Winter’s frost was not yet gone from the steppes, and Bitcoin—coy, capricious—stirred anew. The world’s digital ruble, sullen under its own weight for so long, uttered a shiver and shuddered upward, as if remembering its youth. In corridors of glass and silicon, old hodlers peered from beneath their ushankas, hearts pounding with a hope they barely dared entertain: Could this be the perfumed announcement of $100,000, that elusive summoning of electronic spring?

Look at them—the investors!—crowded together like sparrows on a telephone wire, gossiping greedily about shimmering profits, while the samovars of speculation steam in every midnight kitchen.

Investors Rejoice and Ponder Their Next Overreaction

The MVRV ratio—think of it as the temperature of this strange, digital fever—has bounced off that storied threshold: 1.74. In the smoky back rooms where charts are read like tea leaves, this number is whispered with the reverence of an old Tolstoyan plot twist. Each bounce, they say, tramples the snow flat before the cavalry charges—the very same tracks seen in that last epic consolidation, an August haunted by yen-carry traders with nerves of steel (and wallets of origami).

September 2024, and Bitcoin soared, arms thrown wide, as if to embrace destiny or at least one more zero on the ticker. Every new ascent toward the fabled heights sets investors salivating like Dostoyevsky’s gamblers at the roulette wheel of fate.

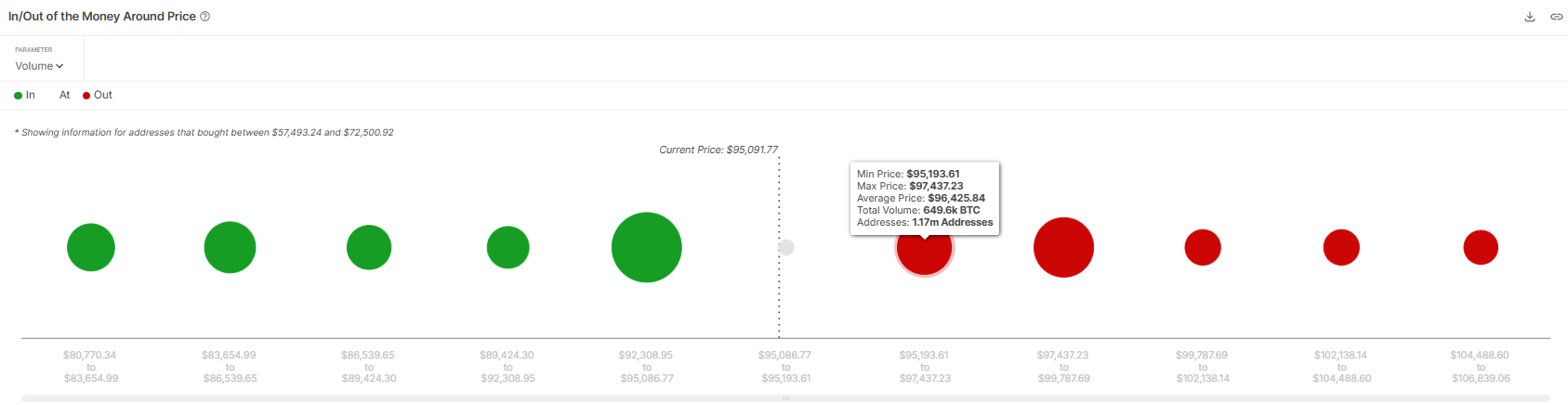

As for the powerful wind in Bitcoin’s sails: it’s not just hope, but hoarding. The IOMAP data reveals a mountain—649,600 BTC, a $61.6 billion hillock—bought between $95,193 and $97,437. It’s as if miners and investors now stand with pickaxes raised, grimly determined not to blink first. Will they sell, or will avarice—sweet, unblinking avarice!—compel them to hold, tight-fisted and white-knuckled? Greed, after all, is the only thing more persistent than a blockchain.

Should the world’s aspiring digital tycoons remain as steadfast as half-frozen birches, Bitcoin may claw its way toward the $98,000 barricades, enshrining each satoshi in a cathedral of gritted teeth and fragile optimism. With every buyer, the foundations thicken until the price itself seems to yearn for altitude sickness 😂.

