Bitcoin exchange-traded funds (ETFs) were at it again on Monday, scooping up a tidy sum of over $500 million in fresh capital, making it seven days in a row of positive flows. Quite the streak, I dare say, though you might wonder if there’s some sort of “happy hour” for these funds. 🍸

The relentless momentum is a testament to investors’ sudden enthusiasm for the beloved Bitcoin, even in the face of a market that’s about as stable as a wobbly table in a pub. 🍻

The BTC ETFs: A Grand Inflow Parade

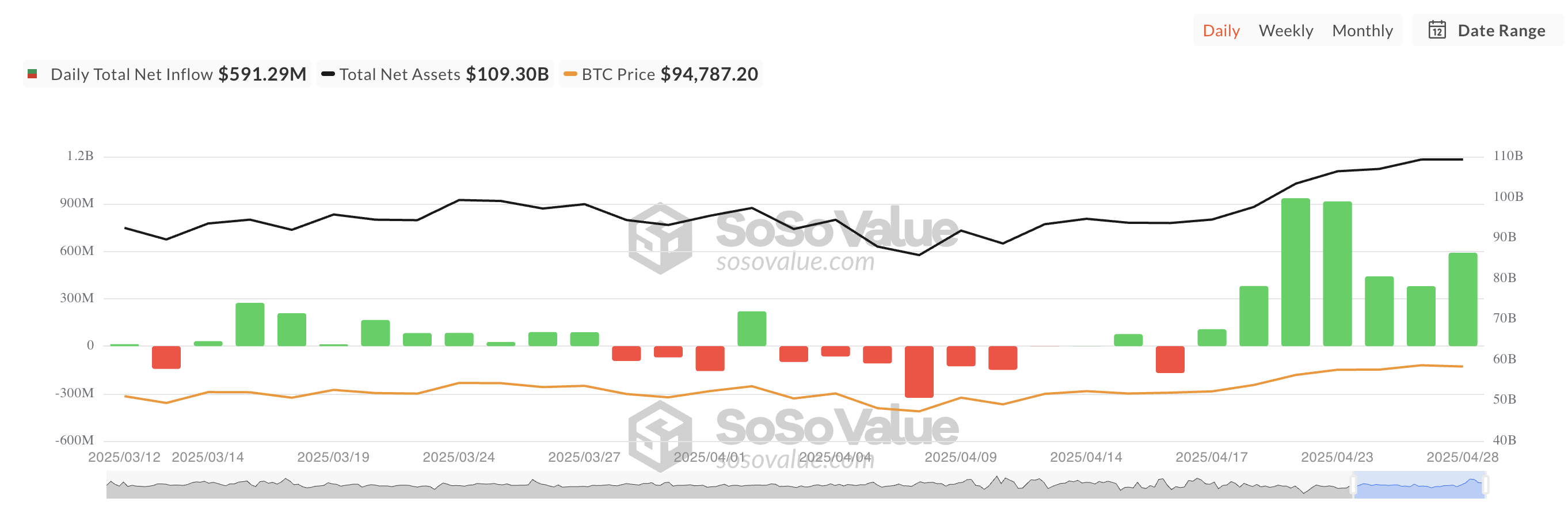

Monday brought yet another day of BTC spot ETFs attracting fresh investor demand, raking in a hearty $591.29 million in net inflows. This little surge kept the streak alive for a seventh day straight, all while Bitcoin itself tried to maintain some stability above the $94,000 mark. Quite the balancing act, one might say, like a cat walking across a highwire. 🐱🎪

And as expected, BlackRock’s iShares Bitcoin Trust (IBIT) led the pack, bringing in the lion’s share of inflows with a robust $970.93 million. In total, the fund has now gathered a staggering $42.17 billion in net inflows. At this rate, it’s only a matter of time before BlackRock buys the moon. 🌕🚀

But as with every party, there’s always one guest who leaves early. ARKB, the Bitcoin ETF run by Ark Invest and 21Shares, experienced a rather untimely $226.30 million outflow on Monday. No worries though, ARKB’s historical inflows still sit pretty at $2.88 billion. Not exactly something to cry over, is it? 😌💸

