So, Bitcoin decided to make a grand entrance, swaggering toward $100,000 like it owns the place—because why not? After a little “crypto contagion” scare (sounds like a sci-fi virus, right?), BTC is now chillin’ at $93,704, up 6.39% this week. That’s right, a comeback bigger than my Aunt Ruthie at karaoke night!

Meanwhile, the Federal Reserve is sweating bullets trying to keep the dollar buff, but with Trump throwing curveballs and global trade rules playing musical chairs, the dollar’s looking weaker than my willpower in a donut shop.

The Deutsche Bank folks—always the party poopers—said the “preconditions are now in place” for the dollar to nosedive harder than a slapstick comedy fall. Goldman Sachs chimed in, whispering that the dollar’s weakness is “here to stay.” Forbes just nodded and pulled out popcorn.

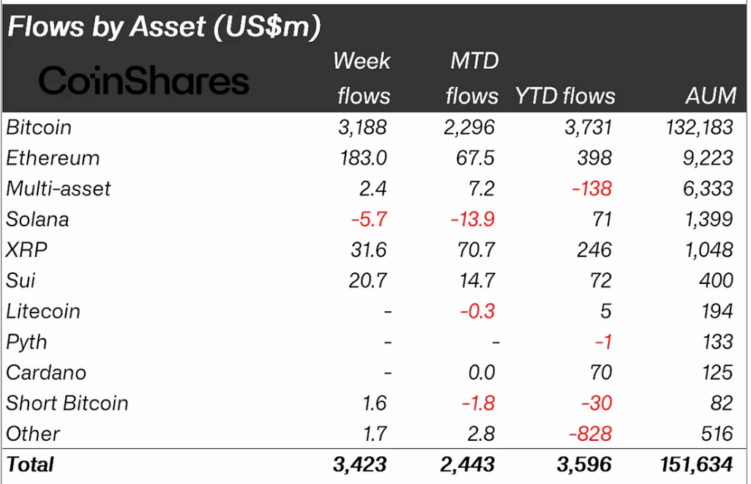

Investors? They’re fleeing faster than tourists in a slapstick chase scene, pouring $3.4 billion into crypto last week alone, mostly Bitcoin ETFs. That’s the third-biggest crypto shopping spree ever, according to CoinShares. Somebody’s been hitting the Bitcoin buffet hard! 🍽️💰

James Butterfill from CoinShares (no relation to butter or filling, sadly) says folks are spooked by tariffs and a flabby dollar, so they’re cozying up to Bitcoin like it’s the last lifeboat on the Titanic.

He went all serious and said, “We believe concerns over tariff impact on corporate earnings and the dramatic weakening of the U.S. dollar are the reasons investors have turned towards digital assets.” Translation? The dollar’s in the ICU and Bitcoin’s the new nurse with a swagger.

Even the big kahunas are jumping on the bandwagon. BlackRock, managing $10 trillion (with a T—holy moly!), is leading with Bitcoin ETFs like they’re handing out candy on Halloween.

Jay Jacobs from BlackRock warned us about “geopolitical fragmentation,” which sounds like a fancy term for, “Everyone’s nuts, and Bitcoin’s the cool kid no one can tie down.”

Apparently, Bitcoin’s acting like it’s got its own thing going on now, ignoring tech stocks like a teenager ignoring family dinners.

And the cherry on top? Larry Fink, BlackRock’s big boss, admitted he was wrong about Bitcoin and now calls it “digital gold.” Who knew admitting you were wrong was this profitable? 🤷♂️

So, with the dollar twitching, global drama escalating, and Bitcoin stealing the spotlight, experts are whispering about a new all-time high being just around the corner. Grab your popcorn and popcorn wallet, folks—this show’s just getting started!

Read More

- Mr. Ring-a-Ding: Doctor Who’s Most Memorable Villain in Years

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nine Sols: 6 Best Jin Farming Methods

- How to Get the Cataclysm Armor & Weapons in Oblivion Remastered Deluxe Edition

- Luffy DESTROYS Kizaru? One Piece Episode 1127 Release Date Revealed!

- Unlock the Secrets: Khans of the Steppe DLC Release Time for Crusader Kings 3 Revealed!

- Invincible’s Strongest Female Characters

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Sigourney Weaver Reveals Key Information About Her Role In The Mandalorian & Grogu

2025-04-28 20:28