Bitcoin Eyes the Gilded Ceiling (Before the Next Icicle Falls)

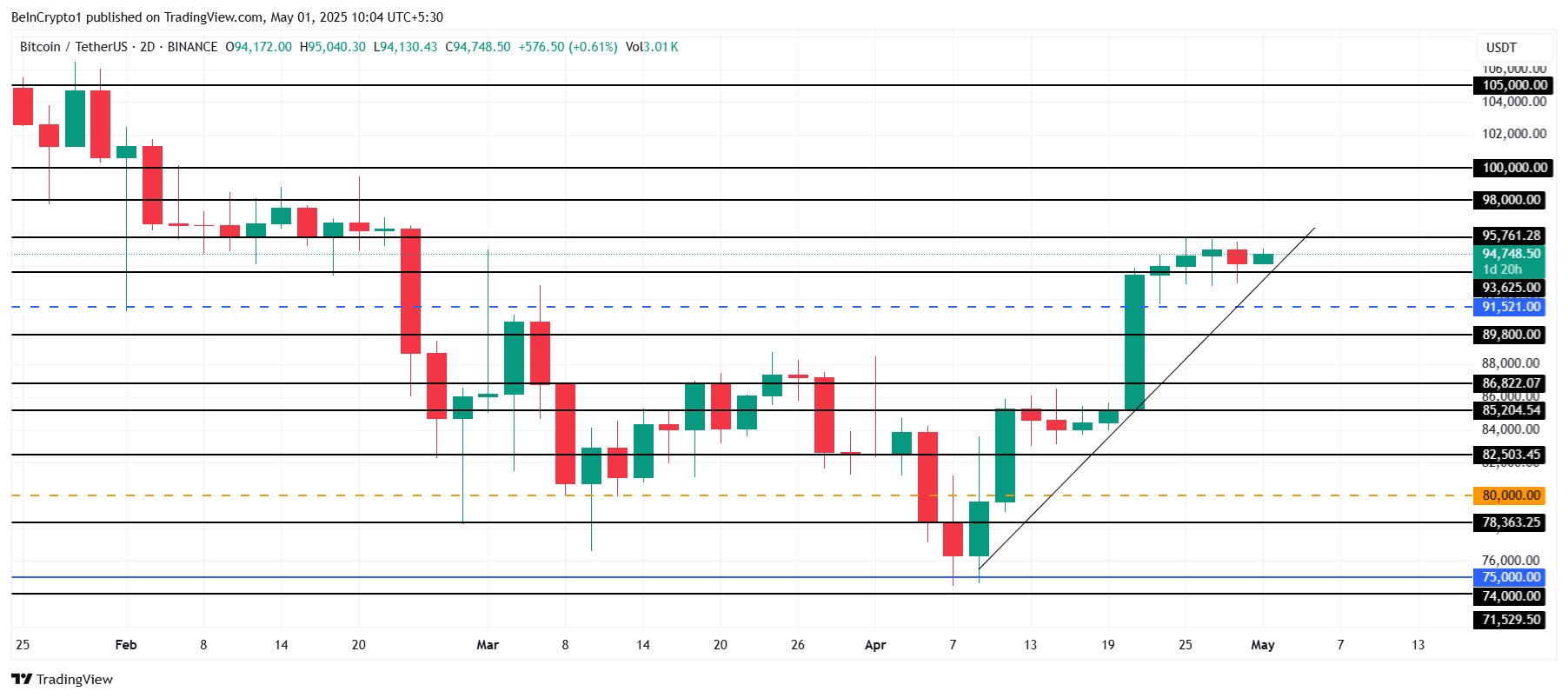

For three weeks—an eternity in this land of tickers and tumblers—Bitcoin has slouched along its upward march, pausing now at $94,748. Its ambitions smolder just beneath the resistance at $95,761, waiting, plotting, gathering its meager strength. Forget Putin’s chessboard; this is a standoff for the ages! If $95,761 yields like a thawing river, the path to $98,000 opens. And beyond that, the forbidden zone: $100,000. Even the ghosts of old investors twitch excitedly at the prospect.

But beware, dear dreamers—should Bitcoin lose its footing, falling through support at $93,625 with a wet, ignominious splat, it could slip further, to $91,521, and the bear would roam the tundra once again. At which point, all attention turns to charts, forums, and the ceaseless whirl of endless “So, what now?” debates 🤔.

So it goes. Another day, another price swing, and somewhere out there, a poet sighs, a speculator sweats, and Bitcoin dreams on—by turns comedian, tragedian, and, always, the unpredictable protagonist of its own windblown epic.

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Top 8 UFC 5 Perks Every Fighter Should Use

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Reach 80,000M in Dead Rails

- USD ILS PREDICTION

- Gold Rate Forecast

2025-05-01 11:41