The Futures Market: A Tale of Open Interest and Options Drama

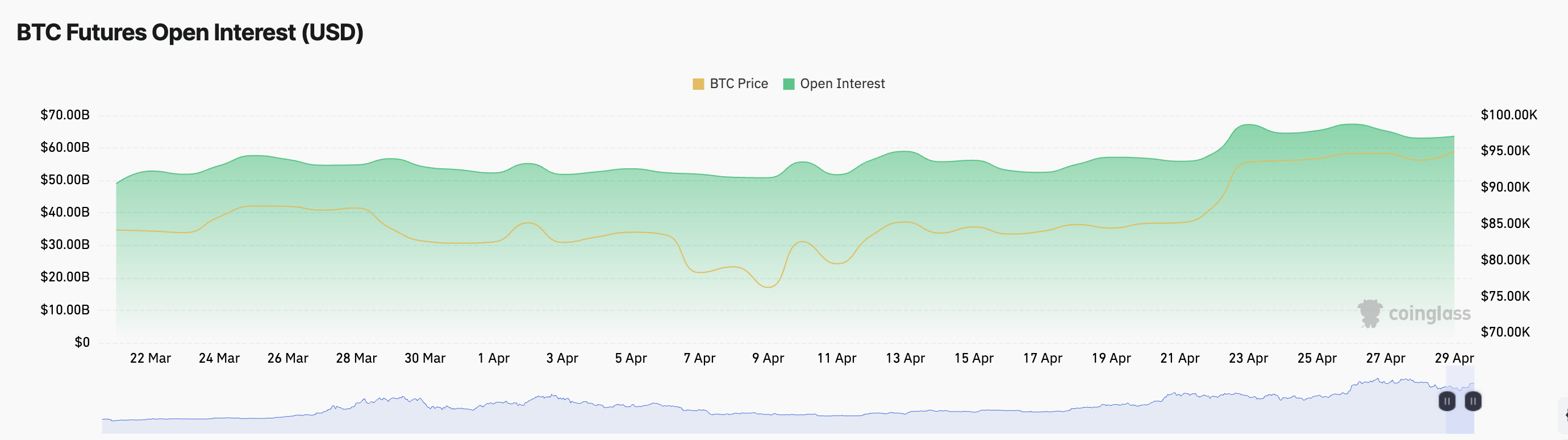

Let’s talk futures, shall we? Open interest in Bitcoin futures has risen by a modest 2% over the last 24 hours. That means more traders are getting in on the action, opening new positions rather than taking a leisurely stroll out of the market. A little bullish signal for you there, my dear Watson. 🕵️♂️

The coin itself has experienced a tiny 0.14% uptick during this period—nothing to write home about, but it’s something. This uptick, coupled with increased open interest, suggests that Bitcoin might continue its gentle price rally for a bit, like a tortoise slowly edging towards the finish line. 🐢🏁

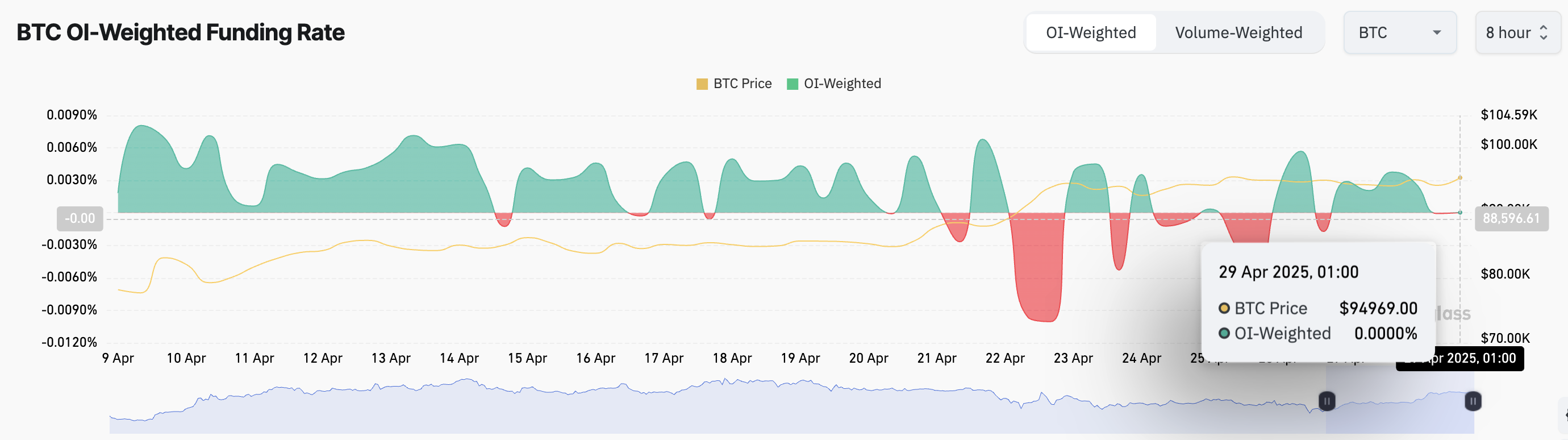

Meanwhile, the funding rate sits at a neutral 0%, indicating that the market is about as balanced as a pancake. With both the bulls and bears sitting pretty, there’s no immediate need to panic (unless you’re a bear, of course). A zero funding rate means that major price movements aren’t likely to be triggered by an avalanche of liquidations. But of course, you never know—markets are funny that way. 🤷♂️💰

