The crypto market has never been this saturated with Tether (USDT). It’s practically overflowing. With this surge, the Tether Dominance ratio (USDT.D) has become a vital figure for anyone in the crypto game. It’s like the weather forecast, but instead of predicting rain, it predicts money moves. Who doesn’t love that?

USDT.D is the fancy way of measuring how much of the crypto world is currently locked up in Tether, compared to everything else. A drop in USDT.D? That’s a big hint that investors are done sitting on the sidelines, spending their Tether stash on Bitcoin and altcoins. Oh, the sweet sound of capital flowing into the market.

When BTC and USDT.D Dance, It’s a Bullish Tango

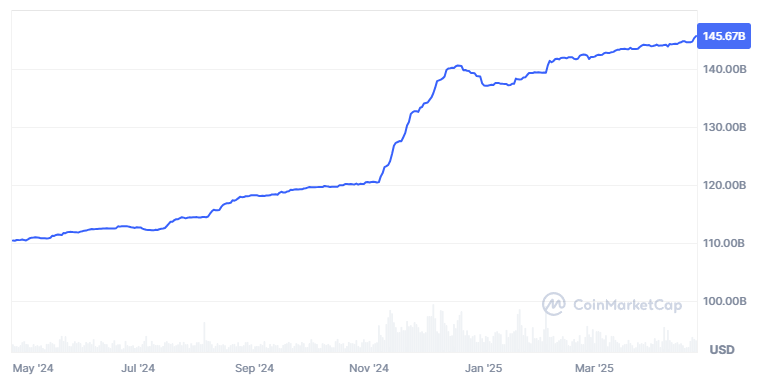

According to CoinMarketCap, Tether’s market cap hit a record high in April 2025, soaring to a whopping $145.6 billion. That’s a $8.5 billion leap since the start of the year. Are we impressed? Yes. Is Tether on a roll? Absolutely.

In April alone, Tether printed over $1.6 billion. If Tether’s market cap is the capital circulating in the crypto bloodstream, then USDT.D is the thermometer, giving us a peek at whether that blood is flowing toward altcoins and Bitcoin. Spoiler: It’s looking like a shift may be coming.

The recent dip in USDT.D? Well, it’s got people whispering about a market-wide recovery. Excited yet? You should be.

Max, the genius behind BecauseBitcoin, pointed out something that made us all sit up straight: there’s a pattern. Every time USDT.D drops, Bitcoin tends to surge. It’s like a beautiful, predictable dance. And this time, both Bitcoin and USDT.D have broken through their support and resistance levels. Could a rally be coming? Max seems to think so.

Max’s historical analysis suggests that Bitcoin could be heading for a price surge in the coming month, while USDT Dominance might continue to slide from its current resistance level of 5.5%. Fingers crossed, folks!

“I think this really should be the breakdown for USDT.D & subsequently the push higher for BTC,” Max said. And who are we to argue?

When Stablecoins Team Up, It’s a Bullish Power Play

But wait, there’s more! Not only is USDT making waves, but its partner in crime, USDC, is also flexing its dominance. When you combine the USDT.D and USDC.D indices, things start looking pretty darn positive.

Investor Cryptosahintas revealed that the combined index hit a key resistance level of 8% this month. This is a strong, bullish signal for altcoins. Stablecoin dominance reacting to resistance? That usually means capital is ready to flow, potentially sparking a price rally that’ll make altcoin lovers very happy. 💸

Cryptosahintas also suggests that this combined index could drop all the way to 3.5%, possibly sticking around until next year. A nice little cliffhanger for 2026, right?

And it’s not just all talk. Investor sentiment is shifting, with people noticing the dips in altcoin prices and buying back in. The Fear and Greed Index made the shift from fear to greed this week. Greed—now there’s a beautiful word.

And, for the cherry on top, the total market cap jumped by 6%, moving from $2.68 trillion to $2.84 trillion. Gotta love that upward momentum.

However, let’s not get too carried away. According to 10X Research, while stablecoin minting is up, it hasn’t quite reached the highs we saw before. So, the researchers are tapping the brakes a bit, reminding us all to proceed with caution. Sometimes the crypto rollercoaster has a few unexpected turns.

Read More

- Invincible’s Strongest Female Characters

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Reach 80,000M in Dead Rails

- Gold Rate Forecast

- USD ILS PREDICTION

2025-04-24 16:26