Ah, Ethereum, the darling of the altcoin world, refuses to succumb to the cold embrace of the market’s downturn. Over the past 24 hours, it has graced us with modest gains of approximately 1%. At the time of writing, it stands proudly at $1,842. Oh, the glory of modest victories in a volatile world.

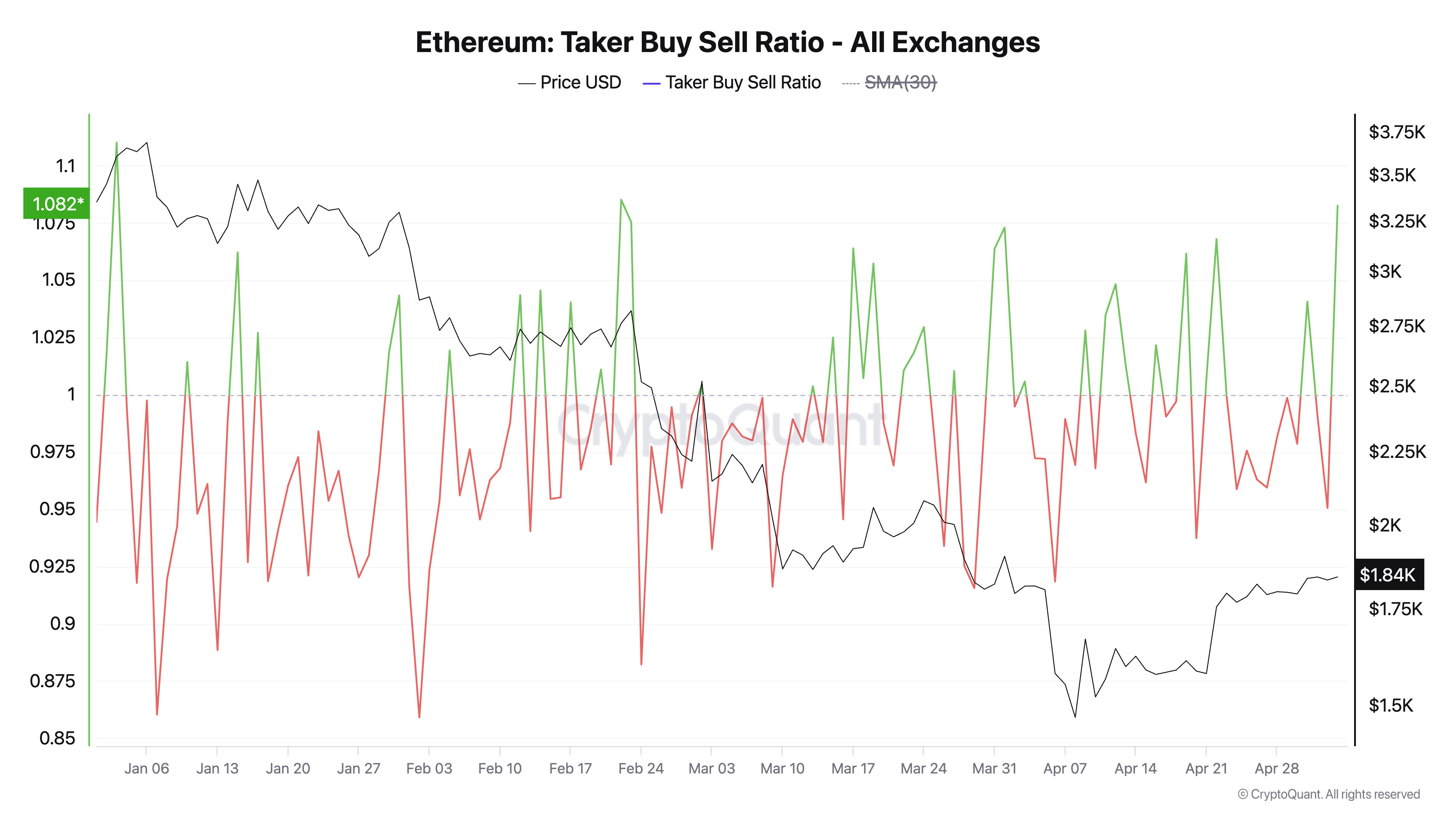

This delightful performance arrives amidst a surge in a key momentum indicator – the taker buy-sell ratio – which has reached its highest point in 30 days. A clear sign, dear reader, that bullish pressure is attempting to reassert itself in the tumultuous seas of futures markets.

The Ether Dream: Traders Eyeing the Sky as Buy Pressure Builds

According to the ever-reliable CryptoQuant, ETH’s taker-buy-sell ratio is currently basking in the delightful number of 1.08, a level not seen since early April. Truly, a number that fills the heart with excitement. Is this the moment we’ve all been waiting for? Or just another fleeting spark?

This metric, my dear investor, measures the delicate dance between buy and sell volumes in the ETH futures market. A number above 1, like a sprightly dancer at a ball, suggests that more traders are aggressively purchasing ETH contracts than selling them. A number below 1? Well, that’s the opposite of a party, indicating that sellers are taking the lead. And right now, with a ratio of 1.08, it seems the buyers are leading the charge, fingers crossed for more victories ahead!