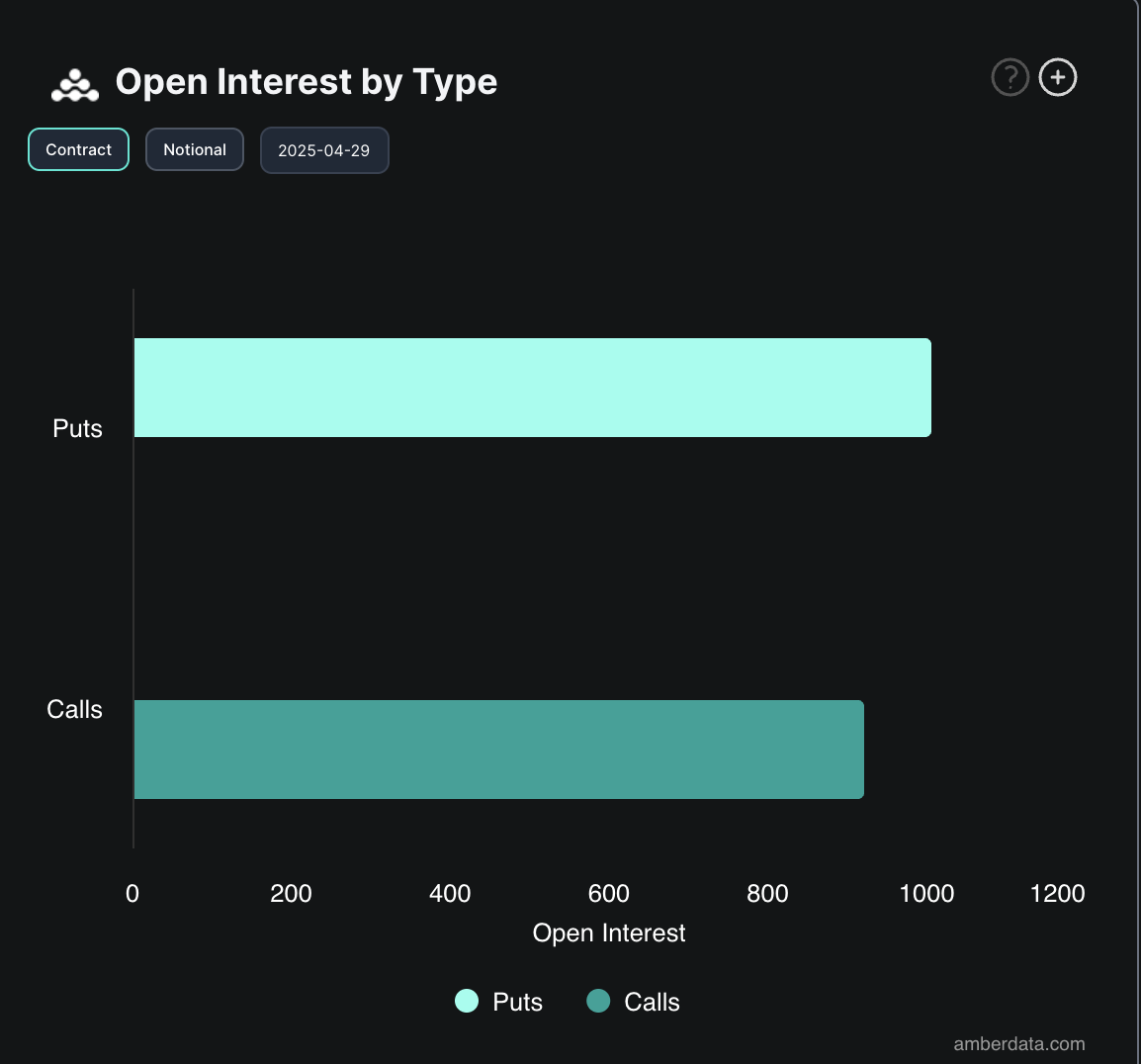

However, the mood among Bitcoin options traders is… let’s call it ‘cautious.’ Today’s high demand for puts suggests that there’s a general sense of bearishness brewing, as if everyone’s suddenly expecting Bitcoin to take a little tumble. Maybe they’re just hedging their bets, or maybe they’ve seen one too many cliffhangers in their time. ⛰️📉

The growing interest in these bearish contracts indicates that many investors are bracing themselves for a potential pullback in Bitcoin’s price. Funny how optimism and pessimism seem to waltz in lockstep. 💃🕺

In the end, until something dramatic happens—either a glorious breakout or a disastrous breakdown—Bitcoin might just keep dancing around in its little consolidation range. Isn’t the market just a delightful mystery? 🎭

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-29 09:49