So, crypto’s wild rollercoaster isn’t everyone’s cup of tea when you just want to buy your avocado toast or send rent without turning it into a financial game of “Will my money still be worth anything tomorrow?” Enter: stablecoins. The crypto world’s answer to “chill out, I got this.”

Imagine stablecoins as the responsible cousins at the family reunion—never spiking or crashing, just pegged to boring-but-reliable stuff like the US dollar (hello USDC, USDT), Euro (EURS), or Japanese Yen (GYEN). They’re basically the pumpkin spice latte of digital cash: comforting, familiar, and useful for paying online, sending money across the globe faster than snail mail, and doing fancy DeFi stuff without losing your shirt.

The Problem Everyone’s Sweating: When Stablecoins Go a Bit Wonky

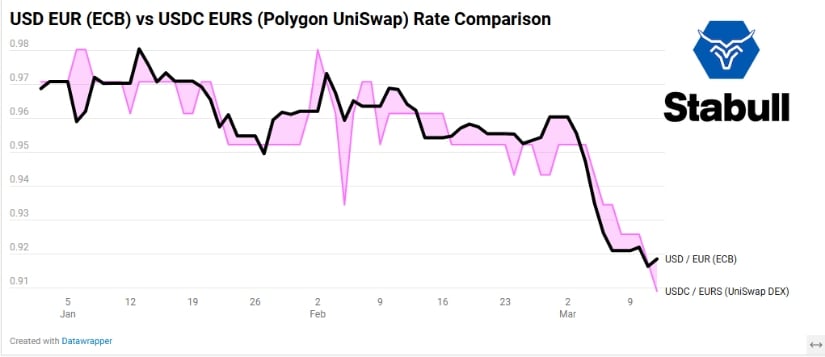

Here’s the catch: even if a coin like EURS has a euro locked up somewhere safe, its price on a crypto exchange might act like it’s had too much caffeine—drifting away from that perfect €1.00 bliss. On decentralized exchanges (DEXs), which are like vending machines run by code rather than actual humans, prices can get a bit loopy.

Why? Because most DEXs don’t have psychic powers or real-time news feeds. They price stuff based on who’s buying and selling right there and then, slow to adjust when the real world changes the game.

Picture this:

- Old Information: DEXs wait for traders to shuffle tokens around before realizing “Oops, Euro is now $0.90, not $1.00.”

- Slow Updates: By the time arbitrage heroes rush in with their “buy low, sell high” moves, prices have been off for a while.

- Markets Take Weekend Breaks: Forex and gold markets snooze on weekends and holidays, but crypto never sleeps. So your stablecoin might be stuck in Friday’s drama until Monday morning—awkward.

If you’re using stablecoins, this is like ordering a latte and getting a surprise mocha—annoying and confusing. For issuers, it’s the headache of trying to be stable while their prices play musical chairs.

Stabull Steps In: The Chill Spot for Real Stablecoins

Stabull Finance was made because some people were fed up watching their non-dollar stablecoins act like caffeinated kangaroos. It’s not a party for every crypto; it’s the VIP lounge for stablecoins and real world assets (RWAs) like tokenized gold or euros. No Dogecoin, no Bitcoin drama—just chill, dependable assets.

Built cheek-to-cheek with crypto folks who basically said, “Shoot, we need a place where prices don’t do the hokey pokey,” Stabull is the oracle-powered answer to stablecoin chaos.

Oracle Magic: How Stabull Keeps it Real (World)

“Oracles” aren’t mystical soothsayers, sadly. They’re data bringers from the real world onto the blockchain battlefield. Stabull buddies up with trusted providers like Chainlink, who keep an eye on global FX and commodity prices in real-time—like busy shopkeepers always updating their price tags while everyone else is stuck with faded stickers.

The workflow at Stabull looks like this:

- Real Price Drop: Oracles send live prices (EUR/USD, TRY/USD, whatever) straight to Stabull’s pools.

- Proactive Moves: Unlike other DEXs waiting for traders to clean up after messes, Stabull’s smart contracts are like that organiser friend, steering liquidity so trades happen right around the real oracle price.

- Price Curve Genius: It’s got a fancy pricing curve that keeps “slippage” (the annoying gap between expected price and what you actually pay) super low. Translation: less heartbreak on every trade.

- Dynamic Dance: As oracles update prices (thank you, 24/7 news cycle), Stabull pools reshuffle liquidity, keeping prices snug with the real world way faster than your average arbitrage gang.

Why You Should Care (Spoiler: Because It Actually Works)

- Fair Prices: When you trade on Stabull, what you see is what the market actually sings—even during weird weekend weirdness or market rollercoasters.

- Stable Issuers: Stablecoin creators love Stabull because it keeps their coins from turning into carnival rides, which means user trust doesn’t tank.

- Price Anchor for the Crypto Oceans: When Stabull’s prices stay true, arbitrage traders swoop on other DEXs with wild price swings, making sure everything else follows suit. It’s like Stabull’s the stable coin’s designated driver, keeping the party from going off the rails—and hey, liquidity providers get some fees too. 🤑

Oracle Risks? Yes, But Stabull Has Your Back

Sure, oracles can be hacky messes—remember Mango Markets’ brutal 2022 hack? But that was a cheap-shot on a tiny token with low liquidity, like robbing a corner shop.

FX and commodity markets? They’re massive, moving trillions daily. Manipulating them on-chain would be like trying to sink the Titanic with a paper clip—basically impossible.

Plus, Stabull uses decentralized oracle networks, like Chainlink’s squad of vigilant node operators, making price tampering a nightmare for any mischief-makers.

It’s not just blind trust either:

- Backup oracle feeds cross-check info like an overachieving sibling.

- During weird market hours or wild swings, Stabull smartly lets market forces have more say—because even machines need a coffee break.

In Conclusion: Making Crypto Less Drama, More “Ahh”

Stablecoins are the unsung heroes making crypto workable for us normal folk—but only if they don’t moonwalk away from their promises.

Stabull’s oracle-powered charm keeps stablecoins actually stable, making trading cleaner, issuers happier, and the whole DeFi galaxy a bit less chaotic. It’s more than an exchange—it’s the stablecoin whisperer we didn’t know we desperately needed.

Read More

- Mr. Ring-a-Ding: Doctor Who’s Most Memorable Villain in Years

- Luffy DESTROYS Kizaru? One Piece Episode 1127 Release Date Revealed!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Get the Cataclysm Armor & Weapons in Oblivion Remastered Deluxe Edition

- Nine Sols: 6 Best Jin Farming Methods

- You’re Going to Lose It When You See the Next Love and Deepspace Banner!

- Get Ready for ‘Displacement’: The Brutal New Horror Game That Will Haunt Your Dreams!

- Prestige Perks in Space Marine 2: A Grind That Could Backfire

- Choose Your Fate in Avowed: Lödwyn’s Ruins or Ryngrim’s Adra?

- Invincible’s Strongest Female Characters

2025-04-27 16:20