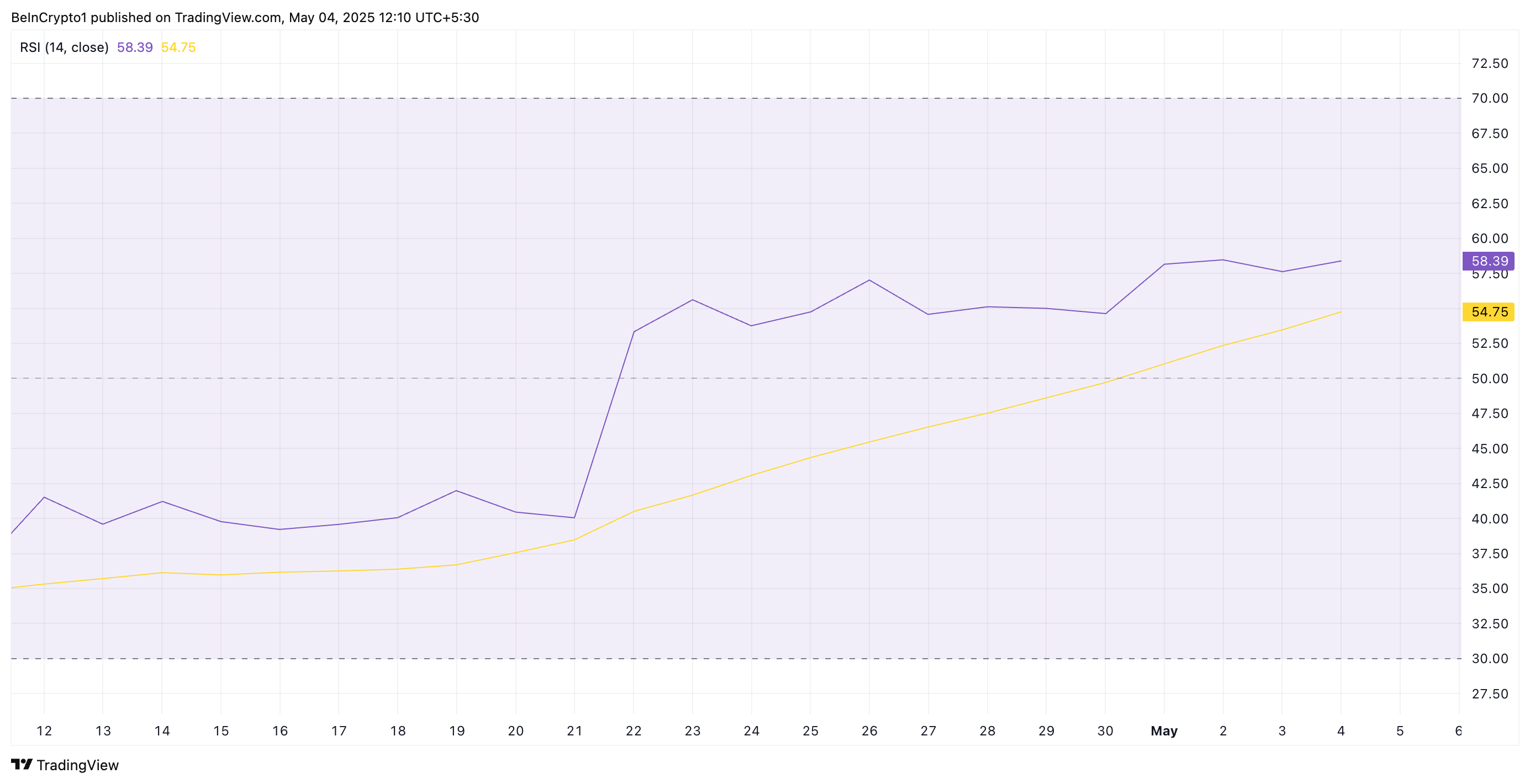

But wait, there’s more! The altcoin’s Relative Strength Index (RSI) continues to rise, proving that the bullish narrative is gaining steam. At the time of writing, it’s a respectable 58.39, and it seems to be on the climb. Oh, what joy it brings to see such upward momentum!

The RSI, in case you’ve forgotten, is the faithful indicator that tells us whether an asset is overbought or oversold. With values above 70 suggesting an impending decline and those below 30 signaling potential for a rebound, Ethereum’s current reading seems to be telling a rather optimistic story. Will it continue its climb? Only time, and a fair amount of speculation, will tell.

ETH’s RSI reading paints a rather rosy picture, reinforcing the belief that we could very well be on the cusp of a further surge. Oh, the excitement of watching markets dance to the whims of traders!

ETH: A Fortress Above Short-Term Support

At this very moment, ETH stands valiantly above its 20-day exponential moving average (EMA), which serves as a dynamic support at $1,770. A sign, if you will, that the short-term bulls have taken charge. How delightfully dramatic!

The 20-day EMA, that trusted sentinel, measures the average price of an asset over the past 20 trading days, giving a weighted advantage to the most recent prices. When an asset trades above this moving average, it’s as if a small triumph has been won. Traders view this as a sign that recent prices are above the average – a subtle but clear indication of an uptrend in the making. Oh, how the markets love to tease us with such small victories!

Thus, with any luck and a bit of momentum, ETH could continue its march toward $2,027. A truly thrilling prospect, don’t you think? If, of course, the buying pressure intensifies. Should it falter, however, it could slip back to its more humble beginnings, perhaps around $1,385. The drama, as always, is in the details.

Read More

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Invincible’s Strongest Female Characters

- Black Clover Reveals Chapter 379 Cover Sparks Noelle Fan Rage

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Reach 80,000M in Dead Rails

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- How to Get the Cataclysm Armor & Weapons in Oblivion Remastered Deluxe Edition

- Ultimate Guide: Final Fantasy 14 Cosmic Exploration

2025-05-04 15:37