the Cassandra of crypto, predicting that Bitcoin will one day grow “bigger” than gold. Back in December, when BTC barely hit $2 trillion market cap and gold was a hulking $15 trillion, she boldly claimed this wasn’t even the beginning of the story.

According to Wood, Bitcoin’s early days are basically kindergarten compared to what’s next. So buckle up, gold bugs—your precious metal might need to share the limelight.

Gold and Bitcoin might just be long-lost financial cousins. Both are safe havens during turbulent times, both are mined (though one is slightly less dusty), and both have limited supplies. Also, Bitcoin apparently stalks gold’s moves a few months later, like a financial fan trying to catch up.

Recently, gold hit a shiny new high of $3,900 as investors nervously clutched their pearls over escalating trade tensions and a weaker dollar. Roughly simultaneously, Bitcoin strutted to a monthly high near $87,570, and then threw a party at $94,000 for good measure. 🎉

Read More

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Invincible’s Strongest Female Characters

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- Top 8 UFC 5 Perks Every Fighter Should Use

- Black Clover Reveals Chapter 379 Cover Sparks Noelle Fan Rage

- How to Reach 80,000M in Dead Rails

- Gold Rate Forecast

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Ultimate Guide: Final Fantasy 14 Cosmic Exploration

2025-04-23 16:18